GSK plc (LON:GSK) has announced its 3rd quarter results.

Highlights

Strong commercial execution drives continued sales growth across Specialty Medicines, Vaccines and General Medicines

·Specialty Medicines £2.7 billion +36% AER, +24% CER; HIV +19% AER, +7% CER; Oncology +28% AER, +19% CER; Immuno-inflammation and other specialty +29% AER +17% CER; COVID-19 solutions (Xevudy) sales £0.4 billion

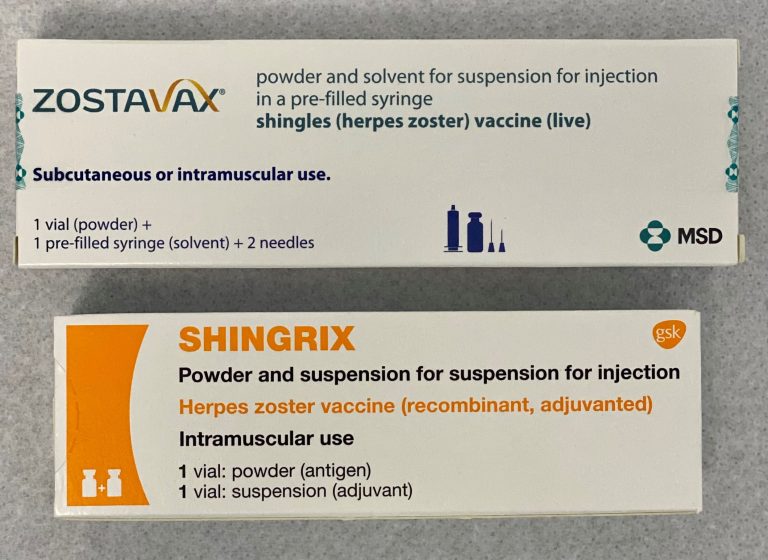

·Vaccines £2.5 billion +14% AER, +5% CER; Shingrix £760 million +51% AER, +36% CER

·General Medicines £2.6 billion +7% AER, +1% CER

Prioritised investment in growth with cost discipline

·Total continuing operating margin 15.2%. Total EPS 255.9p >100% AER, >100% CER primarily reflecting the gain from discontinued operations arising on the demerger of the Consumer Healthcare business. Total continuing EPS 18.8p -14% AER, -35% CER

·Adjusted operating margin 33.3%. Adjusted operating profit growth +18% AER, +4% CER. This included a contribution to growth from COVID-19 solutions of approximately +1% AER, +2% CER

·Adjusted EPS 46.9p +25% AER, +11% CER. This included a contribution to growth from COVID-19 solutions of approximately +1% AER, +3% CER

·Q3 2022 continuing cash generated from operations £1.9 billion. Free cash flow £0.7 billion

Continued strengthening of late-stage R&D pipeline with regulatory approvals, positive data read-outs and further complementary business development

·US FDA approval for Boostrix maternal and Menveo single-vial presentation. Momelotinib for treatment of myelofibrosis submitted to US FDA

·Positive phase III data for RSV older adults candidate vaccine presented at ID Week 2022. Priority Review granted in the US and regulatory submission acceptance in EU and Japan

·Completed Affinivax acquisition on 15 August 2022. Announced exclusive licence agreement with Spero Therapeutics for late-stage antibiotic tebipenem

·Phase III data readouts expected in Q4 2022: Jemperli in 1L endometrial cancer, Blenrep in 3L multiple myeloma and gepotidacin for treatment of uncomplicated urinary tract infection

Growing revenues and improving margin support confidence in outlooks

·2022 Guidance raised: expect to deliver growth in sales of between 8% to 10% CER and growth in 2022 adjusted operating profit of between 15% to 17% CER

·2022 guidance excludes any contribution from COVID-19 solutions

·Dividend of 13.75p/share declared for Q3 2022. No change to expected dividend from GSK of 61.25p/share for FY 2022

Emma Walmsley, Chief Executive Officer, GSK:

“GSK has delivered another quarter of excellent performance, with strong growth in Specialty Medicines, record sales for our shingles vaccine, Shingrix, and further improvements in adjusted operating profit. We are again raising our full-year guidance and expect good momentum in 2023, further strengthening our confidence in our performance outlooks, driven by Shingrix global expansion and expected new launches including our new RSV vaccine. We are also making good progress to strengthen our early-stage pipeline and will continue to invest in targeted business development to build optionality and support growth in the second half of the decade.”

2022 guidance

Reflecting the momentum of the business performance in the year to date, GSK now expects 2022 sales to increase between 8 to 10 per cent and Adjusted operating profit to increase between 15 to 17 per cent, excluding any contributions from COVID-19 solutions. Adjusted Earnings per share is expected to grow around 1 per cent lower than Operating Profit. We have delivered a strong nine-month performance ahead of our full-year guidance. In the fourth quarter, we anticipate continued strong sales growth and a relatively higher rate of R&D spending, reflecting the dynamics of prior year comparisons, in-year phasing, and continued targeted commercial investment.

Notwithstanding uncertain economic conditions across many markets in which we operate, we continue to see evidence of healthcare systems recovering and now expect full-year sales of Specialty Medicines to increase low double-digit percentage at CER excluding Xevudy sales and sales of General Medicines to be broadly flat, primarily reflecting the increased genericisation of established Respiratory medicines. Vaccines sales, excluding COVID-19 solutions, are expected to grow mid to high-teens percentage at CER for the full year. Specifically, for Shingrix, we expect strong double-digit growth and record annual sales in 2022, based on strong demand in existing markets and continued geographical expansion.

From Q2 2022, the Group presented the Haleon plc (Haleon) business as a discontinued operation according to IFRS 5. Adjusted results exclude profits from discontinued operations. Comparatives have been restated to reflect adjusted results from continuing operations, and guidance is provided on this basis.

Dividend policies and expected pay-out ratios are unchanged for GSK, but the dividends per share have been adjusted for the GSK Share Consolidation completed on 18 July 2022. The future dividend policies and guidance regarding the expected dividend pay-out in 2022 for GSK are provided on page 36.

2022 COVID-19 solutions expectations

The majority of expected COVID-19 solutions sales for 2022 have been achieved in the year to date. Based on known binding agreements with governments, we anticipate that sales of COVID-19 solutions will be substantially lower going forward. Sales of COVID-19 solutions for 2022 are at a reduced profit contribution compared with 2021 due to the increased proportion of lower-margin Xevudy sales; we anticipate this to reduce Adjusted Operating profit growth (including COVID-19 solutions in both years) by around 4%. We continue to discuss future opportunities to support governments, healthcare systems, and patients whereby our COVID-19 solutions can address the emergence of any new COVID-19 variant of concern.

All expectations, guidance and targets regarding future performance and dividend payments should be read together with ‘Guidance, assumptions and cautionary statements’ on pages 67 and 68. If exchange rates were to hold at the closing rates on 30 September 2022 ($1.11/£1, €1.13/£1 and Yen 160/£1) for the rest of 2022, the estimated positive impact on 2022 Sterling turnover growth for GSK would be 7% and if exchange gains or losses were recognised at the same level as in 2021, the estimated positive impact on 2022 Sterling Adjusted Operating Profit growth for GSK would be 13%.

Performance: Full year guidance

| All outlooks exclude the contributions of COVID-19 solutions unless stated otherwise | Current 2022 guidance at CER | Previous 2022 guidance at CER |

| Specialty Medicines turnover | Increase low double-digit % | Increase approximately 10% |

| Vaccines turnover | Increase mid to high-teens % | Increase low to mid-teens % |

| General Medicines turnover | Broadly flat | Slight decrease |

| Commercial operations turnover | Increase between 8% to 10% | Increase between 6% to 8% |

| Adjusted operating profit | Increase between 15% to 17% | Increase between 13% to 15% |

| Adjusted earnings per share (no change) | Growth around 1% less than operating profit growth | Growth around 1% less than operating profit growth |

| COVID-19 solutions | Reduced Adjusted operating profit growth (including COVID-19 solutions in both years) by around 4% | Reduced Adjusted operating profit growth (including COVID-19 solutions in both years) by around 4% to 6% |

Demerger of Consumer Healthcare

On 18 July 2022, GSK plc separated its Consumer Healthcare business from the GSK Group to form Haleon, an independent listed company. The separation was effected by way of a demerger of 80.1% of GSK’s 68% holding in the Consumer Healthcare business to GSK shareholders. Following the demerger, 54.5% of Haleon was held in aggregate by GSK Shareholders, 6.0% remains held by GSK (including shares received by GSK’s consolidated ESOP trusts) and 7.5% remains held by certain Scottish Limited Partnerships (SLPs) set up to provide collateral for a funding mechanism pursuant to which GSK will provide additional funding for its UK defined benefit Pension Schemes. The aggregate ownership by GSK (including ownership by the ESOP trusts and SLPs) after the demerger of 13.5% is measured at fair value with changes through profit and loss.

The gain on the demerger for the distributed stake was £7.2 billion which was recognised in Q3 2022. The asset distributed was the 54.5% ownership of the Consumer Healthcare business. The net assets derecognised reflected Consumer Healthcare transactions up to 18 July 2022 which included pre-separation dividends declared and settled before 18 July 2022. Those dividends included: £10.4 billion (£7.1 billion attributable to GSK) of dividends funded by Consumer Healthcare debt that was partially on-lent during Q1 2022 and dividends of £0.6 billion (£0.4 billion attributable to GSK) from available cash balances. GSK’s share of the pre-separation dividends funded by debt resulted in a reduction of net debt for GSK on demerger. The gain on the demerger arising from remeasurement of the retained stake was £2.4 billion which was recognised in Q3 2022.

The total gain on the demerger of the Consumer Healthcare business in Q3 2022 was £9.6 billion. In addition, the Profit after taxation from discontinued operations for the Consumer Healthcare business from 1 January to 18 July 2022 was £0.6 billion which increased the Total profit after tax of discontinued operations in the nine month period to £10.2 billion.

Results presentation

A conference call and webcast for investors and analysts of the nine months and Q3 2022 results will be hosted by Emma Walmsley, CEO, at 12pm GMT on 2 November 2022. Presentation materials will be published on www.gsk.com prior to the webcast and a transcript of the webcast will be published subsequently.

Information available on GSK’s website does not form part of, and is not incorporated by reference into, this Results Announcement.