Cadence Minerals plc (LON:KDNC) has reported that, further to the announcement of February 7th 2022, all of the required contractual documentation has been completed, and Cadence now has vested its 27% of the Amapa Iron Ore Project.

This second stage of investment was to acquire a further 7% (US$3.5 million) of Pedra Branca Alliance (“PBA”), the Cadence and IndoSino joint venture company which owns 100% of the equity of DEV Mineração S.A. (“DEV”). DEV is the owner of the large-scale Amapa Project. This second stage investment was conditional on several preconditions, which have now been satisfied, and consequently Cadence has now vested a further 7%.

Anglo American, a previous owner and 70% shareholder, (with Cliffs owning the remaining 30%), valued the entire Amapa Project at US$ 1.2 billion. In its 2012 Annual Accounts, Anglo American impaired the entire Amapa project value to US$ 660 million.

Cadence CEO, Kiran Morzaria, commented: “I am pleased to report that following the recent oversubscribed fundraising, we have formally completed phase two of our investment into Amapa to acquire 27%. I know our new and longstanding shareholders share our vision for Amapa, and I am pleased to report that the mine rehabilitation plan is progressing on schedule.”

“I look forward to reporting back to you on further operational progress in the coming weeks.”

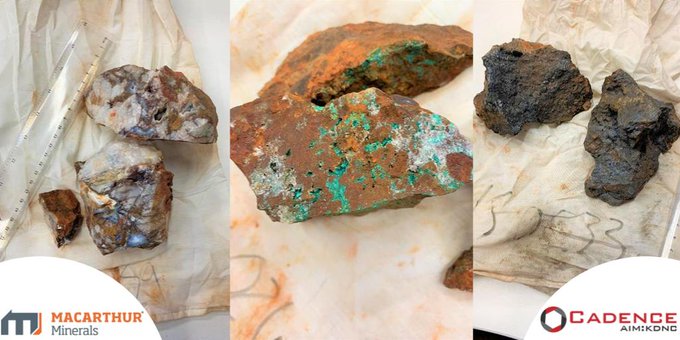

About the Amapa Project

The Amapa Project commenced operations in December 2007 with the first production of iron ore concentrate product of 712 kt in 2008. In 2008 Anglo American (70%) and Cliffs (30%) acquired the Amapa Project in 2008 as part of a larger package of mining assets in Brazil.

Production steadily increased to 4.8 Mt and 6.1 Mt of iron ore concentrate product in 2011 and 2012. During this period, Anglo American reported operating profits from its 70% ownership in the Amapa Project of US$ 120 million (100% US$ 171 million) and US$ 54 million (100% US$ 77 million). Before its sale in 2012, Anglo American valued its 70% stake in the Amapa Project at US$ 866 million (100% US$ 1.2 billion). It impaired the asset in its 2012 Annual Accounts to US$ 462 million (100% US$ 660 million.

Cadence updated the Mineral Resource Estimate on November 2nd 2020, increasing the MRE by 21%. The current MRE contains a Mineral Resource of 176.7 million tonnes grading 39.7% Fe in the Indicated category and Mineral Resource of 8.7Mt at 36.9% in the Inferred category, both reported within an optimised pit shell and using a cut-off grade of 25% Fe.

Details of Ownership and Joint Venture Agreement

Cadence owns 27% of the Amapa Project with our joint venture partner, Indo Sino Pty Ltd (“Indo Sino”) owning the remaining 73%. The ownership of Amapa is via a joint venture company, Pedra Branca Alliance Pte. Ltd. (“JV Co”) which owns 100% of the equity of DEV Mineração S.A. (“DEV”). Should Indo Sino seek further investors or an investment in the JV Co, the Agreement also provides Cadence with a first right of refusal to increase its stake to 49% in the JV Co.

To acquire its 27% interest Cadence has invested US$6 million over two stages. If Cadence is not able to exercise its right of first refusal under the terms of the Agreement, Indo Sino will have a twelve-month option to buy the shares in JV Co held by Cadence for 1.5 times the price paid by Cadence for such shares.

The Agreement also contains security and default clauses which if triggered causes an upwards adjustment mechanism to allow Cadence to either receive cash from JV Co or receive additional shares in JV Co. In the latter case, Cadence Minerals’ shareholding in the JV Co will not go above 49.9%.