Boku Inc. (LON:BOKU), a leading provider of global mobile payment solutions, has announced the following unaudited interim results for the six months ended 30 June 2022.

Jon Prideaux, Boku’s CEO, commented: “Our efforts on eWallets and real-time payments are being validated. In the first half the number of Monthly Active Users of these new payment methods increased 8-fold and value processed increased by 11 times. We launched into new merchant verticals, such as ride sharing, and into new territories such as Vietnam, Pakistan and Nigeria. We launched over 50 new connections with customers such as Netflix, Meta, Apple, Amazon, Spotify, Samsung, Sky and EA Games in the half. These new launches will build our revenues over the coming months and years. Post period end, we have had a number of pieces of very encouraging news. One highlight is a new contract with the world’s leading ecommerce company, Amazon, with whom we’ve recently signed a multi-year agreement for these new payment types. Additionally, we have recently launched an existing major merchant into China for the first time on the country’s largest eWallet, Alipay — volumes on this connection are ahead of our expectations. Truly, the future is bright for Boku. Our strategy is working. No longer the big fish in the small pond of Direct Carrier Billing, Boku is starting to make waves in the Big Pond.”

Group Highlights

| · | The Group saw further growth in volume processed through its mobile-first payments network of Direct Carrier Billing (“DCB”), Bundling, eWallets and real-time payments in the first half of 2022, with total volumes up to $4.3bn. |

| · | Monthly Active Users (“MAUs”)** increased to 46.3m in June 2022, up 22% on a year earlier. |

| · | Total Payments Volume (“TPV”)**** generated from the newer Local Payment Methods (“LPMs”) – eWallets and real-time payments – increased eleven times compared to H1 2021, with new users of these LPMs up six times. |

| · | Boku’s Identity division, as previously announced, was sold on 28 February 2022 to Twilio for a maximum consideration of $32.5m, leaving Boku as a pure play Payments business. |

Following the disposal of the Identity division on 28 February 2022, the results of this division are shown as discontinued in the 2022 interim results and so we only provide here the continuing Payments division results. The prior period comparatives have also been adjusted and exclude the Identity division results.

Financial Highlights

| · | Payments revenues for H1 2022 were $30.3m (H1 2021: $30.7m). The strength of the US dollar against major currencies has affected these results (e.g. on average Japanese Yen down 12%; Euro down 9%; Pound Sterling down 6%; Korean Won down 9%). On a constant currency basis*, revenues would have been 7% higher than the same period in 2021. |

| · | Payments adjusted EBITDA of $9.5m (2021 H1: $11.2m) as currency headwinds impacted and we continued our investment in Boku’s mobile-first payment network. |

| · | Group profit after tax of $28.0m (H1 2021: $1.7m), which includes the profit on the disposal of Boku’s Identity division of $24.6m. |

| · | Group cash of $67.8 million at 30 June 2022 up from $62.4m at 31 December 2021 and $48.6m on 30 June 2021. The Group is now debt free having used the proceeds from the disposal of the Identity division in February 2022 to pay off its debt, along with operating cash generation in the period (before working capital movements). |

| · | The average daily cash balance, a measure which smooths out the effect of carrier and merchant payments, was $63.3m in June 2022, up from $50.8m in December 2021, and $38.0m in June 2021. |

Operational Highlights

| · | Underlying Payments metrics continuing to grow: | |

| o | 46.3m Monthly Active Users of the Boku platform in June 2022 (June 2021: 37.9 million), a 22% increase. | |

| o | 28.8m new users made their first payment or bundling transaction with Boku during the first half of the year. | |

| o | TPV**** of $4.3bn in H1 2022 up from $4.0bn in the same period last year despite currency headwinds. | |

| · | Strong growth in the new Local Payment methods (“LPMs”): | |

| o | Volumes processed from LPMs including eWallets and Real Time Payments increased eleven times compared with H1 2021. | |

| o | MAUs of eWallets and real-time payments increased eight times to over 2.1m in June 2022 compared to the same period in 2021. | |

| o | New users of LPMs increased over six times to 3.1m in H1 2022 (up from 0.5m in the same period in 2021). | |

| · | Over 50 new launches in H1 2022 with existing and new merchants including Netflix, Meta, Apple, Amazon, Spotify, Samsung, Sky and EA Games, through Boku’s expanded mobile-first network. | |

| · | Boku has continued to invest in its regulated payment capabilities which now cover more than 50 markets. A recent highlight is the granting of a payments licence in the Philippines. | |

| · | Mobile-first payments network expanded to over 7bn end user accounts, 42% of which are non-DCB. | |

| · | Identity business sold to Twilio on 28 February for a maximum consideration of $32.5m. | |

* Constant currency calculated by applying the monthly average foreign exchange rates in H1 2021 to the actual H1 2022 monthly results.

** Monthly Active Users (MAU) data includes all users who successfully processed a payment or had an active bundle during the last month of the period.

*** Adjusted EBITDA (Earnings before interest, taxation, depreciation and amortization): Adjusted for stock option expenses, foreign exchange gains/losses and Exceptional items. See reconciliation per the income statement.

**** TPV is the US$ value of transactions processed by the Boku platform and includes transactions from DCB, Bundling, eWallets and real-time payments. Prior periods excluded bundling.

Chief Executive Officer’s Report

“After climbing a great hill we find that there are other mountains to climb… I dare not linger for my long walk has not yet ended” – Nelson Mandela

When Boku started in 2009, buying things and charging it to your phone bill was only used to do things like get a new ring tone or register a vote in a TV Talent contest – but at Boku, we have made this into a mainstream payment service. We realised that the Direct Carrier Billing (“DCB”) technology was best used to help merchants acquire new paying users and hence customised our product to that end. Over the last two years alone, we’ve helped the world’s leading digital companies – including Apple, Google, Sony, Microsoft, Spotify and Netflix – to acquire more than 100 million new users. And still there is plenty of room for growth; there are around 300 connections in our DCB network, the average merchant is only using 10% of them. When we started in DCB, there were many challengers, but Boku was able to emerge as the leading company in the field, the scale player. We could have simply sat back and rolled out more connections; we could have enjoyed the view from the top of the hill that we had climbed, but there was a bigger mountain to climb.

Another Mountain

That mountain is the wider local payment method market, comprising not just mobile network operators, but also mobile wallets and real-time banking payments. Whereas DCB is generally constrained to purchases of digital consumer entertainment, these other payment methods can be used to buy anything and everything. Local payments more generally are an enormous market and developing very quickly. This can be illustrated with some data and an anecdote:

First the data: On 16 November 2020 – less than two years ago – Banco Central do Brazil launched PIX. You don’t see central banks featured in lists of top fintech innovators nor lauded in fancy founder photoshoots. But maybe one should be. Since launch, PIX has grown to become one of the leading payment mechanisms in the world, processing 1,930,514,219 transactions in June 2022. The equivalent figure for the UK’s Faster Payments Service, launched in 2008, is 321,826,000. Adjusting for population, this means that each Brazilian adult made twice as many real-time bank payments in a month when compared to Britons. The US real-time bank system is called Fednow. It will be launched, a year ahead of schedule, in 2023.

The anecdote: There is an employee in our San Francisco office. He’d come over from Indonesia to study and now was working in the global epicentre of technology, Silicon Valley. He had recently visited his parents in Jakarta, having not been back for a couple of years due to COVID. He didn’t have an Indonesian mobile wallet on his phone, so was relying on cash – but he had trouble buying things, even street sellers didn’t want to take it, they didn’t have change. They wanted to be paid with mobile wallets, not Visa or Mastercard, not even cash. This story is common. It’s Western markets which are the laggards now.

Mobile-first Network

If you want to sell you have to adapt to local norms: in countries where local payment methods are popular, it’s not enough to just put-up Visa, MasterCard and PayPal. But integrating local payment methods is hard. There are no simple standards. Getting the money out of the country is subject to regulation and you have to navigate complex local taxes. User interfaces are inconsistent. And once you’ve connected to one, you have to do all the work all over again to enable a second method. To get comprehensive coverage, there will be dozens to do.

This is where Boku can provide the solution. We are becoming a global local payment method provider, riding the wave of expansion in payment methods that operate in a single country.

Boku’s mobile-first payment network spans more than 7.1 billion accounts in 92 countries, 3 billion of which are for the newer payment methods, eWallets and real-time payments. Merchants can access them all with one integration, one contract and one settlement, vastly simplifying the process of accepting these vital payment methods.

Strong Merchant Adoption

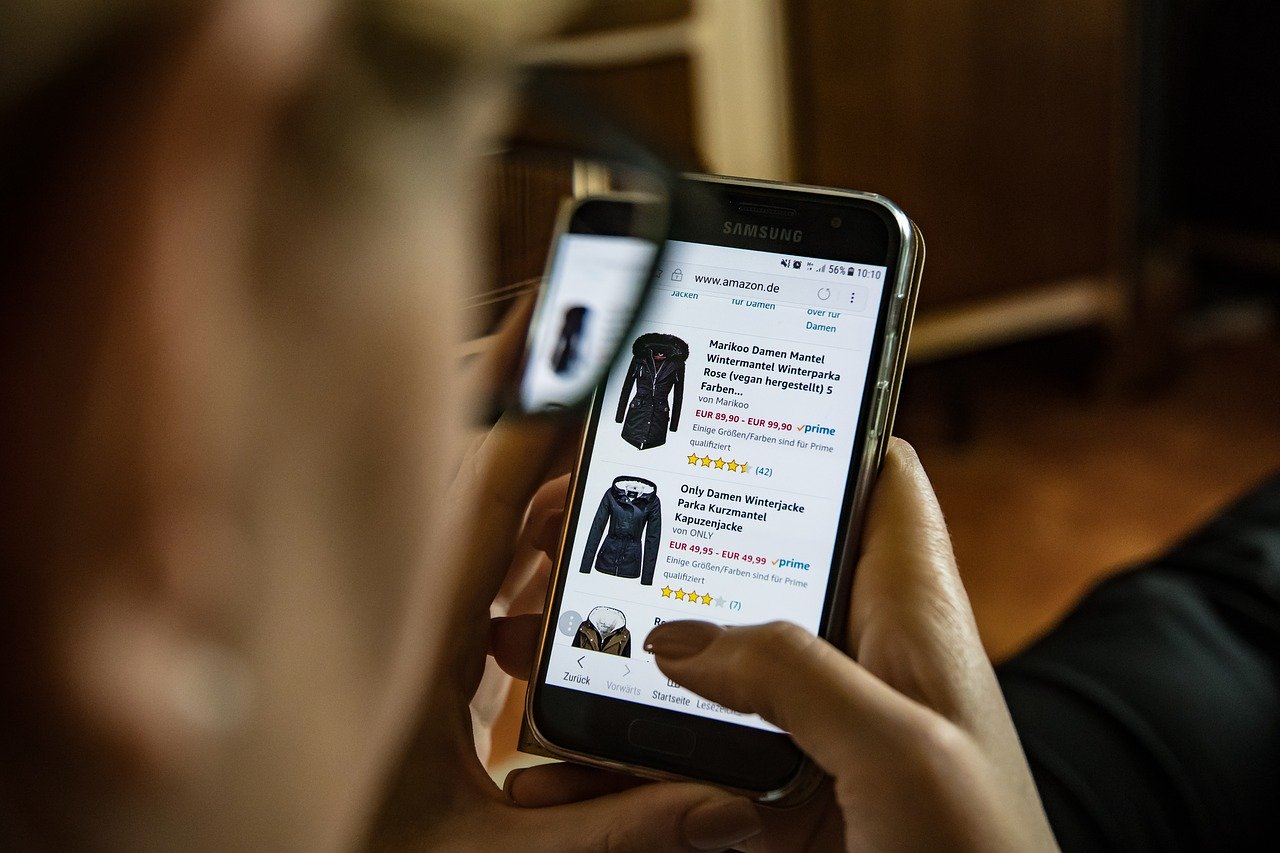

It’s working. Merchants are adopting Boku’s Local Payment Method offer, expanding their usage beyond Direct Carrier Billing. Perhaps the best way of illustrating this is by letting one of our customers talk about how we’ve been able to help them grow in Asia (against trends in other parts of the world). In a recent interview with Bloomberg, Netflix explained the reasons for their growth in APAC, where they’d put on more than one million new subscribers. The article said that it was because they “attract sign-ups through innovative payment methods, like allowing users to include their subscription fees in their monthly phone bills or pay via digital wallets.” And went on to say that, “the number of new members signing up last year using alternative payment methods more than tripled from the previous year, and these measures have been adopted in other markets after their successful launch in Asia“.

No merchant has done more to change the way consumers shop than Amazon. With the acquisition of Fortumo, Amazon became a Boku customer. We help them to distribute their Prime offerings through more than a dozen mobile network operators, but we hadn’t directly provided payment services to them before. The recently announced agreement changes that. It is a material expansion of the relationship and a validation of our strategy. Boku was selected by Amazon on the strength of its wallet network. The multi-year agreement allows us to provide payment services to any Amazon division and it is boosted by an arrangement that grants Amazon market price warrants in return for achieving demanding revenue targets.

Truly Boku is making progress into the Big Pond: continuing to operate a strong Direct Carrier Billing payments platform but driving its growth further with newer payment methods – eWallets and real-time payments – validated by more big merchant wins.

Strong Balance Sheet

Boku completed the disposal of its Identity business to Twilio on 28 February 2022 for a maximum $32.5 million. The timing of this disposal was opportune and we recorded a gain on disposal of $25.2 million net of disposal costs.

With more than $67 million in cash at the end of the period, all debt repaid and strong underlying cash generation before working capital movements, the Company implemented a share buy-back programme in July in part to offset share awards to be made to employees. Boku’s strong balance sheet gives the Company considerable optionality to pursue acquisitions that could help accelerate our efforts on local payments.

Strong Underlying Performance

Our performance in the first half of 2022 can be seen through two lenses. When viewed in Boku’s reporting currency, USD, the results don’t look that spectacular. The context is that the comparison is against a COVID inflated first half of 2021 and, in particular, the appreciation of the dollar by 15%, or more, against many of our trading currencies. Strip away these distortions and a much stronger picture emerges. Monthly Active Users (“MAU’s”), including those from both payments and bundling have increased to 45.4 million up by 21% from last year’s figure of 37.4 million. Total Payment Volume was $4.3 billion, up from last year’s figure of $4.0 billion despite currency headwinds.

It’s when you look at the performance of the newer payment methods that you can start to see the traction really showing through. MAUs in June 2022 on eWallets and real-time payments increased eightfold to 2.1 million up from 0.25 million a year earlier. The number of new users – a strong leading indicator – increased sixfold to 3.1 million over the half year, representing around 14% of all new users in the period. Growth is increasingly being driven by our efforts in these new business areas.

Current Trading and Outlook

Our efforts on eWallets and real-time payments are being validated. In the first half the number of Monthly Active Users of these new payment methods increased by 8-fold and value processed increased by 11 times. We launched into new merchant verticals such as ride sharing and into new territories such as Vietnam, Pakistan and Nigeria. We launched over 50 new connections with customers such as Netflix, Meta, Apple, Amazon, Spotify, Samsung, Sky and EA Games in the half. These new launches will build our revenues over the coming months and years. Post period end, we have had a number of pieces of very encouraging news. One highlight is the recently signed agreement with the world’s leading ecommerce company, Amazon, with whom we’ve signed a multi-year for these new payment types. Additionally, we have recently launched an existing major merchant into China on the country’s largest eWallet, Alipay – volumes on this connection are ahead of our expectations. Truly, the future is bright for Boku. Our strategy is working. No longer the big fish in the small pond of Direct Carrier Billing, Boku is starting to make waves in the Big Pond