Cadence Minerals plc (LON:KDNC) has announced that further to its announcement of 30 March 2022, the Company has completed the sale of its 31.5% stake in in Lithium Technologies and Lithium Supplies to Evergreen PTY Ltd. Evergreen is an unlisted Australian company which is intending to list on the Australian stock exchange.

Highlights:

• Cadence and all LT and LS shareholders have completed the sale of 100% of LT and LS for up to A$21.05 million (£12.08 million)

• Cadence owns 31.5% of LT and LS and has received AS$3.16 million (£1.81 million) in Evergreen shares.

• Subject to Evergreen achieving performance benchmarks Cadence would receive a total consideration of A$6.63 million (£3.80 million)

• Evergreen will spend a minimum of A$4 million over the next three years on the exploration of the prospective Litchfield lithium prospect in Northern Australia.

Background to Transaction

The consideration for LT and LS is up to A$ 21.05 million (£11.82 million). Cadence has 31.5% of LT and LS and will receive up to A$ 6.63 (£3.80 million).

Evergreen is unlisted public company in Australia which has been specifically incorporated for the acquisition of lithium assets. The acquisition of LT and LS is its first acquisition. It raised AS$ 6 million to pursue this strategy. Evergreen now plans to list on the Australian Stock Exchange.

During the completion process and in consultation with the applicable regulatory bodies, Evergreen was restricted from offering cash consideration, therefore the consideration will be entirely settled in Evergreen shares.

As such the consideration that has been paid is AS$3.16 million (£1.81 million) in Evergreen shares, or 15,830,136 shares at A$0.20 per share which represents 13.16% of Evergreen.

Once the performance milestones are achieved, the consideration would also be paid in Evergreen shares, of which Cadence would receive an additional AS$3.47 million (£1.99 million). The pricing of Evergreen shares associated with this consideration is based on a defined pricing mechanism linked to the VWAP and date at which the performance milestones are achieved.

If the performance targets are met the total consideration for Cadence’s equity stake in LT and LS would be AS$6.63 million (£3.80 million).

LT and LS, through their subsidiaries, are the holders of two exploration licenses in the Northern Territory, one granted and one in the application phase. LT and LS further hold seven exploration license applications in Argentina.

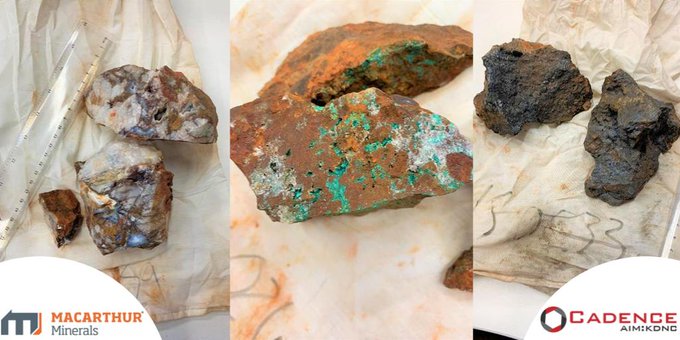

All of the licenses and applications target potential hard rock lithium deposits. The most significant of these is the Litchfield lithium prospect, which is contiguous to Core Lithium’s (ASX: CXO) strategic Finniss Lithium Project (JORC compliant ore reserves: 7.4Mt @ 1.3% Li2O).

The Buyer has committed to spending at least A$4 million on the exploration of Litchfield during the three years post the completion of the sale. Should the milestones not be achieved during this period, the respective consideration will not be payable.

The net loss of LT and LS were A$1,560 and A$1,306, respectively, for the year ended 30 June 2021. As such, the net loss attributable to the Company (being 31.5% of LT and LS) was A$903 (£516). As of 31 December 2021, the total carrying values of LT and LS in the Company’s balance sheet was approximately £803,000. Therefore based on the current share price of Evergreen, the initial profits on the sale of our equity in LT &LS is £1.01 million, with the potential for this to increase to £2.99 million should the performance milestones be achieved.

In relation to the equity in Evergreen received for the consideration, the Company will be bound by an escrow agreement with the Buyer as per the regulatory authorities in Australia, which could be up to 2 years. It will be in the form and substance consistent with the ASX Listing Rules. After the lapse of the escrow arrangement, Cadence will retain or dispose of these shares as per our investment strategy,.

Amapa Project Update

Operations at the Amapa Iron Project continue to focus on delivering the Pre-Feasibility Study (“PFS”). Over the last month, all the significant contractors were at Amapa to review and analyze their respective engineering areas. Wardell Armstrong International were also on-site as part of their role in the publication of the PFS. We expect to publish a Maiden Ore Reserve on the Amapa Iron Ore mine followed by the PFS.

Elsewhere the Amapa Project has been focusing on the relevant environmental permitting, compliance with Brazilian legislation in relation to Tailing Storage Facilities and implementing the policies, structures and controls required for a developing company. All of these should stand us in good stead when we move past the PFS stage.

Cadence CEO Kiran Morzaria commented: “On behalf of the Cadence board and other LT and LS shareholders, we are pleased to report the completion of the sale of our investment in LT and LS”

“Recent exploration and sampling work at the Litchfield project, along with the project’s proximity to Core Lithium’s assets have led us to believe that Litchfield has considerable potential to host lithium mineralisation.”

“For Cadence, this transaction provides an excellent opportunity to retain exposure to the booming hard rock lithium market in Australia. The consideration is being paid entirely in shares, and given that Evergreen intends to list on the Australian Stock Exchange, we will potentially have exposure to any future upside. Hard rock lithium assets have seen excellent returns of late, plus we also have a commitment that Evergreen will spend at least A$4 million to explore the primary assets.”