Egdon Resources plc (LON:EDR) is the topic of conversation when we caught up with Brendan Long WHIreland Director, Institutional Research.

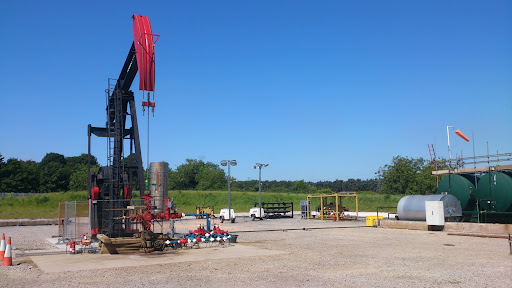

Brendan, Egdon Resources has announced that the Wressle oil field has received consent from the North Lincolnshire Council for the storage of crude oil. What does this mean for the company?

We have long-held the view that bringing Wressle onstream can be expected to set Egdon Resources on a positive trajectory. We anticipate that the success at Wressle will provide a positive impetus to concentrate on progress at the Biscathorpe and North Kelsey exploration prospects. Thereafter, we anticipate that the focus will shift to the Resolution gas field (70% Shell/30% EDR) given the intention to acquire seismic over that offshore gas discovery in February 2022.

How do you view the company in terms of investment case?

We believe a rerating for Egdon Resources is long-overdue given the inherent value of its portfolio. We believe that today’s news unlocks the potential of the Wressle field and sets the company on a positive trajectory and, as such, we expect a material rerating of the company.

What do you hope to see next from the company?

With Wressle onstream – expected imminently – we expect Egdon Resources to generate cash flow from operations of £1.0M in the company’s financial year ending 31 July 2022. We highlight that achieving positive cashflow from operations is a key milestone for any oil & gas company.