Diploma PLC (LON:DPLM), the international value-add distribution group, has announced the proposed acquisition of Peerless Aerospace Fastener LLC, a market-leading distributor of specialty fasteners into the US and European aerospace markets for ca. £236m ($300m). The transaction is expected to complete in the next few weeks following customary regulatory clearances.

· A high quality business: Peerless is one of the largest independent value-added distributors of aerospace fasteners with a strong reputation for quality and breadth of product, speed to market, and value-add customer service. This customer proposition has driven a long track record of organic growth of ca. 9% and has enabled ca. 30% operating margin.

· Strong strategic fit: the acquisition will add to our established position in aerospace fasteners, extending our capability from aircraft cabin to airframe, accelerating organic growth by significantly expanding our capability in the US with an enhanced product offer and further penetrating key strategic markets in Europe.

· Attractive valuation: ca. £236m represents a multiple of ca. 7x FY24 EBIT and a year one ROATCE of 15%, well in excess of our cost of capital. It will be immediately accretive to Group growth and operating margin and drive 8% EPS accretion in the first 12 months of ownership.

Positioning behind structurally growing end markets

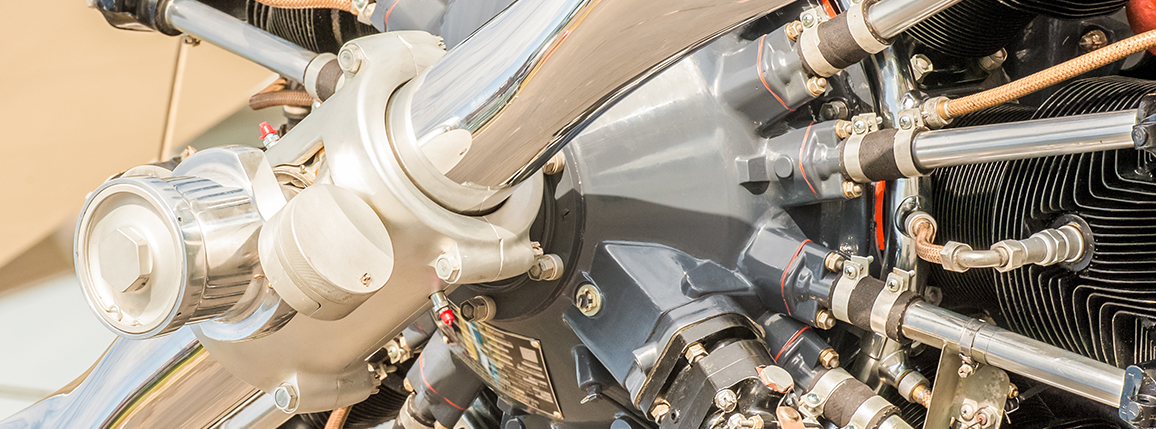

Aerospace fasteners represents a ca. $7 billion, highly fragmented addressable market. They are highly specialised products and amongst the most critical components in aircraft manufacturing. An aircraft contains ca. 1 million fasteners, representing up to 5% of total aircraft build value. There is currently a 10+ year backlog for commercial aircraft manufacture, and the combination of new build and ongoing maintenance supports sustainable long-term market growth. Diploma has operated successfully in this space for more than a decade through our Clarendon business, which has delivered sustained double digit growth, and to which Peerless is highly complementary.

Peerless is a strong strategic fit

Peerless, which was founded in 1952 and is headquartered in Farmingdale, NY, is an approved supplier to all major aerospace companies globally, primarily serving ca. 80 sub-contractors to the principal OEMs. It is a business that we have been tracking, and building a relationship with, for some time. It demonstrates all of the core characteristics we look for in acquisitions:

· Quality value-add business: similar to Clarendon, Peerless’ market-leading reputation and value-add is based on product tracking and traceability; scheduled inventory management; customised kitting; and custom, automated VMI solutions. This is reflected in strong operating margins of ca. 30%.

· Impressive organic growth track record, exciting potential: the business has delivered long-term organic revenue CAGR of ca. 9% and has significant headroom for continued growth in fragmented markets.

· Excellent management team: a highly experienced management team, led by Bill Way and Don Russo, has successfully grown the business for over 20 years. There is strong cultural alignment and we are delighted that they will remain with the business under Diploma’s ownership, within our Controls Sector.

Peerless will be very complementary to our existing business and has strong alignment with our growth strategy:

· Product range extension to expand addressable markets: Peerless significantly extends our value-add fastener solutions for aircraft with the addition of airframe fastening solutions to Clarendon’s existing focus on cabins. Peerless also provides solutions to accelerate Clarendon’s growth in the Defence and Space markets.

· Penetrating further into core developed geographies: Peerless will extend our US reach from predominantly West Coast to national, and extends our capabilities in Europe.

· Cross-sell opportunity: there are clear opportunities to cross sell Clarendon product to Peerless customers in the US and Europe and vice versa.

Compelling financial rationale

As a quality compounder, Diploma has a long track record of accelerating organic growth through selective acquisitions. Over the last five years, we have invested ca. £1 billion to acquire 37 businesses collectively delivering ROATCE of 16% and growing, whilst maintaining balance sheet discipline.

The acquisition of Peerless will continue this track record of strong capital returns as well as being immediately accretive to Diploma’s organic growth and margins. Peerless has delivered long term organic revenue CAGR of ca. 9% and has EBIT margins of ca. 30%. In the first 12 months of ownership, Peerless is expected to be accretive to Group EPS by 8% and achieve a ROATCE of 15%, more than covering the Group’s cost of capital.

For the 12-month period ended 30 September 2023, Peerless generated revenue of $107.7m and EBIT of $33.5m. Gross assets at the end of the period were ca. $84m.

Funding

The Group has recently completed the restructuring of its balance sheet to provide the capacity and flexibility for sustained profitable growth. In July 2023, the Group refinanced its existing bank facilities with a £555m syndicated Revolving Credit Facility maturing in July 2028, with two 1-year extension options. Earlier this month, the Group supplemented this with a successful debut US Private Placement issuance, raising €250m with a mix of 7, 10 and 12 year maturities at an all-in blended fixed coupon of 4.28%.

For the acquisition of Peerless, an initial payment of ca. £228m will be made in cash to Polar Holdings Inc. on closing, with the remaining 3.5% to be paid to management based on Peerless’s FY27 performance.

Our balance sheet remains strong, with flexibility for continued investment; year-end leverage is expected to be ca. 1.3x, assuming no further acquisitions. We expect Group ROATCE to remain strong, at ca. 18%, consistent with FY23.

Johnny Thomson, Chief Executive said:

“Peerless is an excellent acquisition for Diploma, aligned to our strategy of building high quality, scalable businesses for sustainable organic growth. Bill, Don and our new Peerless colleagues have created an exceptional value-add business with a very strong market reputation and I am delighted to welcome them to the Group. We know and like the aerospace fasteners market and Peerless significantly extends our US capabilities and adds scale in Europe. The business is already generating strong performance and there are significant opportunities to enhance returns by working together across our existing businesses. We expect Peerless to extend our track record of acquisitions that drive organic growth at great returns, as part of our focus on continuing to deliver sustainable quality compounding.”

Analyst call

Johnny Thomson, Chief Executive Officer, and Chris Davies, Chief Financial Officer, will host a conference call for analysts and investors this morning at 8:00am (UK time).

Conference call dial in details:

Pre-registration

Dial in

• Dial in: +44 (0) 33 0551 0200 (UK); +1 786 697 3501 (US)

• Password: Diploma Conference Call