Cadence Minerals plc (LON:KDNC) Chief Executive Officer Kiran Morzaria caught up with DirectorsTalk for an exclusive interview to discuss why it’s chosen the minerals and commodities for its projects, which of them is going to drive shareholder value and the short term upside in terms of progress in Amapá.

Q1: First off, Kiran, can you give us a summary of what the company does?

A1: Cadence Minerals is an investment company, listed on the London Stock Exchange, and it invests primarily in the minerals and metals market, specifically in the lithium, rare earth, and iron ore assets around the world.

Q2: It has an interesting spread of minerals and commodities that you’ve invested in, why have you chosen those in particular?

A2: As I said, we invest in lithium, rare earth and iron ore, one thing they all have in common fundamentally is that they are very critical to the EV market and our view, and our view for a very long time, has been the EV market is where are we going to see a substantial change in the way that we transport ourselves on a day to day basis on the roads. Therefore, there’s going to be an increasing demand with metals associated with that so for example:

- The lithium is, of course, vital to the lithium ion battery, which at the moment is really the only technology out there that is commercialised and cheap enough to penetrate the EV market.

- Also, you’ve got rare earth minerals, specifically neodymium and praseodymium, both of which are vital to the permanent magnets used in the electric motors, our rare earth asset is in those two elements.

- In addition to that, you have iron ore, that’s used to make steel, and lo and behold steel is used to make cars.

So, when we see this increase in EV present penetration, by some estimates, of up to 47% by 2040, you’re going to see an increase in demand of these commodities so for us, that’s a good place to be in terms of the minerals and metals sector. When we look at the projects, you’ll see why they’re really important because they have real key strategic advantage over others out there.

Q3: How has the market faired in these minerals and commodities recently, and how do you see them performing going forward?

A3: Well, that’s an interesting question because a lot of people made an assumption with an economic downturn as a result of COVID, that we may see some poor performance in that market.

Let’s first of all, go to iron ore. Iron ore, in terms of a commodity, has been one of the stellar performers over this COVID period, partly because China came out of lockdown much earlier than everyone else and put a huge stimulus in there. Nonetheless, even despite COVID, we’ve seen, in terms of steel production, around a 9.1% year-on-year increase between this time last year and now so there’s a steady increase in steel production, which then translates into iron ore demand. Importantly, again, looking at projects when we get to them, there’s an increasing demand for high grade material, above 65% Fe content in the ore that you ship to China.

Now, the reason for that is, in essence, it basically is less energy to turn it into the final products, it takes less pollution because of the impurities, that there are less impurities in there, and there’s less waste. Taking all those three into account, I think we’re going to start seeing more of a premium of anything above 65% so I think the driver as I said, between EV vehicles, new vehicles, infrastructure spending around the world and particularly China, we’re going to see a continued strong iron ore price for the foreseeable future. There may be fluctuations, but it’s positive outlook, if you look recently, we saw that the actual majority of demand that came from China was for what they called flux steel, which is ultimately used in consumer goods and vehicles so it’s a positive trend there on the iron ore front.

Now in terms of the lithium front and the rare earth front, I’m just going to make it simplified, we’re just going to put it under the EV vehicle. So, as I said beforehand, we’re seeing now that there was a downturn in the lithium price or LCE, lithium carbonate equivalent price, that predominantly was, we had this very high price, this brought on some hard rock pegmatite producers, which at the moment need around $14,000 a ton for LCE, it’s gone below that, and as a result tail-end of last year and beginning of this year, we’ve basically seen a shutdown of a lot of these hard rock pegmatite producers. However, projects that we are involved in critically have much lower cost of production, around the $3,000/$4,000 per tonne.

All of this lithium is effectively going to be, while there’s enough lithium around the world, there isn’t enough producers of lithium products around the world, based on current rates, a forecasted increases in consumption of lithium through EVs, we’re going to have to bring on 25,000 tons per annum every year, all the way out to 2030/2040. We’re talking a huge increase, we’re talking about 14% CAGR on EV vehicles, we’re talking about basically reaching 40% in about 2040 and around 2030, 20 million cars every year needing electric vehicles, which will need longer ranges etc.

So, the output long-term for lithium is positive and particularly going 2024 onwards.

Q4: You’ve explained the choice of minerals, but just looking at those assets, they look broad geographically and I guess they’re all in similar stages of development. Which of them do you see driving value for the company’s shareholders?

A4: Well, that’s like choosing your favourite child. We’ve been involved with a lot of these projects for a very long time, and some of them more recent so they all have a potential to drive substantial for the company but I think, if we’re talking short-term value, I think we’re looking at Amapá.

Fundamentally, Amapá is an iron ore asset in Brazil, and we could go to 27% for $6 million and when it was run by Anglo American the full 100% valuation was closer to book value, was $600 million. So, in terms of a potential upside, the way that I look at it, we’re buying a price of an early exploration project but we’re getting a not fully functional mine but a very de-risk asset. So, in terms of short term value here, what we’re aiming to do is within 18 months of our first shipment of iron ore, which comes from stockpile that’s already there, is to be 18-24, is to be into full time production.

The great thing about this asset, because it’s an old asset we’re rehabilitating, we’re short cutting a lot of the risks historically so we definitely know there’s a historic resource and as the scoping study has been advancing, I’m really positive that that will be put into a full JORD compliant resource without a further drill hole being drilled. We have a processing part, a beneficiation part, which the product’s going to be doing 65% or thereabouts quality product, which as I mentioned beforehand is pretty vital to the market. It has a railway owned by the company that will take it to a port owned by the company so there’s a resource there, you can produce material and it can be shipped to the docks. More importantly, because this material was produced and it was being produced around the six million tonnes a year mark, we know there’s a market, we know there are Chinese buyers and international offtakers or trade partners who would buy this product and market it for us and it’s a good product using furnaces historically.

So, we’re looking to get 4.5 million tonnes out of it in the longer term, in the short term, as I said, many times our critical drivers are, we’ve agreed the bank settlement terms, we’re now going through the legal framework and paperwork to get that done. Either before then, depending on the agreement with banks, or just after then, we will be shipping material iron ore from the stockpile, which will generate revenue for the company, and that means we’re cash generative. After that, we’re talking about getting the scoping study finalised and published, it will provide shareholders with a clear understanding of value, timeline, capital costs to a scoping study level, which is about 40% accuracy and then we’ll look at the licenses, getting all the licenses and that’s when we put all our next tranche of three and a half million in. Effectively, by that time, we will have a scoping study, valuation, be shipping out iron ore, have all the licenses to operate and have a much better understanding and we’ll have 27% of that. We’ll then go through the recommissioning study all the way to from shipment of iron ore, about 18- 24 months, to production.

So that to me is a really short timeline to get to production and deliver value to the company’s shareholders.

Q5: We spoke earlier about some of Cadence Minerals assets, what can you tell us about your other assets?

A5: As I said, it’s hard, it’s like picking your favourite child. When I look at the other assets, I suppose the best way to look at is where I perceive the market is valuing them in terms of proportionate gap.

So, the next one is European Metals Holdings, we’ve got a 15% stake in that, again, and this is going to be a common theme as we go through the assets, we can see where they are there. They’re a bankable feasibility study, they’ve got a solid partner in CEZ who has was funded €29 million to take 51% of the company, to take it all the way to basically a construction decision. When you look at the EMH deposit, which it’s Cinovec, it’s the largest in Europe, it’s 7.7 million tonnes of lithium carbon equivalent, the next one below that is 1.78 million tonnes.

It has a low cost curve so about $3,300 per tonne in terms of cost, as opposed to lithium hydroxide, they’re planning on doing it for $12,000 a tonne in terms of revenue and it’s strategically located, it’s located in Czech Republic on the border with Germany. You just have to look at that address in terms of the people that surround it, you have Tesla building a giga factory, you have Volkswagen pushing into electric vehicles requirement, you’ve got Skoda. If you then look at the intermediary producers, you have LG Chem, Samsung, I could go on, but their battery production centre is all going to be around that area, whether it be in Croatia, Czech Republic, Germany so it’s a critical place. The European Union are very clear that they, I forget the quote, but basically to stay competitive, to stay bringing our green energy policy, we have to be sourcing our materials from Europe and therefore the Czech Republic and the largest hard rock deposit Cinovec in Europe, I think is critical and part and parcel of that plan.

So, I really look froward to them doing their bankable feasibility study, and they’ll be producing samples to send off to potential offtakers and offtakers that hopefully are strategic relationships going forward so EMH is another part of it.

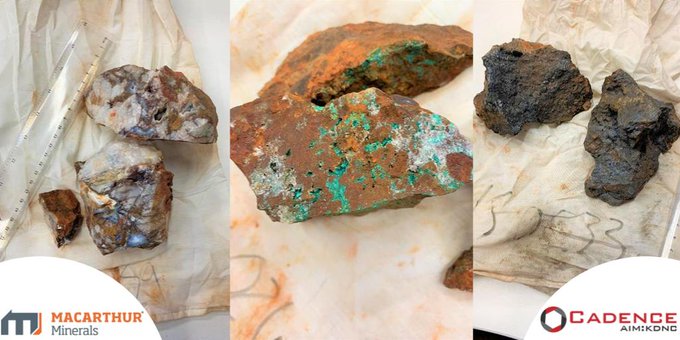

If we then look at MacArthur Minerals, we’ve got a smaller stake, probably under 2% now, because they did a recent share issue and resulted in some conversions of convertible loan notes but again, we look at MacArthur Minerals, it’s a very large deposit, it’s a sort of “generational” as they quote it, type of iron ore, high grade material. They’ve progressed again in their DFS, they’re progressing that further, they have an offtake partner with Glencore, I could really go on in terms of where they’re going to. I think off the top of my head, they’re looking for production in a relatively short period of time, I think they were looking at basically Q1 2024 so that’s interesting and we look forward to seeing the updates as they come from there.

The other ones are really two joint ventures we have, they’re basically 30% stakes in the Yangibana Rare Earth deposit and 30% of part of the Sonora Lithium Project. The Sonora Lithium product, again, has similar attributes to EMH, they have a very large deposit, one of the largest in the world, 8.8 million tonnes of lithium carbon equivalent and lower cost quartile. They’re in the bankable feasibility stage, they’ve got a great partner with Ganfeng, one of the premier lithium producers in the world, they own about 29% of the company and other large stake that the asset level. They’ve got a great team who have taken this all the way from basically an early resource and all the way to now, a bankable feasibility study ongoing, getting the financing and construction ongoing. So that’s really positive on that one.

And last of the rare earth elements with Yangibana, we had 30% free carry on that and they’re very much in a similar position. When we start to think about the size of this deposit, and I think some people don’t realise this, I’m going to get some quotes here from their website, in terms of the type of product, it’s all neodymium and praseodymium, of which their assets 75% to 100% higher than any other in the world. Their capex is 50% lower than any in the world and when they get to full production it represents 6%-7% of the market share and they have also made great progress. They’re now expanding their exploration and they’ve got almost AU$300 million of financing ready.

So, all of these assets are in great position in terms of risk and return. I would add that both Sonora and Yangibana are 30% JV, when we look at the mine, it will probably be mined out in the 12-14 year period, once Yangibana has partnered with BFS.

But overall, these assets are in a great place in terms of risk return and some long term keepers there as well as some short term upside in terms of progress in Amapá and others like it.