Ciaran Donnelly, Equity Research Analyst, Technology & Media at Liberum, noted “demand for BSS/OSS systems has fundamentally shifted post Covid as telecom operators upgrade their systems to ensure they are prepared for hybrid working environments and the additional demand on telecom infrastructure. Demand for Cerillion’s product suite is driven by industry changes such as 5G, virtualisation, increased security concerns and greater digitalisation. The trend of newer entrants such as MVNOs, cable operators, utility companies and media companies that are offering telecom and media services that require BSS systems has continued. Cerillion’s high quality product suite and deep vertical expertise is leading to larger contract wins, which supports continued growth.”

At the beginning of 2021, Cerillion plc (LON:CER) made a series of predictions as to the state of the telecoms industry, and how the industry will drive recovery after the shocks of 2020.

As it turns out, the on-going effects of the COVID-19 pandemic have carried over well into 2021, accelerating the structural challenges and trends that have long faced the telecommunications industry.

As countries around the world begin to approach something resembling normality at differing velocities, Cerillion assesses just how well those January predictions now hold up.

Private 5G Networks

Whilst consumer adoption of 5G continues on its steady path, private 5G is developing at a much quicker rate. Not only a channel for high quality, superfast connectivity, private 5G bears an equal economic imperative to keep businesses productive, regardless of troublesome external factors.

Private 5G networks guarantee connectivity across geographically large sites or dispersed infrastructure, providing business-critical applications with a consistent level of performance, and many businesses are already taking advantage of their benefits, launching their own networks throughout the first half of 2021.

Qualcomm and Capgemini are just two of the companies partnering to launch private 5G networks across industrial sites around the world.

In Ireland, Ericsson and Three have launched the country’s first indoor 5G campus network at Glanbia’s multi-purpose dairy processing plant in County Kilkenny, while Fujitsu has launched a private 5G network at its plant in Oyama, Japan, leveraging data and video to support remote work and provide quality control.

Across the Atlantic, a private 5G municipal network is being rolled out across Las Vegas by Terranet Communications, as part of a plan to democratise access to broadband connectivity, in particular for its school age population, while AT&T has partnered with real estate firm JBG SMITH to build a 5G Smart City in Washington D.C..

Distributed & Edge Computing

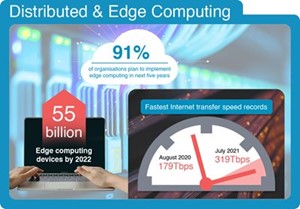

Hand-in-hand with the rise of 5G, in 2021, distributed and edge computing is becoming critical to open up new revenue streams for operators as, come 2022, there will be an estimated 55 billion edge devices on the market – by 2025, this is expected to grow to 150 billion.

Edge computing can enable providers to reduce the power and processing needs of connected devices by extraditing critical tasks and processes away from hardware and into the cloud. And once these devices are enabled with 5G, they too will benefit from the cloud as much as smartphones and other portable devices.

IBM and Scale Computing have inked a new deal to help enterprises optimise their edge computing strategies – in a recent study, 91% of the respondents stated their organisations plan to implement edge computing within the next five years.

Amazon Web Services has announced plans to launch edge computing services for its business customers in the UK. The global technology giant will partner with Vodafone UK to provide fast data transfers using its 5G platform to support edge computing services which use augmented reality and machine learning to analyse bulk data.

Over in Japan, the National institute of Information and Communications Technology (NICT) has broken the internet transfer record by a huge margin, transferring data at 319Tbps using existing infrastructure – nearly twice as fast as the 179Tbps managed by a joint team of British and Japanese researchers in August 2020. Meanwhile, BT has announced trials for a new hollow core optical fibre cable at its R&D facility in Ipswich, which could provide better latency and performance for future broadband services.

Rural Broadband Modernisation

Governments and service providers across the world are accelerating their efforts to modernise rural broadband infrastructure in an effort to deliver gigabit broadband to all their customers, a long overdue move towards eliminating the disparities in digital access, both regionally and nationally.

As we’ve already revisited over the past few months, service providers have been making great strides towards improving their infrastructure, while also replacing any Huawei equipment within their networks as imposed by local governments.

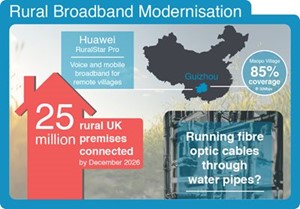

In the UK, Openreach has further expanded its goal of 20 million gigabit-capable Fibre-to-the-Premises (FTTP) installations up to 25 million by December 2026, creating an additional 7,000 jobs.

More recently, the UK government has considered more innovative ways of connecting rural homes without the need to dig up roads, launching a £4 million fund to support projects running fibre optic cables through water pipes.

Over in Denmark, OpenNet has signed up Midtjyllands Elektricitetsforsynings Selskab (MES) to its centralised wholesale platform, providing greater fibre coverage and more high-speed Internet and TV options to customers in Jutland. And at MWC Shanghai 2021, Huawei announced that its China-based RuralStar Pro programme has been commercially rolled out in Guizhou Province, south of Chongqing, aiming to provide broadband services to rural villages in the region, whose connections fall victim to the region’s mountainous topography and other climatic conditions.

Digital Communications & Engagement Solutions

Digital Communication and Engagement Solutions (DCES) leverage engagement technologies across telecoms businesses to better communicate the benefits of new 5G networks.

While 83% of telecom industry professionals said that 5G has either met or exceeded their expectations so far, when it comes to customers, there’s still work to be done.

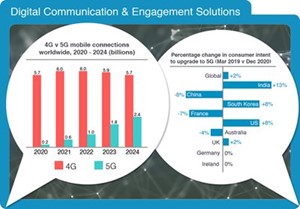

There continues to be a wide disparity around the world when it comes to intent to upgrade to 5G, with many customers still in the dark as to new service offerings; according to recent research by Ericsson, intent to upgrade to 5G increased by only 2% in 2020, so there’s still plenty of need to inform and educate customers on its benefits.

The starkest gap in understanding lies between the improved speed of mobile Internet, and far-out applications such as IoT and virtual reality – benefits that they don’t see as relevant to themselves.

Globally, 5G smartphone adoption is still expected to accelerate in 2021, reaching one billion devices by 2022.

India is currently the world’s fourth largest market for 5G smartphones, with one of the greatest rises in intent to upgrade, despite the current unavailability of 5G to consumers there.

Stratospheric & Lunar Base Stations

Though this year has seen several high-profile space launches containing billionaire cargo, the telecoms space race continues apace, with firms such as SoftBank trying to create “flying base stations” that can deliver radio waves to remote areas — such as mountains, isolated islands, and the sea — to further expand their communications services.

However, no sooner had we sung the praises of Loon in our predictions than its CEO announced that the company was “winding down” because they hadn’t “found a way to get the costs low enough to build a long-term, sustainable business.”

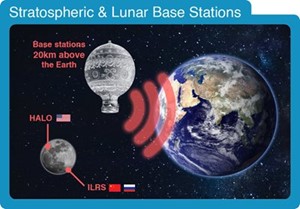

Nevertheless, many firms are continuing to look into the possibility of sending base stations 20 kilometres into the sky with the help of solar-powered aerial vehicles.

Canadian satellite operator Telesat announced recently that French-Italian space hardware manufacturer Thales Alenia Space will build its next-generation broadband satellite network called Lightspeed.

neWeb, owned by a consortium including Softbank, Eutelsat and the UK Government, is developing a constellation of Low Earth Orbit satellites to provide high-speed broadband for government and maritime operations, as well as rural broadband developments.

Meanwhile, SpaceX recently acquired Swarm Technologies, manufacturers of pico satellites – swarms of miniature, lightweight satellites, operable and launched at low cost; so low, in fact, that the company were raked across the coals by the FCC back in 2018 for managing to deploy four of their satellites without regulatory approval.

In further out-of-this-world developments, NASA and Northrop Grumman are developing a Habitation and Logistics Outpost (HALO) on the moon as part of NASA’s Artemis program, including a high-capacity system to enable communications between Earth and the various installations on the lunar surface.

And not to be outdone by the Americans, Russia and China plan to build a joint International Lunar Research Station (ILRS) on the moon, with its own telecommunications infrastructure. The proposed lunar base is intended to be ready for crewed visits by 2036.

Back on Earth, we can watch this second space race play out live and in HD.

Cerillion plc (LON: CER) is a leading provider of billing, charging and customer management systems with more than 20 years’ experience delivering its solutions across a broad range of industries including the telecommunications, finance, utilities and transportation sectors.

It has established a reputation within the global telecoms market for being a leading supplier of carrier-grade, enterprise billing and CRM software, supporting fixed wire, mobile, broadband and TV communications service providers.