The Board of Directors of Digital 9 Infrastructure plc (LON:DGI9) has declared an interim dividend in respect of the period from 1 January 2023 to 31 March 2023 of 1.5 pence per Ordinary Share, payable on or around 30 June 2023 to holders of Ordinary Shares on the register on 16 June 2023. The ex-dividend date will be 15 June 2023.

The Company is targeting an aggregate dividend of 6.0 pence per Ordinary Share for the year ending 31 December 2023.1

Note:

1 The target dividend is a target only and not a forecast. There can be no assurance that the target will be met and it should not be taken as an indication of the Company’s expected or actual future results.

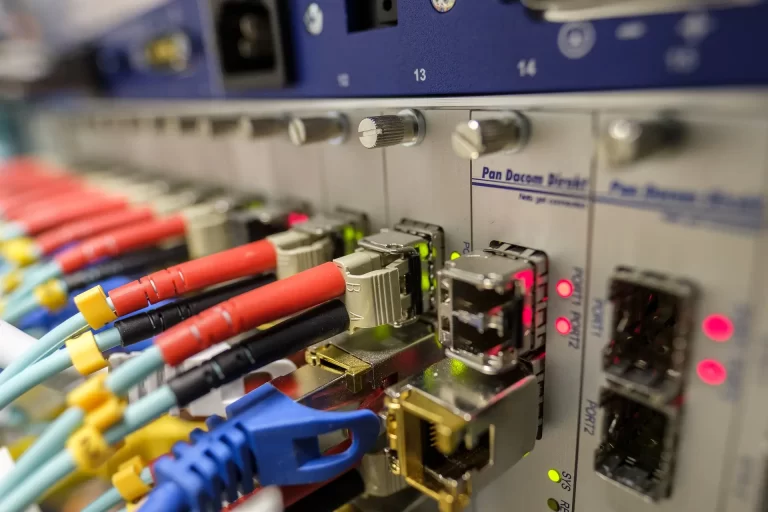

Digital 9 Infrastructure plc (DGI9) is an investment trust listed on the London Stock Exchange and a constitutent of the FTSE 250, with ticker DGI9. The Company invests in the infrastructure of the internet that underpins the world’s digital economy: digital infrastructure.

The Investment Manager is Triple Point Investment Management LLP which is authorised and regulated by the Financial Conduct Authority, with extensive experience in infrastructure, real estate and private credit, while keeping ESG principles central to its business mission. Triple Point’s Digital Infrastructure team has over $300 billion in digital infrastructure transaction experience and in-depth relationships across global tech and global telecoms companies.

The number 9 in Digital 9 Infrastructure comes from the UN Sustainable Development Goal 9, which focuses the fund on investments that increase connectivity globally and improve the sustainability of digital infrastructure. The assets DGI9 invests in typically comprise scalable platforms and technologies including (but not limited to) subsea fibre, data centres, terrestrial fibre and wireless networks.

From its IPO in March 2021 and subsequent capital raises, DGI9 has raised total equity of £905 million and a revolving credit facility of £375 million, invested into the following data centres, subsea fibre, terrestrial fibre and wireless networks:

· Aqua Comms, a leading owner and operator of 20,000km of the most modern subsea fibre systems – the backbone of the internet – with a customer base comprising global tech and global telecommunications carriers (April 2021);

· Verne Global Iceland, the leading Icelandic data centre platform, with 40MW of high intensity computing solutions in operation or development, powered by 100% baseload renewable power (September 2021);

· EMIC-1, a partnership with Meta on a 10,000km fibre system from Europe to India (July 2021);

· SeaEdge UK1, a data centre and landing station for the North Sea Connect subsea cable, part of the North Atlantic Loop subsea network, improving connectivity between the UK, Ireland, Scandinavia and North America (December 2021);

· Elio Networks (previously Host Ireland) a leading enterprise broadband provider that owns and operates Fixed Wireless Access networks (April 2022);

· Verne Global London (previously Volta), a premier data centre based in central London, providing 6MW retail co-location services (April 2022);

· Verne Global Finland (previously Ficolo), a leading Finnish data centre and cloud infrastructure platform, with c.23MW of data centre capacity, powered by 100% renewable power and distributing surplus heat to district heating networks (July 2022).

· Giggle, a revolutionary Fibre to the Home network providing affordable broadband to social housing in Glasgow (July 2022); and

· Arqiva, the only UK national terrestrial television and radio broadcasting network in the United Kingdom – providing data, network and communications services, as well as a national IoT connectivity platform (October 2022).

The Company’s Ordinary Shares were admitted to trading on the Specialist Fund Segment of the Main Market of the London Stock Exchange on 31 March 2021. It was admitted to the premium listing segment of the Official List of the Financial Conduct Authority and migrated to trading on the premium segment of the Main Market on 30 August 2022.