Drax Group Plc (LON:DRX) have today published full year results for the twelve months ended 31 December 2023.

| Twelve months ended 31 December | 2023 | 2022 |

| Key financial performance measures | ||

| Adjusted EBITDA (excl. EGL)(1/2/3) (£ million) | 1,214 | 731 |

| Electricity Generator Levy (EGL)(3) (£ million) | (205) | – |

| Adjusted EBITDA (incl. EGL)(1/2/3) (£ million) | 1,009 | 731 |

| Net debt(4) (£ million) | 1,084 | 1,206 |

| Net debt to Adjusted EBITDA (incl. EGL) | 1.1x | 1.6x |

| Adjusted basic EPS(1) (pence) | 119.6 | 85.1 |

| Dividend per share (pence) | 23.1 | 21.0 |

| Total financial performance measures | ||

| Operating profit (£ million) | 908 | 146 |

| Profit before tax (£ million) | 796 | 78 |

Will Gardiner, CEO of Drax Group, said: “Drax performed strongly in 2023 and we remained the single largest provider of renewable power by output in the UK. We have created a business which plays an essential role in supporting energy security, providing dispatchable, renewable power for millions of homes and businesses, particularly during periods of peak demand when there is low wind and solar power.

“Policy support for our UK BECCS project continues to progress and we remain in formal discussions with the UK Government to ensure Drax Power Station can play a long-term role in UK energy security, creating thousands of jobs during construction and helping the country reach Net Zero.

“We have made further progress in our ambition to be a world leader in carbon removals and have visibility of high-quality, long-term earnings to 2042 and a strong balance sheet which supports returns to shareholders and investment in growth, both in the UK and internationally.”

Financial highlights – strong financial performance and returns to shareholders

· Adj. EBITDA growth driven by system support services, renewable generation, and energy solutions (Customers)

· Strong liquidity and balance sheet – £639 million of cash and committed facilities at 31 December 2023

· New £258 million term-loan facilities with 2027-2029 maturities (February 2024)

· Proposed final dividend of 13.9 pence per share (2022: 12.6 pence per share) – 10% increase

· £150 million share buyback programme concluded(5)

Current business and targets provide strong long-term foundation for balance sheet, dividend and investment

· Flexible generation and energy solutions portfolio – targeting post 2027 recurring Adj. EBITDA of >£250 million

· Pumped storage, hydro, Open Cycle Gas Turbines (OCGTs) and energy solutions

· Operating in power, renewable, system support and capacity markets

· c.£580 million of capacity payments to 2042 – existing and new capacity, including Cruachan refurbishment

· Pellet production – targeting post 2027 recurring Adj. EBITDA >£250 million from own-use and third-party sales

· Biomass generation – 2.6GW of flexible renewable generation

· Strong forward hedges support firm cash flows (2024-2026) with additional value from uncontracted power

· Expect long-term value from bridging mechanism and BECCS

Financial outlook

· Full year 2024 expectations for Adj. EBITDA in line with analysts’ consensus estimates(6)

· Expect to repay Q4 2025 debt maturities through cash generation and refinancing activities in 2024

· Outlook for 2025 Adj. EBITDA underpinned by a strong hedge book – >90% hedge of power on RO units

Attractive opportunities to invest for long-term growth linked to energy transition and security of supply

· Options for c.£4 billion of growth investment by 2030, with additional investment through 2030s

· UK BECCS – targeting first unit (4Mt pa) by 2030 in line with UK ambition, with second unit (4Mt pa) to follow – good progress over last 12 months

· UK Government Biomass Strategy (August 2023) highlights important role for BECCS

· Planning consent granted for two units (January 2024)

· Consultation on BECCS bridging mechanism (January – February 2024)

· MoU with Harbour Energy and bp to assess options for transportation and storage of CO2 (February 2024)

· Ongoing formal discussions with UK Government regarding bridging mechanism and BECCS

· Global BECCS – targeting first project (3Mt pa) by 2030 – site selected in US South, moving to FEED in 2024

· Targeting 600MW expansion of Cruachan Power Station (pumped storage) by 2030, planning consent granted

· Targeting 8Mt pa of pellet production capacity by 2030, subject to clarity on UK BECCS

· Ambition for the development of over 20Mt pa of carbon removals through 2030s

Capital allocation policy unchanged – continue to assess capital requirements in line with the current policy

· Compliance with TCFD reporting requirements

· Science Based Targets initiative (SBTi) targets approved

· Forum for the Future BECCS Done Well report and publication of initial Drax response

National Audit Office (NAO) and Ofgem

· NAO review of UK Government’s biomass strategy published (January 2024)

· Outlines opportunities to develop standards consistent with existing statements from UK Government

· Highlights UK Government’s commitment to biomass and its long-term role in delivering UK targets

· Ofgem – annual assessment of compliance with Renewables Obligation (RO) scheme (May 2023) – “Good” rating

· Ofgem – investigation of annual biomass profiling reporting under RO scheme (ongoing)

Operational and financial review

| £ million | 2023 | 2022 |

| Adj. EBITDA breakdown (incl. EGL) | 1,009 | 731 |

| Pellet production | 89 | 134 |

| Pumped storage and hydro | 230 | 171 |

| Biomass generation | 703 | 525 |

| Energy solutions (Customers) | 72 | 26 |

| Corporate, innovation, Global BECCS and other (7/8) | (85) | (125) |

Pellet Production – production and sales supporting UK generation and sales to third parties

· Robust performance in a challenging environment

· Progressing development of new Longview pellet plant, and Aliceville expansion complete

· Investment of c.$300 million adding c.0.6Mt of new capacity

· Pipeline of new third-party sales opportunities

· 0.5Mt contract to Japan over five years, commenced in 2023

· Letter of Intent for sale of up to 1Mt of biomass to European utility, for projects incl. Sustainable Aviation Fuel

Generation – energy security with dispatchable renewable generation and system support services

· Pumped storage and hydro – strong system support and generation performance

· Includes forward sale of peak power (Q1 2023), system support services, renewables and capacity payments

· Biomass generation – strong system support and renewable generation performance

· Period-on-period reduction in output reflects two major planned outages

· Higher achieved power price and value from system support, but higher biomass costs

· As at 26 February >£2.8 billion of forward power sales between 2024 and 2026 on RO biomass, pumped storage and hydro generation assets – 22.3TWh at an average price of £127.3/MWh(9/10)

· RO generation – fully hedged in 2024 and >90% hedged in 2025

· A further 2.6TWh of CfD generation contracted for 2024

| Contracted power sales as at 26 February 2024 | 2024 | 2025 | 2026 |

| Net RO, hydro and gas (TWh)(9) | 10.8 | 9.3 | 2.2 |

| – Average achieved £ per MWh(10) | 149.0 | 111.1 | 89.6 |

| CfD (TWh) | 2.6 | ||

Energy Solutions (Customers) – renewable power sales and energy services

· Strong Industrial and Commercial (I&C) performance with 7% increase in power sales – 15.8TWh (2022: 14.8TWh), stable margins on contracted sales and lower balancing costs

· Growing value from 100% renewable power products

· Development of energy solutions business including system support services via demand response, and electric vehicle services following acquisition of BMM (August 2023)

· Impairment of Opus Energy of £69 million, following transfer of renewables activities to Drax Energy Solutions (along with £145 million of Goodwill) and the previously announced ending of gas sales

Other financial information

Capital investment

· Capital investment of £519 million (2022: £255 million)

· £187 million maintenance and other, including two major planned outages on biomass units

· £332 million growth, including £189 million OCGTs and £76 million pellet plant developments

· 2024 expected capital investment of £410-450 million

· OCGTs – c.900MW – three new-build sites, commissioning in H2 2024

· Continuing to evaluate options for these projects

Cash and balance sheet

· Cash generated from operations £1,111 million (after £155 million inflow of collateral) (2022: £320 million, after £407 million outflow of collateral)

· Net debt at 31 December 2023 of £1,084 million (31 December 2022: £1,206 million), including cash and cash equivalents of £380 million (31 December 2022: £238 million)

· Good progress on financing activities

· ESG term loan, extended maturity to 2026 and reduced size to C$200 million (November 2023)

· £144 million of infrastructure facilities repaid (January 2024)

· Extension of £300 million revolving credit facility to 2026 (January 2024)

· New £258 million term-loan facilities with 2027-2029 maturities (February 2024)

Footnotes:

(1) Financial performance measures prefixed with “Adjusted” are stated after adjusting for exceptional items (including impairment of non-current assets, proceeds from legal claims, change in fair value of financial instruments and impact of tax rate changes). Adj. EBITDA and EPS measures exclude earnings from associates and amounts attributable to non-controlling interests.

(2) Earnings before interest, tax, depreciation, amortisation, other gains and losses and impairment of non-current assets, excluding the impact of exceptional items and certain remeasurements, earnings from associates and earnings attributable to non-controlling interests.

(3) In December 2022, the UK Government confirmed the details of a windfall tax – the Electricity Generator Levy (EGL) – on renewable and low-carbon generators, implemented in 2023 and running to 31 March 2028. The EGL applies to the three biomass units operating under the RO scheme and run-of-river hydro operations. It does not apply to the Contract for Difference (CfD) biomass or pumped storage hydro units. Following review, we have concluded that EGL will be accounted for as a levy within Gross Profit and therefore Adj. EBITDA. For 2023 we have presented Adj. EBITDA including and excluding EGL for ease of comparison.

(4) Net debt is calculated by taking the Group’s borrowings, adjusting for the impact of associated hedging instruments, and subtracting cash and cash equivalents. Net debt excludes the share of borrowings and cash and cash equivalents attributable to non-controlling interests.

Borrowings includes external financial debt, such as loan notes, term loans and amounts drawn in cash under revolving credit facilities, net of any deferred finance costs.

(5) Following completion of the share buyback programme Drax has c.384.7 million shares in issue, with a further c.40.3 million held in treasury.

(6) As of 21 February 2024, analyst consensus for 2024 Adj. EBITDA (incl. EGL) was £968 million, with a range of £882 – 1,097million. The details of this company collected consensus are displayed on the Group’s website.

(7) In 2023 a review of the mechanism for corporate recharges was performed, leading to a greater proportion being recharged to business units, primarily Generation. The remaining £85 million in 2023 is comprised of £57 million for Global BECCS (2022: £14 million) and £28 million of other corporate and innovation costs, including the development of options for pumped storage expansion (2022: £24 million) and intercompany eliminations. 2022 is not restated in the table, but footnote 8, below includes a restated Adj. EBITDA breakdown for 2022 which includes the cost reallocation on the same basis as 2023.

(8) The table shows Adj. EBITDA breakdown with 2022 restated inclusive of the cost reallocation exercise described in footnote 7.

| £ million | 2023 | 2022 |

| Adj. EBITDA breakdown (incl. EGL) | 1,009 | 731 |

| Pellet production | 89 | 125 |

| Pumped storage and hydro | 230 | 171 |

| Biomass generation | 703 | 453 |

| Energy supply (Customers) | 72 | 20 |

| Corporate, innovation, Global BECCS and other | (85) | (38) |

(9) Includes 3.5TWh of structured power sales in 2025 and 2026 (forward gas sales as a proxy for forward power), transacted for the purpose of accessing additional liquidity for forward sales from RO units and highly correlated to forward power prices.

(10) Presented net of cost of closing out gas positions at maturity and replacing with forward power sales.

Chair’s statement

Introduction

I am pleased to present my first Chair’s statement for the Group. I joined the Drax Board in August 2023 and assumed the role of Chair in January 2024.

I have spent most of my executive career working in power generation, primarily in North and South America. What drew me to Drax, among other things, was the Group’s strong sense of purpose in enabling a zero carbon, lower cost energy future.

Over the last 15 years Drax has transitioned from a UK-based coal-fired power generator to an international renewable energy company. With the development of carbon removal opportunities utilising BECCS technology, I believe that Drax is at the forefront of the energy transition, and I am excited to be a part of that.

On a personal note, I am grateful to Philip Cox for his support during my introduction to the Company and I would like to thank him on behalf of the Board for his nine years of service to the Group, as a Non-Executive Director and Chair.

During his stewardship, the business has completed its transition from coal to biomass power generation, our Pellet Production business has grown, and we have progressed opportunities for BECCS.

These actions have been driven by the Group’s continuing commitment to deliver our purpose and contribute to the fight against climate change.

People and values

Since joining the Board, I have already spent time with many colleagues across the Group. I have visited several sites, and I look forward to visiting more during 2024 as I continue to learn about Drax.

I have been impressed with the commitment and enthusiasm of colleagues I have met, and the strong sense of pride in what we are doing. This extends to making sure we do what is right in the way we work, that we support one another, and that we actively engage with stakeholders.

Sustainability is at the heart of the Group, and we believe that achieving a positive economic, social, and environmental impact helps us create sustainable long-term value. We welcome healthy discussion and challenge about what we do, and we acknowledge that there is always room for continued improvement.

The Board remains committed to building a supportive, diverse, and inclusive working environment where all colleagues feel comfortable contributing to healthy debate to achieve the best results. In our latest colleague engagement (My Voice) survey we received positive outcomes on measures, such as inclusion and safety, with an overall engagement score of 79% (2022: 79%). I am also pleased to report that as at 1 January 2024, 56% of the Board were women.

Results and dividend

Adjusted(1) EBITDA (excluding EGL) in 2023 was £1,214 million. This is significantly higher than 2022 (£731 million), reflecting a strong power generation and system support performance in the UK. The balance sheet also remains strong, with Net debt of £1,084 million (2022: £1,206 million), which is significantly below our target ratio of around 2 times Net debt to Adjusted EBITDA.

At the 2023 Half Year Results, we confirmed an interim dividend of £36 million (9.2 pence per share). The Board proposes to pay a final dividend in respect of 2023 of £53 million, equivalent to 13.9 pence per share. This will make the full year 2023 dividend £89 million (23.1 pence per share) (2022: £84 million, 21.0 pence per share).

This represents a 10% increase on the dividend per share paid in respect of 2022. It is also consistent with our policy to pay a dividend that is sustainable and expected to rise as the strategy delivers stable earnings, cash flows and opportunities for growth.

The Group has a clear capital allocation policy. In determining the rate of growth in dividends from one year to the next, the Board will take account of cash flows from contracted income, the less predictable cash flows from the Group’s commodity-linked revenue streams, and future investment opportunities. If there is a build-up of capital, the Board will consider the most appropriate mechanism to return this to shareholders. In line with this policy, between May 2023 and September 2023 the Group conducted a £150 million share buyback programme, purchasing over 26 million shares.

Summary

I would like to thank all colleagues for their hard work, dedication, and expertise in helping us deliver our purpose and our financial results.

In 2023, we used our generation assets and our supply chain to provide reliable and flexible power; we enhanced security of supply in the UK; and we continued to deliver strong financial performance, which resulted in growing dividends to our shareholders.

At the same time, we have made good progress with our strategic objectives. Our biomass growth strategy is clear and underpins our plans for biomass sales, opportunities for BECCS, and renewable power generation.

Through these complementary opportunities, we believe we can deliver sustainable long-term value to our stakeholders as we realise our purpose of enabling a zero carbon, lower cost energy future and become a carbon negative company, removing more carbon from the atmosphere than we produce across our direct operations.

(1) Adjusted financial performance measures are described in note 4.

Andrea Bertone,

Chair

28 February 2024

CEO’s Review

The global geopolitical environment continued to be challenging in 2023, with the ongoing war in Ukraine, as well as the conflict in the Middle East. Nevertheless, markets stabilised and prices came down for many commodities, as Europe, in particular, adapted to the new reality and limits on imports of gas from Russia. Despite these challenges, the world continues to drive towards decarbonisation, with an agreement at COP28 to commit to transition away from burning fossil fuels.

These trends also apply to the UK, where gas and power prices have come down significantly. Energy security continues to be a key focus and, despite all the challenges, the UK looks to continue delivering its net zero targets.

As many countries seek to decarbonise in a cost-effective manner, while protecting energy security and delivering a Just Transition, our purpose – to enable a zero carbon, lower cost energy future – is well aligned with these competing priorities.

The world must act now to address the climate crisis if we are to limit global warming to 1.5oC above pre-industrial levels. We need more renewable energy, and more flexible energy systems to make the best use of intermittent renewables. Crucially, we also need carbon removal technologies, like BECCS, to remove carbon from the atmosphere.

We believe that the use of sustainable biomass and BECCS, alongside flexible, renewable generation and energy systems can make an important contribution – decarbonising and protecting energy security, whilst stimulating economies and minimising the cost.

These benefits will only be possible with the right biomass – biomass that is sourced sustainably. At Drax we are committed to using biomass that can deliver positive outcomes for the climate, nature, and people. We continue to put in place policies, procedures, and controls to support this, and we are committed to working in partnership with stakeholders in the communities where we operate, as well as with industry, scientists, and civil society organisations to achieve our ambitions.

Against this backdrop we are continuing to execute our strategy for carbon removals from BECCS in the US and UK by 2030. In addition we are planning to expand our pumped storage hydro business, and biomass supply chain.

Through our strategy we are creating opportunities for growth and attractive returns while aligning to global decarbonisation efforts. Investments remain subject to the right frameworks from governments and regulators, underpinned by high-quality earnings and cash flows from our core business. We are delivering for shareholders today, paying a sustainable and growing dividend and additional returns via a £150 million share buyback programme conducted in 2023, in line with our capital allocation policy.

Safety

Safety remains a primary focus and, in 2023, we achieved an improvement in performance with our Total Recordable Incident Rate of 0.38 (2022: 0.44). As we explained in our 2022 Annual Report, we widened the scope of reporting to include contractor incidents and saw improvements in the recording of incidents in our pellet operations.

We are committed to a strong safety culture across the Group and remain focused on improving performance. We implemented Health, Safety and Environmental (HSE) improvement plans across our businesses in 2023, including investment in training, human resource, and capital projects. We also strengthened our HSE reporting culture by encouraging all colleagues to provide feedback when they identified any hazards or near misses. From this, we were able to implement action plans to prevent reoccurrence. Our See it, Stop it, Report it campaign was run Group-wide.

Chair

At the start of 2024 Andrea Bertone became the new Chair of the Drax Board. With her extensive experience of the energy sector in the Americas, Andrea’s stewardship will be valuable as we develop our growing global business.

Andrea replaces Philip Cox, who dedicated nine years of service as a Non-Executive Director and Chair. Philip was Chair throughout my time at Drax and I am grateful for his calm and assured stewardship of the business during a period of significant change and growth. Thank you, Philip.

Summary of 2023

In 2023 we delivered a strong financial and operational performance. We did so while continuing to play an important role supporting energy security in the UK through the provision of dispatchable, renewable generation for millions of homes and businesses.

Adjusted(1) EBITDA (excluding EGL) of £1,214 million, represents a 66% increase on 2022 (£731 million). This reflects a very strong system support and renewable power generation performance across the portfolio as well as growth in our Customers business.

Biomass operations in Generation and Pellet Production remain at the heart of the Group, with combined Adjusted EBITDA (excluding EGL) of £974 million in 2023 (2022: £659 million).

Flexible generation and energy supply (pumped storage, hydro and Customers) delivered Adjusted EBITDA (excluding EGL) of £325 million (2022: £197 million).

In addition, capital projects, innovation, and other costs give Consolidated Adjusted EBITDA (excluding EGL) of £1,214 million (2022: £731 million).

Our balance sheet is strong, with total cash and committed facilities of £639 million and Net debt of £1,084 million. This means that Net debt to Adjusted EBITDA (excluding EGL) was less than 1 times – significantly below the Group’s target of around 2 times.

In line with our policy to pay a sustainable and growing dividend, the Group plans to pay a total dividend for 2023 of 23.1 pence per share. This is an increase of 10% on 2022 (21.0 pence per share), which in addition to the £150 million share buyback programme, represents total returns to shareholders of £236 million.

The Group’s capital allocation policy remains unchanged and Drax continues to assess options for capital investment, further returns to shareholders, and the repurchase or retirement of debt.

(1) Adjusted financial performance measures are described in note 4.

Electricity Generator Levy

As a consequence of higher gas prices, the UK Government introduced the EGL, a levy on renewable generation. The charge incurred in 2023 was £205 million.

Ofgem and the National Audit Office

In May 2023, Ofgem (via its audit contractor, Black & Veatch), completed an annual assessment of Drax Power Limited’s compliance with the Renewables Obligation (RO) scheme, with Drax receiving a “Good” rating (the highest of four available ratings).

Separately, also in May 2023, Ofgem announced the opening of an investigation into Drax Power Limited’s annual biomass profiling reporting under the RO scheme. In its opening statement, Ofgem confirmed that it had not established any non-compliance that would affect the issuance of Renewables Obligation Certificates (ROCs). Drax awaits the conclusion of this investigation.

In September 2023, the National Audit Office (NAO) announced a review of the UK Government’s biomass strategy. In January 2024, the NAO concluded its process, acknowledging the important role that sustainably sourced biomass has to play in the UK Government’s plans for net zero, and recognising the importance of sustainability reporting and criteria being robust and fit for purpose.

Operational performance

Pellet Production

Adjusted EBITDA of £89 million (2022: £134 million) reflects lower levels of production, an increased proportion of sales to third parties under legacy contracts, and higher operating expenditure due to maintenance costs arising from unplanned outages and increased staff costs.

Against the backdrop of a more challenging operational and market environment, we believe that this was a robust performance, with opportunities to improve profitability in our Pellets business.

We also continued to progress development opportunities with the expansion of Aliceville (Alabama) and a new-build pellet plant at Longview (Washington State) that includes the development of a new co-located port facility.

Taken together, existing operations and developments will give Drax a network of 18 pellet plants (around 5.4Mt of capacity), with access to five deep-water ports in the US South and West Coast of North America.

The pellet supply market experienced a challenging year but, as a vertically integrated producer, user, buyer, and seller of biomass, we operate a differentiated biomass model from our peers and see the current global biomass market as representing a favourable balance of risks and opportunities for the Group.

In the short term, we are focused on managing risks to our supply chain, while at the same time remaining alert to the opportunities this may create. Longer term, we are fundamentally positive on the outlook for biomass demand and expect this to grow, as sustainable woody biomass is increasingly used for BECCS and carbon removals, as well as for next-generation sustainable aviation fuel (SAF).

The Group currently has over 17Mt of long-term biomass sales contracted to third parties in Asia and Europe extending to the mid-2030s.

In November 2023, we commenced supply of a new 0.5Mt five-year contract with a Japanese customer, and in December agreed a Letter of Intent for the sale of up to 1Mt of biomass to a major European utility, including a biofuel project which is targeting a final investment decision during 2025.

We believe that these developments demonstrate the growing demand for biomass pellets in Asia and Europe and its wider application in the energy transition.

Generation

Adjusted EBITDA (excluding EGL) of £1,138 million was an increase of 64% on 2022 (£696 million). This reflects a strong system support and renewable power generation performance across the portfolio – providing high levels of dispatchable renewable and low-carbon power, and system support services – offsetting incrementally higher biomass costs.

Our portfolio generated over 4% of the UK’s electricity between October 2022 and September 2023 (the most recent period for which data is available). We also generated 8% of the UK’s renewable electricity over the same period, making Drax the largest renewable generator by output. In addition, during 2023 our assets produced on average 16% of the UK’s renewables at times of peak demand and up to 67% on certain days. This underlines the important role that Drax plays in security of supply in the UK.

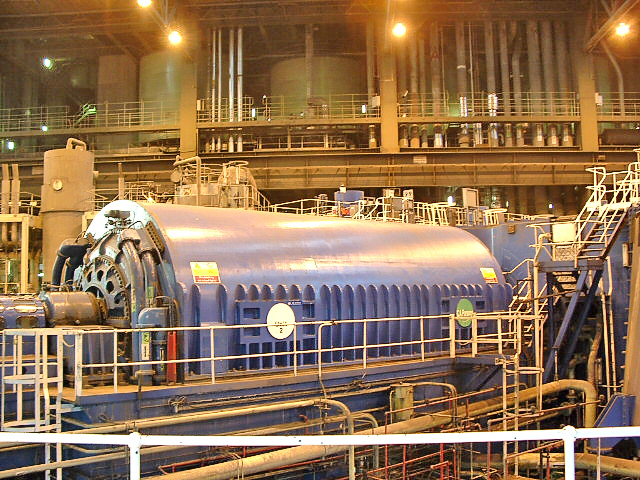

The current operating environment highlights the importance of continued investment to ensure good operational performance and availability. As a part of this investment programme, we completed two major planned outages at Drax Power Station in July and November 2023.

Biomass

The Group has a robust and diversified global supply chain. It consists of both third-party suppliers and around 5Mt of owned production capacity across the Group’s operational facilities in the US and Canada. This diversification provides a high level of operational redundancy designed to mitigate potential disruptions at supplier level.

In the UK, Drax utilises dedicated port facilities at Hull, Immingham, Tyne and Liverpool, with annual throughput capacity and biomass rail sets providing supply chain capacity significantly in excess of the Group’s typical annual biomass usage.

Drax Power Station has around 300,000 tonnes of onsite biomass storage capacity. Taken together with volumes throughout the supply chain, the Group currently has visibility of around one million tonnes of biomass in inventories. This adds to the resilience and security of the UK power market over the winter period. Around 30% of the UK’s gas storage sites are required to produce the equivalent amount of electricity that the Drax inventory supports.

Most of the biomass we use is under long-term contracts. However, as we previously reported during 2022, upstream inflationary pressures in certain aspects of our supply chain led to some cost increases in 2023, in addition to an increase in labour costs at Drax Power Station adding to the fixed cost base of the plant.

Pumped Storage and Hydro

Cruachan pumped storage and the Lanark and Galloway hydro schemes delivered a very strong performance in 2023. Adjusted EBITDA (excluding EGL) of £253 million is significantly above 2022 (£171 million) and historical levels of Adjusted EBITDA since acquisition, which have been in the region of £70 million.

The primary driver of this strong performance was a high level of activity at Cruachan. The plant delivered system support services via the short-term balancing mechanism, ancillary services and peak off-peak power generation. As forward power prices have reduced, we expect a lower level of Adjusted EBITDA in 2024, although well above the historical performance. Cruachan and elements of our run-of-river hydro schemes also operate in the Capacity Market.

While power prices are unpredictable, we believe that increased reliance on intermittent renewables in the UK system will continue to drive further demand for dispatchable power and system support services. This creates long-term enduring earnings opportunities for assets like Cruachan.

Coal

At the request of the UK Government, during the winter contract period of 2022-2023 we kept the remaining two coal units at Drax Power Station available to provide a “winter contingency” to support the UK power system. At the end of March 2023 we closed these units and decommissioning is underway.

Customers

Our Customers business performed well in 2023 with Adjusted EBITDA of £72 million (2022: £26 million). This headline performance benefited from a reduction in the volatility seen in the previous period, which we do not expect to recur to the same extent in 2024. The Industrial and Commercial (I&C) business performance was underpinned by stable margins on higher contracted power prices and elevated value from renewable products. Conversely, our Opus business declined because of the exit from gas supply and lower customer numbers.

Over the past three years, we have restructured the Customers business, streamlining operations. These changes have supported the development of our core I&C supply operations, which represents the majority of earnings in our Customers business.

Setting aside one-off benefits, 2023 was a strong underlying performance reflecting the high-quality customer base and the increased value of renewable power underpinned by Renewable Energy Guarantees of Origin (REGO) certificates. With a growing demand for 100% renewable power supply to customers, prices for these certificates have increased and our Customers business provides a means to realise greater value from our large scale renewable generation – a benefit of our integrated value chain.

Alongside supplying renewable energy, we see an important role in supporting the decarbonisation of I&C businesses through the provision of additional products – including asset optimisation, electric vehicle (EV) services, and carbon offset certificates – which we believe could evolve in the future to the provision of Drax carbon removals. Reflecting this potential, in August 2023 Drax Energy Solutions acquired BMM Energy Solutions (BMM), an installer of EV charge points. The acquisition enhances our end-to-end EV charging proposition, as part of the Group’s commitment to support customers in achieving their net zero ambitions.

Strategy

Through 2023 we continued to progress our strategy, which is designed to realise our purpose of enabling a zero carbon, lower cost energy future and our ambition to be a carbon negative company. It includes three complementary strategic pillars, closely aligned with global energy policies: (1) to be a global leader in carbon removals; (2) to be a global leader in sustainable biomass pellets; and (3) to be a UK leader in dispatchable, renewable generation.

A UK leader in dispatchable, renewable generation

The UK’s plans to achieve net zero by 2050 will require the electrification of sectors such as heating and transport systems, resulting in a significant increase in demand for electricity. We believe that intermittent renewable and inflexible low-carbon energy sources – wind, solar and nuclear – could help meet this demand. However, this will only be possible if other power sources can provide the dispatchable power and non-generation system support services required to ensure security of supply and to limit the cost to the consumer.

With demand for these services growing, and with fewer assets capable of doing this as older thermal plants are retired, this is a challenge for the power system but also an opportunity for the Group.

Biomass, pumped storage and hydro all have an important role to play and we are looking at ways to supplement the portfolio and create long-term value for the Group and our shareholders.

We are continuing to develop options for Cruachan, including a 600MW expansion. The location, flexibility and range of services Cruachan can provide makes it strategically important to the UK power system and an enduring source of long-term earnings and cash flows linked to the UK’s energy transition. In July 2023, the Scottish Government awarded planning consent for the expansion and, subject to the right investment framework, we are targeting a final investment decision to be taken in 2025.

In this regard, in January 2024 the UK Government launched a consultation on an investment mechanism to support the development of new long-duration storage projects, like pumped storage, with a “minded to” preference for a “cap and floor” mechanism. We continue to target commercial operations by 2030.

We are continuing to construct three new-build Open Cycle Gas Turbine (OCGT) projects at two sites in England and one in Wales, targeting commissioning during 2024. The three plants will provide combined capacity of around 900MW and be remunerated under 15-year Capacity Market agreements (2024-2039), in addition to peak power generation and system support services. The units are expected to enter service in the second half of 2024.

These assets are highly flexible and able to provide the grid with a range of services, which we believe will become increasingly important as the UK energy system becomes progressively more reliant on wind. Whilst gas is not renewable, we expect the units to operate on a limited basis at times of system stress, resulting in a low-carbon footprint.

We also continue to assess options for these assets, including their potential sale.

A global leader in carbon removals

Our ambition is to develop carbon removals globally, and to deploy BECCS in the UK and US by 2030. The Intergovernmental Panel on Climate Change (IPCC) is the world-leading authority on climate science. Its research states that Carbon Dioxide Removal (CDR) methods, including BECCS, are needed to mitigate residual emissions and keep the world on a pathway to limit global warming to 1.5oC.

The illustrative mitigation pathways assessed by the IPCC use significant volumes of carbon removals, including BECCS, as a key tool for mitigating climate change. The IPCC has assessed that globally up to 9.5 billion tonnes of CDRs from BECCS could be required per year by 2050.

The Group is developing a pipeline of projects that could contribute towards this total, with our ambition for 20Mt of carbon removals. We are progressing plans to develop 7Mt of carbon removals through BECCS by 2030. Of this, 3Mt would be in the US and 4Mt in the UK.

US BECCS

The US represents an attractive investment environment for large-scale carbon removals. It combines good access to fibre and carbon storage, thereby shortening our supply chain, in addition to a supportive investment horizon provided by the Inflation Reduction Act and associated schemes.

We have a first site selected and progressing through pre-FEED (front-end engineering design). The site, located in the US South, would be a new-build BECCS power plant capable of producing around 2TWh per annum of renewable electricity from sustainable biomass and capturing around 3Mt of carbon dioxide per annum. Total investment is estimated to be in the region of $2 billion with a target final investment decision (FID) in 2026 and commercial operation by 2030. Additional projects could be brought onstream through the 2030s.

The capital cost of the project reflects the construction of new-build power generation capacity as well as carbon capture and storage (CCS) systems.

The design of the plant enables a wider choice of sustainable biomass materials, including non-pelletised material, such as woodchips. Drax aims to locate new plants in regions that are closer to sources of sustainable biomass and carbon transportation and storage systems. This is expected to significantly reduce the operating cost of a new-build BECCS plant compared to a retrofit, as well as reducing carbon emissions in the supply chain. However, we may need to source from further afield to ensure consistent access to the volumes and quality of fibre required.

Investment in the first new-build BECCS site and subsequent developments through the 2030s will be subject to long-term CDR offtake agreements with corporate counterparties, and power purchase agreements for 24/7 renewable power, with discussions with prospective counterparties underway.

We are allocating resources across all of these opportunities and in August 2023 we opened a new Global BECCS headquarters in Houston, Texas. We now have over 100 employees working on our Global BECCS programme in the UK and North America.

We are also continuing to assess options for BECCS projects using existing non-Drax assets, in addition to screening other regions for BECCS potential, including Europe and Australasia.

UK BECCS

We continue to develop an option for BECCS at Drax Power Station, with plans to add post-combustion carbon capture to two of the existing biomass units that use sustainable biomass and technology from our technology partner, Mitsubishi Heavy Industries (MHI). The captured carbon will be transported and stored under the North Sea.

In August 2023, the UK Government published a Biomass Strategy which set out its position on the use of biomass in the UK’s plans for delivering net zero. This outlined the potential “extraordinary” role that biomass can play across the economy in power, heating and transport. This includes a priority role for BECCS, which is seen as critical for meeting net zero plans due to its ability to provide large-scale CDRs.

In December 2023, the UK Government confirmed further policy support for the development of carbon capture and storage in the UK, including an update on the Track-1 expansion and Track-2 processes, having previously set out an indicative timetable for selection of successful projects during 2024, moving onto bilateral discussions regarding the level of Government support. This support is expected to take the form of a 15-year Contract for Difference (CfD) with a dual payment mechanism linked to both low-carbon electricity and negative emissions.

Both options are potentially available to Drax and the timing for their deployment is consistent with our expectations. This could see us take a FID on a first Drax Power Station BECCS unit in 2026 and commence BECCS operations by 2030. In January 2024, the project received planning approval which represents another milestone in the development of the project.

Bridging mechanism

In January 2024, the UK Government launched a consultation on a bridging mechanism to support large-scale biomass generators transitioning from their existing renewable schemes to BECCS. We participated in the consultation and we now await Government’s response.

We believe that a bridging mechanism offers the most effective way to build a link between the end of the current renewable schemes in 2027 and BECCS operations. This could provide multi-year certainty allowing Drax to secure long-term biomass supplies and continue to support energy security via flexible and reliable renewable biomass operations in advance of BECCS.

Innovation

We continue to invest in innovation in biomass and BECCS. In 2023, we commissioned a small sugar extraction plant and we remain an equity shareholder in C-Capture Limited, which is developing a solvent technology that could be used for BECCS and other applications.

A global leader in sustainable biomass pellets

We believe that the global market for sustainable biomass will grow significantly, creating international opportunities. These will include sales to third parties, BECCS, generation and other long-term uses of biomass, including SAF. Reflecting that growth, we are developing a pipeline of new contracts for biomass supply into new markets and uses to supplement our existing long-term third-party supply arrangements.

To support this expected growth in demand for biomass products, we are targeting 8Mt of pellet production capacity. This will require over 2Mt of new biomass pellet production capacity to supplement existing capacity and developments.

Drax is differentiated as a major producer, supplier and user of biomass, active in all areas of the supply chain, with long-term relationships and over 20 years of experience in biomass operations. We can deploy the Group’s innovation in coal-to-biomass engineering, together with the development of a leading position in carbon removals, alongside our large, reliable and sustainable supply chain. In doing so, we will form long-term partnerships to support customers with their decarbonisation journeys.

Sustainability

As a purpose-led organisation, as we grow, positive outcomes for climate, nature and people should grow too. We believe the more we do, the more atmospheric carbon could be reduced and removed. Our operations can help sustain more working forests, and provide more jobs and opportunities in communities where we source and operate.

We must continue to meet all sustainability expectations of us, promote continuous improvement, and be seen to do so.

Working in partnership with industry, communities, scientists, and civil society organisations will be vital to achieving our ambitions. We will look to work constructively with them to help us deliver improvements and perpetuate positive outcomes for the climate, nature, and people.

Engaging with stakeholders is an important element. In 2022, we commissioned Jonathon Porritt CBE (a leading environmental campaigner and co-founder of Forum for the Future) to convene a High-Level Panel to conduct an independent inquiry into how to implement BECCS in a way that delivers positive outcomes for the climate, nature and people. The Panel reported back in November 2022, setting out the conditions for BECCS to be done well, and in July 2023 we published our response.

In 2023 the Science Based Targets initiative (SBTi) also validated that our carbon reduction targets are in line with the actions required to follow a 1.5oC pathway. This adds further rigour to our plans to continue to reduce carbon emissions within the Group.

We are a supporter of the Task Force on Climate-related Financial Disclosures (TCFD). We are also a Taskforce on Nature-related Financial Disclosures (TNFD) adopter, and in 2023 we participated in a TNFD pilot project for our pumped storage and hydro assets. We are also a signatory to the UN Global Compact (UNGC) and we are committed to promoting the UNGC principles concerning respect for human rights, labour rights, the environment, and anti-corruption.

Outlook

We are continuing to play an important role in supporting energy security in the UK. We are using our supply chain and dispatchable, renewable generation portfolio to provide large volumes of reliable renewable power and system support services. In this context the strategic importance of our portfolio and its contribution to the UK power system is clear. We believe we will have a long-term role to play as the UK manages the need to decarbonise whilst maintaining energy security.

Our long-term focus remains on progressing our strategy and our ambition is to become a carbon negative company, underpinned by the development of BECCS. The potential for the growth in CDRs, and the opportunity this could afford BECCS in the UK and our plans for North America, are both significant. We anticipate making further progress on these options during 2024.

Through these strategic objectives, we expect to create opportunities for long-term international growth, underpinned by strong cash generation and attractive returns for shareholders, and to deliver value for our stakeholders.

Will Gardiner,

CEO

28 February 2024