SmartSpace Software plc (LON: SMRT) is focused on digital workspace technologies that make real estate more efficient and organisations more effective.

Listed on the Alternative Investment Market of the London Stock Exchange, they provide software solutions via several routes to market including; direct sales, via Distributors, Partners & Resellers, which enable corporate offices to become Smart Buildings delivering optimisation of the workplace.

SmartSpace Software is the parent company of the UK’s leading workspace optimisation providers:

SPACE CONNECT

Space Connect believe all workplaces should be smart workspaces.

The company is championing your right to optimise your workspace:

- To cut your building costs and use your space really cleverly.

- To give your employees a connected, empowering place to work in.

- To understand, predict and anticipate how your workspace is used.

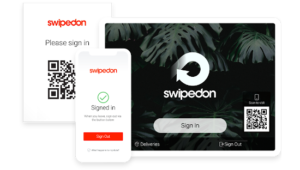

SWIPEDON

SwipedOn is on a quest to help businesses across the globe deliver the best visitor experience imaginable.

The company has been servicing the USA since 2014 and are trusted by Bayer, Disney, The University of Texas Austin, FedEx, United States Cold Storage, 3M, Krispy Kreme, Gate Gourmet, Bosch and many more to deliver the best visitor experience imaginable.

ANDERS+KERN

Anders+Kern UK is a leading distributor of Workspace & Audio Visual technologies based in Suffolk, UK.

Founded in 1989, they deliver product and services via a network of channel partners and resellers. Their partners are specialists in workspace software, sensor technologies, meeting room and desk management / booking systems, visitor management, data analytics & audio visual solutions.