Enteq Technologies plc (LON:NTQ), the energy services technology supplier, has announced its audited final results for the year ended 31 March 2023

Key features

· Total revenue $6.2m ($7.3m for year ended 31 Mar 2022)

· Gross and net cash balance increased to $5.4m

· Sale of freehold facility in Houston for $2.5m

· Post year-end sale of XXT intellectual property and assets for up to $3.16m (Initial cash consideration of c.$1.89m plus up to c.$1.27m to be paid in cash over a 12-month period).

· Continued investment in SABER project ($2.6m)

· The SABER Tool (SABER), successfully completed downhole drilling testing, proving the system to be effective in an operational test environment.

Financial metrics

Years ended 31 March ($m):

| 2023 | 2022 | ||||

| Continued operations | Discontinued operations | Continued operations | Discontinued operations | ||

| Revenue | 0.0 | 6.2 | 0.0 | 7.3 | |

| Gross profit margin | 0.0 | 23% | 0.0 | 36% | |

| Underlying overheads ** | (1.5) | (1.1) | (1.3) | (1.0) | |

| Adjusted EBITDA | (1.5) | 0.3 | (1.3) | 1.6 | |

| Exceptional items | 0.0 | (0.5) | 0.0 | 0.0 | |

| Total post tax profit/(loss)* | (1.4) | (1.4) | (1.6) | 0.8 | |

| Post tax profit/(loss) per share (cents) | (2.0) | (2.0) | (2.2) | 1.1 | |

| Cash balance | 5.4 | 0.0 | 4.8 | 0.0 | |

| Investment in engineering projects | 2.6 | 0.0 | 2.7 | 0.0 | |

| *prior to intercompany interest charges | |||||

| **all central costs allocated to the continued operation | |||||

Outlook

· Ongoing investment in the development and deployment of technologies with significantly enhanced market size and differentiation.

Andrew Law, CEO of Enteq Technologies plc, commented:

“The SABER project has reached a pivotal milestone, having achieved proof of SABER’s novel concept whilst drilling in an operational test environment. The engineering programme and Norway testing during the year led up to the successful testing in Oklahoma which has provided us with validation needed to advance with SABER commercialisation.

A number of efforts were realised during the year to focus on generating cash to support the SABER project, notably the sale of the XXT product line and the sale of the property.

We look forward to working alongside selected customers and industry partners in different regions to bring this technology to the oil and gas, geothermal and methane abatement markets and to deliver a positive and disruptive impact.”

1 The reconciliation between Underlying overheads and Administrative expenses before amortisation is follows:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Total underlying overheads 2.6 2.3

Depreciation – fixed assets 0.2 0.2

Depreciation – rental fleet 0.6 0.5

PSP Share charge 0.2 0.2

Administrative expenses before amortisation 8.6 3.2

2 The reconciliation between Loss attributable to shareholders and Adjusted EBITDA is follows:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Loss attributable to shareholders (2.8) (0.8)

Exceptional items 0.5 –

Amortisation 0.4 0.2

Depreciation – fixed assets 0.2 0.2

Depreciation – rental fleet 0.6 0.5

PSP Share charge 0.2 0.2

Tax (0.3) –

Interest – –

Adjusted EBITDA (1.2) 0.3

Both the above alternative performance measures are shown as the Board consider these to be key to the management as the business as a whole.

3 The cash balance includes:

Year to 31 March 2023 Year to 31 March 2022

$m $m

Cash and cash equivalents 5.4 3.3

Bank deposits – 1.5

Cash balance 5.4 4.8

The Company also separately issued today an AGM Trading Statement.

Combined Chief Executive and Chairman’s report

Introduction

Enteq develops and provides downhole electronics and technologies for measurement, data and control, which are used by the geothermal, methane capture, oil and gas sectors around the world.

Specialist directional technologies, including Rotary Steerable Systems (RSS) and Measurement While Drilling (MWD) are used by service companies around the world who either purchase or rent equipment from third parties such as Enteq or develop systems themselves.

The international RSS market is the target for new Enteq technology and is currently estimated at over $2bn annually.

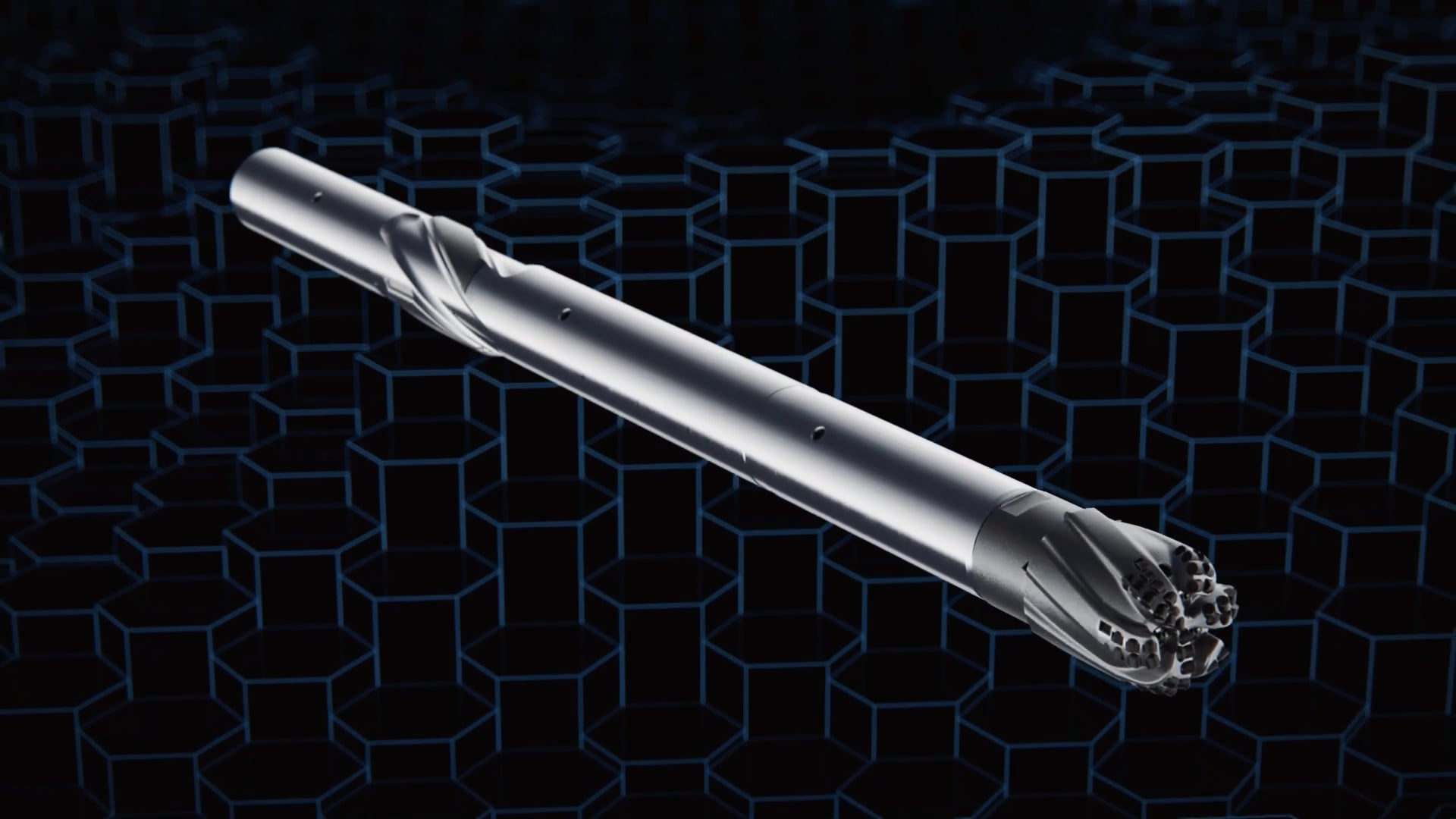

Enteq has a proven track record of providing extremely reliable and respected technology to regional and independent service companies globally. Enteq is commercialising game-changing technologies to deliver improvements in efficiency, operating cost and reduced environmental impact in drilling. Enteq’s SABER technology is a novel RSS originated by Shell and subsequently developed by Enteq under an exclusive IP and technology license agreement.

Enteq now has a rented operations facility in Houston, (having sold a freehold in year-ending March 2023) and a technology centre in the UK. International business is supported through a network of sales representatives.

Enteq plans to maximise growth through the commercialisation of SABER and associated technologies in the substantial global directional drilling market.

Sale of XXT

The sale was a result of a strategic focus to improve the Company’s medium term cash position to underpin investment in product line development, primarily the deployment of SABER, the rotary steerable drilling solution.

The XXT intellectual property (previously amortised over time to a book value of nil) and associated product lines and trademark, together with selected technology agreements, customer account receivable balances, and inventory have been sold for a cash consideration of c.$1.89m; further selected customer account receivables and inventory have also been sold for up to c.$1.27m to be paid in cash over a 12 month period.

The Disposal reflects Enteq’s focus on differentiated specialist MWD technologies, and the rotary steerable sector (SABER) where there is a larger addressable market.

Review of the Year

This year has been one of increasing the focus on the SABER technology development project, resulting in a critical milestone being successfully accomplished.

The SABER development project has progressed well during the year with the most important milestone being the successful downhole drilling testing in North America post financial year end, proving that the novel concept underpinning SABER can steer effectively in operational test conditions. A simplified design of the SABER control system was implemented during the year, to widen the operating range and to improve operating effectiveness.

Continued customer and industry engagement on the SABER project confirmed there is a high degree of appetite for this technology. SABER remains on-track for commercialisation, with existing resources in place to complete the remaining phase of the development project. A phased roll out is planned in 2024.

As a result of a strategic focus to improve the Company’s cash position to underpin investment in the development of SABER, Enteq sold the freehold property in South Houston for $2.5m and sold the XXT intellectual property and associated assets for an initial cash consideration of $1.89m (with selected account receivables and inventory for up to c.$1.27m to be paid in cash over a 12-month period).

As significant overhead reductions were made in recent years, the underlying overheads have remained steady in comparison to the previous year.

Staff

There were a total of 13 employees at the end of the year, down from the 15 at the previous year end. The Board would like to recognise the on-going loyalty, dedication, and support of the staff as Enteq continues with its excellent reputation for the reliability of equipment and commitment to customer support.

Prospects

Enteq has continued investment in the SABER RSS project development, having achieved successful downhole drilling field test performance, to significantly reduce the technical risk. Sustained testing has confirmed that the system has performed to the design criteria and met all requirements to date.

Continued engineering of the project has resulted in an enhanced, simplified design with a wider range of operation and a low cost to operate.

Extensive industry engagement with existing and new customers and partners, both internationally and across North America, has confirmed that SABER is on-track to meeting the market requirements for the geothermal, methane capture and oil and gas sectors.

Financial Review

Income Statement

This is a pro-forma statement which is different in presentation to the statutory format shown on page 35.

| Year to 31 March: | Continued | Discontinued | Continued | Discontinued |

| 2023 | 2023 | 2022 | 2022 | |

| $ million | $ million | $ million | $ million | |

| Revenue | 0.0 | 6.2 | 0.0 | 7.3 |

| Cost of Sales | 0.0 | (4.8) | 0.0 | (4.7) |

| Gross profit | 0.0 | 1.4 | 0.0 | 2.6 |

| Overheads | (1.5) | (1.1) | 1.3 | 1.0 |

| Adjusted EBITDA | (1.5) | 0.3 | (1.3) | 1.6 |

| Depreciation & amortisation | 0.0 | (1.2) | 0.0 | (0.8) |

| Other charges | 0.2 | 0.0 | 0.3 | 0.0 |

| Ongoing operating loss | 1.7 | (0.9) | (1.6) | 0.8 |

| Exceptional items | 0.0 | (0.5) | (0.3) | 0.0 |

| Operating Loss | (1.7) | (1.4) | (1.6) | 0.8 |

| Interest | – | – | – | – |

| Loss before tax | (1.7) | (1.4) | (1.6) | 0.8 |

| Tax | 0.3 | 0.0 | – | – |

| Loss after tax | (1.4) | (1.4) | (1.6) | 0.8 |

The North American market saw a steady increase during the year with the rig count rising from 673 as at 31 March 2022 to 758 as at 31 March 2023 an increase of 85 (13%). This compares to an increase 243 (57%) in the previous year. This was against a background of the price of a barrel of WTI falling during the year to 31 March 2023 from $104 to $73 compared to a rise from $64 as of 31 March 2022. The oil price was at levels during the year under review to be profitable for the operating companies that require the services of Enteq’s customers.

North American revenue was steady at $5.8m compared to the $6.2m reported last year. The North American revenue was largely driven by demand for specific third-party technologies, with revenues deliberately controlled by the Company to maintain working capital efficiency. The international market continued to experience challenges of capital availability, with international revenue at $0.4m, down from the $1.1m reported last year.

The full year gross margin was 23%, down from last year’s 36%, due to an increasing proportion of revenue coming from the third party components mentioned above.

Total underlying overheads, at $2.3m were at the same level as last year’s figure. This reflected the concentration on reducing all levels of overheads in previous years without impacting the level of customer support given.

The combined depreciation and amortisation charge was up on the previous year due to an increased level of amortisation on previously capitalised software enhancements plus a higher level of depreciation on both the rental fleet and the underlying assets.

The “Other charges” shown above relate, primarily, to the non-cash cost associated with the Performance Share Plan.

Statement of Financial Position

This is a pro-forma statement which is different in presentation to the statutory format shown on page 36.

Enteq’s net assets at the financial year-end comprised of the following items:

| As at 31 March: | 2023$million | 2022$million |

| Intangible assets | 6.4 | 4.1 |

| Property, plant & equipment | 0.1 | 2.2 |

| Rental fleet | – | 0.3 |

| Net working capital | (1.0) | 4.1 |

| Assets held for sale | 2.2 | – |

| Cash balance | 5.4 | 4.8 |

| Net assets | 13.1 | 15.5 |

Both the closing balance and the increase in the year in the intangible assets relate to the on-going spend on the SABER rotary steerable system.

The net book value of property, plant & equipment at $0.1m is $2.1m down primarily due to sale of the freehold Houston site plus the annual depreciation charge.

The reduction in net book value of the rental fleet reflects the disposal of all the rental kits during the year.

The net working capital of ($1.0m) has decreased by $5.1m during the year. This is primarily due to a decrease in all major components; debtors down by $3.3m; inventory down $2.4m countered by creditors down $0.6m. All these movements relate to the strategic decision to move away from the lower margin MWD market and no longer offering extended credit terms to the major customers.

Cash flows

This is a pro-forma statement which is different in presentation to the statutory format shown on page 38.

Overall, the Group saw a net cash inflow of $0.6m (2022: outflow of $3.3m) increasing the Group’s closing cash balance as at 31 March 2023 to $5.4m. The major elements of the non-operational cashflow relates to the $3.0m of on-going investment in the engineering projects, primarily the SABER tool and the disposal of the freehold Houston site for a net $2.3m.

| Year to 31 March: | 2023$ million | 2022$ million |

| Adjusted EBITDA | (2.0) | 0.3 |

| Change in net operational working capital | 2.9 | (0.2) |

| Operational cash generated | 0.9 | 0.1 |

| Net investment in rental fleet | – | (0.8) |

| Investment in engineering projects | (2.6) | (2.7) |

| Investment in fixed assets | – | (0.1) |

| Interest and share issues | – | 0.2 |

| Disposal of fixed assets | 2.3 | – |

| Net cash movement | 0.6 | (3.3) |

| Opening cash balances | 4.8 | 8.1 |

| Closing cash balance | 5.4 | 4.8 |

Financial Capital Management

Enteq’s financial position continues to be robust. Enteq had no bank borrowings, or other debt, and had a closing cash position of $5.3m as at 31 March 2023 ($4.8m as at 31st March 2022).

Enteq monitors its cash balances daily and operates under treasury policies and procedures which are set by the Board.

The financial statements are presented in US dollars as the Company’s primary economic environment, in which it operates and generates cash flows, is one of US dollars. Apart from its UK based overhead costs, substantially all other transactions are transacted in US dollars.

Enteq is subject to the foreign exchange rate fluctuations to the extent that it holds non-US Dollar cash deposits. The year-end GBP denominated holdings are approximately 3% of total cash holdings, down from the 5% of last year’s balance.

Annual General Meeting

The Company’s Annual General Meeting was held on 29 September 2023 at 11am at the offices of Cavendish Capital Markets, 1 Bartholomew Close, London, EC1A 7BL.

Annual Report and Notice of General Meeting

Enteq Technologies 2023 Annual Report and Accounts (together with a notice of General Meeting proposing an ordinary resolution to receive the report of the directors, the audited annual accounts and the auditors’ report), will be available on the Company’s website later today, and will today be posted to those shareholders who have requested to receive copies. The General Meeting will take place at 11.00 a.m. on Monday 30 October 2023 at the offices of Cavendish Financial plc, 1 Bartholomew Close, London, EC1A 7BL.

Mark Ritchie

Chief Financial Officer

29 September 2023