Echo Energy plc (LON:ECHO) Chief Executive Officer Martin Hull caught up with DirectorsTalk for an exclusive interview to discuss the company background, reshaping the business, strengthening the balance sheet, the benefits of having production assets and what big ticket operational and financial news investors should look out for.

Q1: It has been a very busy time for Echo Energy but before we discuss that in detail perhaps you can introduce the company to us?

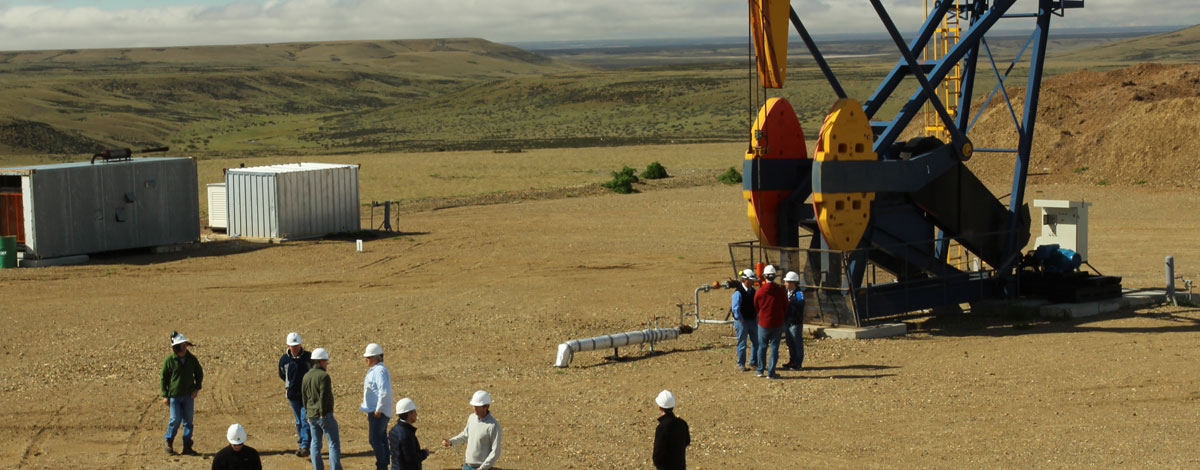

A1: We are a LatAm-focused energy company, we’ve got a very exciting portfolio of producing assets in Argentina which we think has significant growth potential.

Today, we’ve got a large current production base of about 2,000 boe and that generates substantial cashflow which provides real leverage, operational and financial leverage, to future positive commodity price cycle so that gives investors a real exposure to that commodity price.

Within the portfolio, we’ve got about 12 million boe, or 2P reserves, so that provides us with a great deal of running room to boost production and also cashflow, resulting from that production in the future.

I think the other point to make is that we believe we’ve made very important steps, we’ve taken very important steps in recent months to refocus the assets, reduce our costs and importantly, to strengthen our balance sheet which provides us a real platform for the future.

Q2: Now, you mentioned that you’ve reshaped the business, can you just expand on that a little for us?

A2: Since I joined the company, a key element of my work has really been to refocus the asset base onto lower risk, nearer term opportunities that can provide immediate cashflow. Where we are today, we believe we have absolutely achieved this.

Our Santa Cruz Sur portfolio, which we acquired at the back of end of last year, has been with us nearly a year now and has been operationally going very well. It provides a lower risk platform which we are then able to grow and boost production very considerably. An example of that is that we have identified and already begun work on a programme of activities that could boost our production from where it is today, around 2,000 boe a day to actually getting in excess of 2,500 in pretty near term. As I say that programme is live and ongoing and we hope to be reporting back to investors on that and those developments in the days and weeks ahead.

Importantly, at the same time we’ve retained low cost optionality for our shareholders with exposure to real material exploration upside and that’s through a number of pieces in the portfolio. For example, it’s the future testing of the already drilled Campo Limate well and then our separate Tapi Aike exploration option.

Q3: You’ve had news out earlier this week and it was an important step in strengthening the balance sheet, can you tell us more about that?

A3: This was very important and a real positive milestone for the company and what we’ve done is we’ve very much strengthened our financial platform in a real and important way.

My experience, for 18 years as an investment banker has been very helpful in terms of bringing those skills to the company and its financial restructuring.

The key point of what we announced earlier this week is that we’ve successfully reached an agreement with our debt providers, our banking debt providers, that pushes back the maturity of that debt 3 years, it wasn’t due until 2022 and it’s now due, final maturity, in 2025. More than that, we’ve actually rolled up the interest, the coupon, to that maturity so there’s no cash outlay associated with that debt in the months and years ahead until maturity. That provides us with a great deal more flexibility, it preserves cash and allows us to reinvest that cash into growth opportunities.

In addition to that bank debt, we’ve also engaged very constructively with our bondholders, that’s ongoing and we hope to be in a position to announce a successful full restructuring in the weeks ahead.

Q4: Can you tell us about the benefits of having production assets at the moment? What does the cashflow allow you to do?

A4: So, I think there are 2 very important key positives, with our debt issues resolved in the near term, the cashflow allows us to invest for growth in the portfolio. As I have already said, our unique portfolio provides a great deal of running room with lower risk opportunities, we need capital to get after that. Now, pushing back the debt, preserving that capital, invest that capital to really drive production growth and that’s near term, straight to cash flow and it’s very positive.

Secondly, with our immediate production, this is not production that’ll be in the future, it’s stuff we’re getting out the ground now, we are immediately leveraged to the improving commodity cycle. So, if one is positive about commodity prices from the lows that we’re at at the moment, we are a great investment, we will see direct material impact on our cashflow from an improving commodity cycle.

Q5: I think you’ve already hinted at this but what are the big ticket operational and financial news items that investors should focus on going forward?

A5: We’re very fortunate actually that there are plenty of items in the pipeline that can really catapult Echo Energy forward so I’ll list them and go through them in a bit of detail.

The improving market outlook means that we can now switch on wells that we shut-in earlier in the year. We started this year with production of 2,500 boe per day and we hope to be there pretty quickly once we reactivate all of those wells and that’s something we’re doing and will be announcing in the days and weeks ahead.

In addition to that, we’ve got our workover programme. This is further boosting production as you go in and recommission wells that have previously been producing in the past, before we owned them, but it’s a low cost intervention to get these wells flowing again. It’s also limited risk which really generates significant value.

We’ve already talked about the financial restructuring so we’ve got the ongoing engagement with bondholders and that’s progressing and progressing well. As a reminder, we engaged with our bondholders earlier in the year and we got unanimous support from them which was very very encouraging. We hope to bring the ongoing discussions to a positive conclusion soon and of course, that’ll be something that we’ll announce and could be a real catalyst for us.

We’ve then got our exploration options, the key one being that we remain very excited about the Campo Limate exploration well, we drilled this well earlier in the year but it was due to COVID constraints that we haven’t tested it. So, it’s drilled, it’s ready to test and we look forward to testing that in the near future. It has the potential to be an important upside in terms of opening up an area of gas to additional commercial opportunities so something, as I say, that we remain excited about.

Of course, beyond these very near term things, we’re also looking always at other growth opportunities, we’ve done deals in the past and it’s something that we are keen to look to continue to grow. We think there’s opportunities in the market at the moment to drive shareholder value and we’ll do that where we see good opportunities, we’ll look at them across the energy space.