Cadence Minerals plc (LON:KDNC) has announced its interim results for the six months ended 30 June 2021.

Highlights

The focus of the Company since the beginning of the year has been its investment into the Amapa Iron Ore Project (‘Amapa Project’). This investment continues to be our top priority which has involved finalising the settlement agreement with the secured bank creditors and the advancement of the pre-feasibility study on the asset. The delays in crystallising our investment are a result of the secured bank creditors’ internal bureaucratic process, which is required when settling a loan of this value and under the terms agreed. Nonetheless we have continued to move the Amapa Project forward which has included, amongst other things, the iron ore stockpile shipments commencing in March and the pre-feasibility studies starting soon after that.

We are also in the process of reviewing our privately held assets, in particular, our early-stage lithium prospects in north Australia. We believe that these could be of some strategic importance given their proximity to the Finniss Project, owned by ASX listed Core Lithium.

During the period our equity investments have performed very well, primarily driven by the performance of European Metals Holdings. Our equity investments generated a total income of £3.54 million resulting in profit before taxation of £2.84 million for the six months ended June 2021.

At a macro-economic level, the first half of 2021 saw the continued global recovery from the physical demand shock from COVID-19 experienced in 2020. According to the World Bank Group, the global economy is set to expand some 5.6% in 2021, its most robust post-recession pace in 80 years. However, this recovery is expected to be uneven and primarily reflects sharp rebounds in some major economies – most notably the United States – driven by substantial fiscal support. These ongoing monetary easing programmes have continued to support commodity prices and, in particular iron ore in the first half of this year. In addition, the accelerated transition and electrification of vehicles has increased lithium compound pricing, with the Benchmark Lithium Price Index up 85.3% on a year-to-date basis.

After the period end, we saw a softening of iron ore and other commodities (although lithium compound pricing remains strong). We believe this is primarily driven by China’s protectionist policies, including the possible imposition of steel quotas, crackdowns on speculative trading and the potential spread of the COVID-19 Delta variant. We expect the demand-supply balance to remain relatively tight for iron ore and lithium compounds in the medium term although there is still some residual uncertainty about how vaccine deployment and the policy and behavioural response to the newer, more infectious strains of COVID-19 will interact over the coming quarters.

As outlined in our annual report and accounts, Cadence operates an investment strategy that includes both investments in private projects via a private equity model and investments in public equity. In both investment classes, we take either an active or passive role. We have reported on each class below.

Private Investments (Active)

The Amapa Iron Ore Project, Brazil

The Amapa Project is a large-scale open-pit iron ore mine with associated rail, port and beneficiation facilities that commenced operations in December 2007. In 2019, Cadence entered into a binding investment agreement to invest in and acquire up to 27% of the Amapa iron ore mine, beneficiation plant, railway and private port owned by DEV Mineração S.A (‘DEV’) (‘The Agreement’). The Agreement also gave Cadence a first right of refusal to increase its stake to 49%.

To acquire its 27% interest, Cadence will invest US$6 million over two stages in a joint venture (‘JV’) company. The first stage is for 20% of the JV, the consideration for which is US$2.5 million. The second stage of investment is for a further 7% of the JV for a consideration of US$3.5 million. The investments are wholly contingent on DEV delivering several key preconditions. The funds for the first stage of investment are currently held in a judicial trust account of the commercial court of Sao Paulo.

All of our shareholders are aware that the remaining major precondition for Cadence to make its first stage investment in the Amapa Project requires DEV and the investors (Cadence and Indo Sino via our JV company) to reach a settlement agreement with the secured bank creditors. As of the date of the publication of these interims, the investors, DEV, and the secured bank creditors have agreed on the principal terms of the settlement agreement, which include the quantum, timing and all other material terms. The final settlement agreement is in near-final form, and the secured bank creditors have either had credit committee approval or are awaiting it.

We understand that this process has been frustrating, given that we agreed on the principal terms of the settlement in September 2020, but this matter has been outside of our control. The alternative to the current agreed (in principle) settlement would be hugely detrimental to the secured bank creditors, nonetheless. We have a high degree of confidence that we will execute a settlement agreement and will be announced as soon as it is completed.

As of the end of August 2021, DEV had shipped three cargoes totalling approximately 143,000 wet tonnes of 58% iron ore. DEV is also contracted to carry out logistical and shipping activities for third parties who have stockpiles held at DEV’s port, which it has been doing since it completed its third shipment in May of this year. These third-party stockpiles are separate from the 1.25 million tonnes of 58% iron ore (+/- 10%) owned by DEV. At this point, DEV intends to continue to carry out these shipping activities for these third parties. This is because current shipping rates have increased dramatically (US$80-90 per tonne), which is reducing the profitability of shipping DEV’s material. We believe that these rates should normalise over the medium term; therefore, the shipping of DEV’s material will recommence at a later stage.

The first portion of the net revenues has been used to pay historic small and employee creditors. Approximately US$6 million of the net revenues will be used to begin recommissioning studies on the Amapa Project and to start maintenance and monitoring of the current tailing dam facilities. The remaining net revenues will provide working capital for the operations and will be used as payment against the outstanding amount due to the secured bank creditors.

After the period end, DEV was permitted to export a further US$10 million (after the deductions of all logistical, regulatory, shipping and sales costs) of iron ore from its stockpiles situated at its port in Santana, Amapa, Brazil. This authority is in addition to the first permission granted to DEV on 10 February 2021, in which it was permitted to ship an initial US$10 million (net of costs) of iron ore.

Work on the started earlier in the year on the Pre-feasibility Study (‘PFS’). DEV has appointed internationally accredited engineering and consulting firms to carry out the engineering and conditioning study on the beneficiation and processing plant. These firms will also review the power supply options for the mine and plant, particularly the possibility of connecting to the grid network, enabling the mine and the plant to be predominantly powered by low-cost renewable energy. In addition, PFS work has started on the railway with the inspection of some 193km of rail and associated infrastructure. Both of these studies, once complete, will form part of the PFS. In the coming months, we expect DEV to appoint a consulting and engineering firm to start work on the port studies and conduct a geotechnical investigation of the mine.

As previously announced in May of this year, DEV began tailing dam maintenance. DEV has now employed a civil engineer and two geotechnical consulting firms to advance the work programme, including monitoring, geotechnical stability testing and statutory reporting. The end goal is to ensure that the current dams will be suitable for future operations amid Brazil’s more stringent regulatory environment.

In addition to the PFS work, DEV has worked with Companhia Docas de Santana (‘CDSA’) to increase loading capacity at the public port. Together with CDSA, DEV has established and tested a process at CDSA’s port in Santana for loading a 45,000-tonne vessel with iron ore at Pier Two from the berth side. This operation was the first of its kind and will allow shipment of the DEV stockpile at a faster rate if required.

Lithium Technologies Pty Ltd and Lithium Suppliers Pty Ltd (‘LT’ and ‘LS’)

Cadence owns 25.85% of LT and LS, which owns or has applied for three prospective hard rock lithium assets in Australia and six exploration applications in Argentina.

With the increase in lithium compound pricing, we have seen renewed interest in hard rock lithium projects in Australia. Our assets are prospective for pegmatites and especially our Litchfield exploration licence, which is adjacent to Core Lithium’s Finniss Project. A feasibility study was completed on the Finniss Project, which shows a pre-tax net present value of AU$384 million.

Given the progress being made at the Finniss Project, we will be reviewing the targeting and fieldwork studies carried out in 2019 to determine if it is worth pursuing further exploration in our joint venture areas.

Private Investments (Passive)

Our two passive private investments consist of our 30% equity stake in five lithium concessions that form part of the Sonora Lithium Project and our 30% interest in three mining leases, six exploration licences and two general-purpose licences that form part of the Yangibana Rare Earth Project. Our joint venture partners for these assets are Bacanora Lithium and Hastings Technology Metals, respectively.

Although Hastings Technology Minerals has progressed the development of the Yangibana Rare Earth project, most of this has been in relation to its wholly owned assets, with the only a change being reassessment of our joint venture mineral resources and reserves occurring in July 2021. There was no material difference in the recalculation of our portion of the resource and reserves; an updated summary can be found on our website.

In May 2021, Bacanora Lithium and Ganfeng International Trading (Shanghai) Limited (‘Ganfeng’) entered into an agreement regarding the terms of a possible cash offer by Ganfeng for the entire issued share capital of Bacanora Lithium, other than that which it already owns, for 67.5 pence per Bacanora Lithium share (the ‘Possible Offer’). The preconditions to the Possible Offer are progressing, with the latest update provided on 29 July 2021. The Possible Offer remains subject to certain other preconditions, including the Due Diligence Precondition. The satisfaction or waiver of the Due Diligence Precondition is at the sole discretion of Ganfeng’ s board.

As far as the Company is aware, the Possible Offer has no direct effect on our joint ventures. Should the cash offer be successful, it will be highly encouraging for the development of the project, given Ganfeng’s involvement in the development of the asset to date, their extensive experience in the lithium market and the fact that their holding company is the world’s third-largest (and China’s largest) lithium compounds producer.

Public Equity

The public equity investment segment includes both active and passive investments as part of our trading portfolio. The trading portfolio consists of investments in listed mining entities that the board believes possess attractive underlying assets. The focus is to invest in mining companies that are significantly undervalued by the market and where there is substantial upside potential through exploration success and/or the development of mining projects for commercial production. Ultimately, the aim is to make capital gains in the short to medium term. Investments are considered individually based on various criteria and are typically traded on the TSX, ASX, AIM or LSE.

During the period, our public equity investments generated an unrealised gain of £3.12 million and a realised gain of £0.42 million. The majority of these profits were derived from the sale of European Metals Holdings shares.

As of 30 June 2021, our public equity stakes consisted of the following:

| Company | Listing | Value £’000 | Type of Investment |

| European Metals Holdings Limited | (ASX & AIM: EMH) (NASDAQ: EMHXY) | 14,180 | Active |

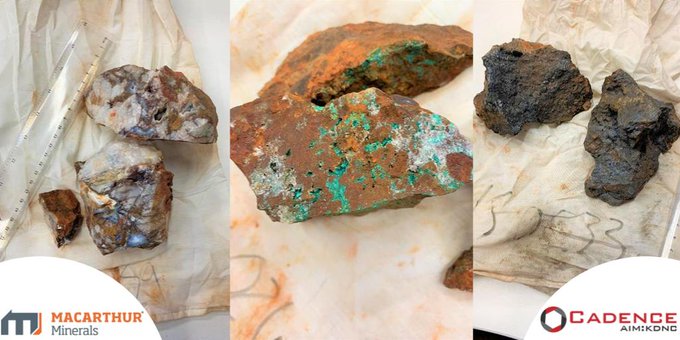

| MacArthur Minerals Limited | (ASX: MIO) (TSX-V: MMS) | 327 | Passive |

| Celsius Resources | (ASX: CLA) | 103 | Passive |

| Eagle Mountain Mining Limited | (ASX: EM2) | 153 | Passive |

| Charger Metals NL | (ASX: CHR) | 109 | Passive |

| Miscellaneous | Various | 6 | Passive |

| Total | 14,878 |

European Metals Holdings Limited (‘European Metals’)

Cadence has held an investment in European Metals since June 2015. As of the period end, Cadence held approximately 9.7% of the Cinovec deposit in the Czech Republic through a direct holding in the share capital of European Metals that owns 100% of the exploration rights to the Cinovec lithium/tin deposit.

Cinovec hosts a globally significant hard rock lithium deposit with a total Indicated Mineral Resource of 372.4Mt at 0.45% Li2O and 0.04% Sn, and an Inferred Mineral Resource of 323.5Mt at 0.39% Li2O and 0.04% Sn, containing a combined 7.18 million tonnes of lithium carbonate equivalent and 263kt of tin (as reported on 28 November 2017). An initial Probable Ore Reserve of 34.5Mt at 0.65% Li2O and 0.09% Sn (as reported on 4 July 2017) had been declared to cover the first 20 years of mining. A projected output of 22,500tpa of lithium carbonate was reported on 11 July 2018.

The project has been significantly de-risked and is moving towards a final investment decision. European Metals has continued to progress the development of the assets across all the critical areas of the project. This includes further resource drilling to upgrade areas into measured resources and the completion of the locked cycle testing, which further supports the project’s credentials to produce battery-grade lithium carbonate and convert it to lithium hydroxide.

Trading Portfolio Public Equity (Passive)

Cadence’s passive investments are typically direct purchases of listed mining equities but may include other investment structures. The aim is to make capital gains in the short to medium term. Investments are considered individually based on a variety of criteria. Investments are typically traded on the TSX, ASX, AIM or LSE. During the period, we invested in a broader range of publicly listed investments and retained our stake in MacArthur Minerals Limited. Our trading portfolio generated a realised gain of £0.02 million over the period. A summary of our holdings is detailed in the table above.

Given that none of our trading portfolio investments represent more than 10% of our net assets and are below the relevant reporting thresholds in the applicable jurisdiction, we have determined that going forward, we will not republish regulatory announcements associated with these investments unless, of course, they become material. We will report on the performance of the trading portfolio investments via our annual and interim financial statements.

Financial Results

During the period, the Company made a profit before taxation of £2.84 million (six months ended 30 June 2020: loss of £1.40 million, the year ended 31 December 2020: profit of £7.82 million). There was a weighted basic profit per share of 1.914p (six months ended 30 June 2020: loss of 1.521p, the year ended 31 December 2020: profit of 6.705p).

The total assets of the Company increased from £22.61 million as of 31 December 2020 to £25.37 million. Borrowings were reduced from £0.22 million at 31 December 2020 to zero at 30 June 2021.

During the period, Cadence Minerals’ net cash outflow from operating activities was £1.15 million, and our net cash position increased by £0.78 million to £1.39 million.