Cadence Minerals plc (LON:KDNC) has announced that Castillo Copper (ASX/LON:CCZ) has entered into a 90-day option agreement with Lithium Technologies Pty Ltd and Lithium Supplies Pty Ltd, in which Cadence owns a 29% shareholding, to acquire – subject to due diligence – the Litchfield and Picasso Lithium Projects in the Northern Territory (NT) and Western Australia (WA) respectively.

Highlights:

· ASX and London listed Castillo has a 90-day option to acquire – subject to due diligence – the Litchfield and Picasso Lithium Projects.

· Consideration for 100% of the holding companies which hold these assets (plus others) is up to AUS$ 3 million in equity of Castillo.

· Castillo is an Australian-based explorer primarily focused on copper across Australia and Zambia. The group is embarking on a strategic transformation to morph into a mid-tier copper group underpinned by its core projects.

· The Litchfield Lithium Project is contiguous to Core Lithium’s (ASX: CXO) strategic Finniss Lithium Project which has JORC compliant ore reserves (7.4Mt @ 1.3% Li2O), with production slated to start in 2H 20221. There is potential for lithium pegmatite bodies along Litchfield’s north-west boundary.

· The Picasso Lithium Project in WA is proximal to Liontown’s Resources’ (ASX: LTR) Buldania Project, with a JORC compliant resource at 14.9Mt @ 0.97% Li2O3 and has mapped pegmatites that potentially host lithium mineralisation.

Castillo’s Managing Director Simon Paull commented: “Acquiring prospective lithium projects, which complement the copper assets, arguably provides Castillo with a strong comparative advantage moving forward. In focusing on developing copper and lithium projects, the Board is positioning Castillo to potentially create significant incremental value from the transition towards renewable energy sources and accelerating demand for electric vehicles globally.”

Overview

LT and LS each own 50% of Synergy Prospecting Pty Ltd and have granted Castillo a 90-day option to acquire 100% of the outstanding shares of LT and LS and by implication 100% of Synergy.

During this 90-day period, Castillo will be conducting due diligence on all three entities to ensure the underlying assets are in good standing and there are no material adverse issues. Under the terms of the option agreement, Castillo can exercise its right to acquire LT, LS, and Synergy at any time during the 90-day period.

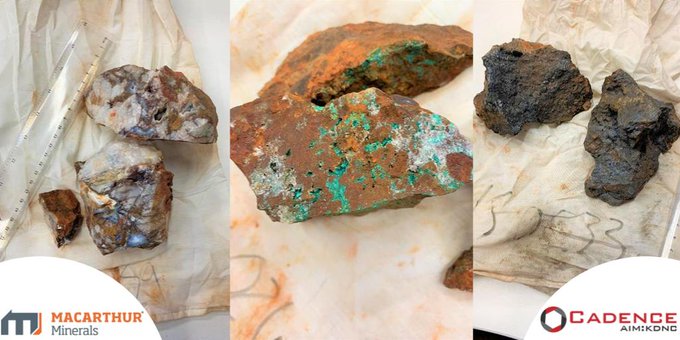

Castillo Copper Limited is an Australian-based explorer primarily focused on copper across Australia and Zambia. The group is embarking on a strategic transformation to morph into a mid-tier copper group underpinned by its core projects:

· A large footprint in the in the Mt Isa copper-belt district, north-west Queensland, which delivers significant exploration upside through having several high-grade targets and a sizeable untested anomaly within its boundaries in a copper-rich region.

· Four high-quality prospective assets across Zambia’s copper-belt which is the second largest copper producer in Africa.

· A large tenure footprint proximal to Broken Hill’s world-class deposit that is prospective for zinc-silver-lead-copper-gold.

· Cangai Copper Mine in northern New South Wales, which is one of Australia’s highest grading historic copper mines.

The primary assets of Synergy, which are wholly owned, comprise the Litchfield Lithium Project (EL31774) in NT and Picasso Lithium Project (E63/1888) in WA. In addition, Synergy has an application in NT – EL31828 – known as the Alcoota Lithium Project, which comprises ground proximal to Alice Springs. Castillo will need to undertake further geological due diligence on this application.

LT and LS also hold applications for six lithium properties in San Luis Province, Central Argentina. Again, Castillo will need to undertake further geological due diligence on these applications.

Further details on these assets and all the applications and permits are contained on our website.

Option terms & consideration

The terms of the 90-day option are as follows:

· A$50,000 non-refundable deposit in cash on formally granting the option that will go directly to Synergy for working capital purposes.

Upon exercising the option within the 90-day period, the binding consideration terms are as follows:

· A$1m script payment in CCZ shares will become payable to the Vendor Group based on the 14-day WVAP calculated from the date of which the option agreement is announced to the ASX. Note, the Vendor Group will be subject to a 6-month voluntary escrow period for 50% of the shares and 12-months for the 50% balance from the date of settlement. In addition, both parties agree to sign off on a binding term sheet.

Incremental consideration terms are applicable if the following milestones are achieved:

· A$1m script payment in CCZ’s shares to the Vendor Group based on the 14-day WVAP if two drill-holes produce assayed intercepts greater or equal to a true width of at least 10m @ 1.3% Li2O.Note, the two holes will be at least 100m apart, but not greater than 200m.

· A$1m script payment in CCZ’s shares to the Vendor Group based on the 14-day WVAP if a JORC compliant total inferred resource of at least 7Mt @ 1.3% Li2O is modelled by SRK Consulting.

· In the event of commercial mining operations commencing a 2% NSR will be payable to the nominees of the facilitator.

Cadence Minerals CEO Kiran Morzaria added: “The potential acquisition by Castillo provides Cadence with an exposure to developing copper assets which complements our already substantial lithium portfolio. Moreover, given Castillo’s established in country leadership and cash position we see this potential acquisition by Castillo as the best strategic approach to maximize returns for our shareholders. We look forward to seeing Castillo develop these assets further.”