Echo Energy plc (LON:ECHO) is a full cycle, exploration led, gas focused AIM-listed E&P with an exciting asset base in Latin America.

The company has an ambitious growth strategy to deliver shareholder value from both the existing portfolio and new opportunities.

The Company is led by a highly experienced team with strong regional connections and an indisputable track record in building mid cap AIM listed gas businesses with sustainable value growth for private investors.

Echo Energy seeing benefits of reinvesting capital and profitable growth

The company has a bold growth strategy and the competence to rapidly deliver shareholder value from both the existing portfolio with Tapi Aike at its core, and new opportunities providing an exciting platform for growth.

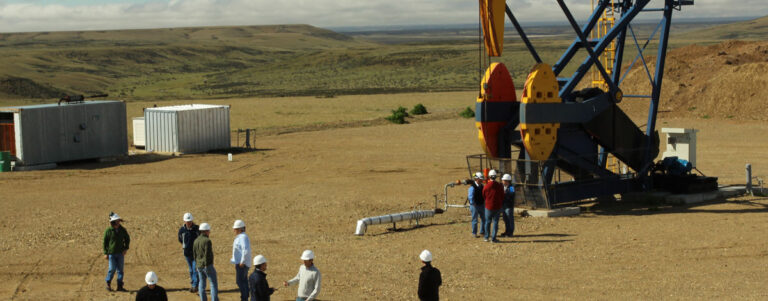

ARGENTINA

Argentina offers favourable investment opportunities in the upstream sector. A historical lack of investment means the country is now reliant on imported gas to feed its growing economy. The country is opening itself to foreign investment in a bid to replace reserves and halt the decline in domestic production.

BOLIVIA

Bolivia offers significant investment potential within the upstream gas sector. Its favourable position at the core of the continent, with existing gas hungry markets on its doorstep secures it a future as one of the principal exporting hubs of Latin America. Neighbouring gas hungry markets and an increasing domestic demand are sparking the need for future exploration.

Below you will find the 5 day trade history, latest news, interviews and Echo Energy share price.