Biome Technologies plc (LON:BIOM) Chief Executive Officer Paul Mines caught up with DirectorsTalk for an exclusive interview to discuss the key highlights from their trading update, growth drivers, progress of both divisions, outlook for the rest of the year and bio-based products’ role in abating climate change.

Q1: Paul, you’ve announced a trading update for the six months ended 30th June with an almost 50% increase in revenues over the same period last year. Could you just talk us through the highlights from the results?

A1: Group revenues in the first half were £3.6 million versus £2.4 million last year, an increase of £1.2 million or 47% on the previous year. This was been driven by the continuation from the last half of last year of robust demand for bioplastics for existing and new customers in North America in film and filtration applications, which I’ll talk about in a bit. Also revenues in our RF division were up 25% in the first half on the same period last year.

So, clearly this is a mid-year trading update and the full unaudited results will be out around 27th September this year.

Q2: It’s an impressive first half, and I know you’ve just touched on this but what is driving the growth for Biome Technologies?

A2: Let’s talk about the bioplastics division for of all, and there the divisions revenues in the first half of this year were £3 million to £2 million last year so a 50% increase. We continue to see high level of demand for our products in North America from a variety of applications and from new customers coming on board in North America, customers that we’ve been working on for the last 2-3 years.

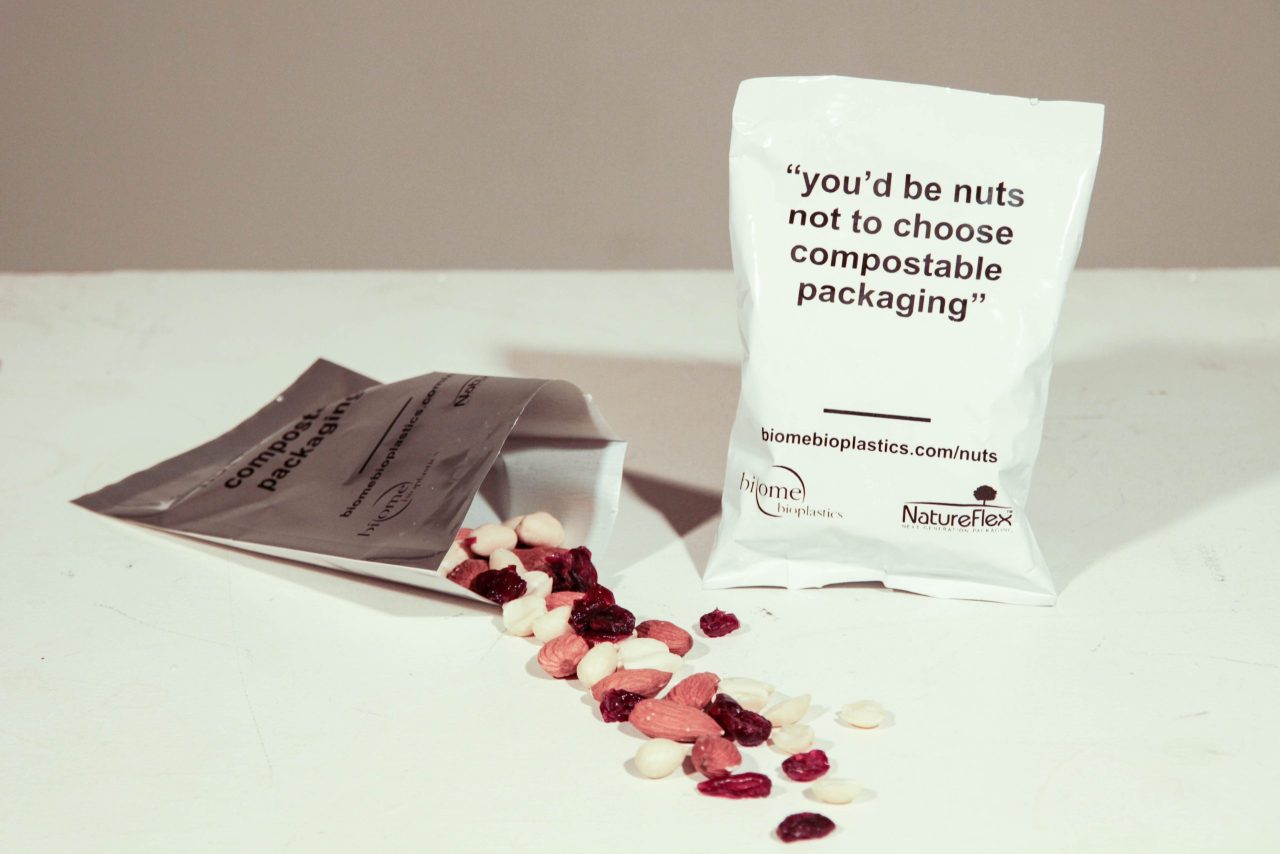

These are into applications for coffee pod packaging, packaging of biscuits, cakes, where our materials are used to provide a barrier to keep those products safe as they get to the consumer. You can then take the packaging and compost it at the end of its life.

Most of this growth, as I’ve described, has come in North America in the first half, and that comes on the back of us opening two new businesses there, one in the USA and one in Canada. One of the senior members of our team responsible for business development relocating to Canada to spearhead that charge, we talked a little bit about that in our last discussion. We’ve also opened additional stock points in North America as well.

All that has helped get that momentum going in the US portion of our business.

Q3: I know you have great hopes for future growth of the bioplastics division, what steps are taking to drive that?

A3: The first thing to point out is that it’s an interesting space.

The environmental awareness that pervades the thought process of consumers and brands at the moment is driving an increasing environmental awareness both in the source of products i.e. where they come from, and also their end of life. So, particularly in a number of applications we serve, it’s very difficult to imagine recycling, burning, or landfilling being the right route for those products. Often composting is, and so, we’re designing products that have a low carbon footprint at the beginning of their life and then can be composted at the end of their lives so we’re in a good, in interested, growing space.

We’ve got a great team, it’s based down at Southampton, generating new products, patenting them where appropriate, and then getting them to market.

I think the other part we focus on particularly is really working with our customer set to understand their needs and support their journey. They’ve often been working with fossil fuel-based plastics for many, many years so they need their hands holding and support from our understanding as they make that transition from fossil plastics to bioplastics.

Q4: What do you expect from Biome Bioplastics in terms of growth in the balance of 2023?

A4: We expect really the demand for the division’s products in the second half to continue and reach similar levels to that we’ve experienced in the last few months. I think there’s further growth that we would hope for and we believe will come in time, that remains linked to our customers launching new products and they their demand from us lifting.

It remains difficult to actually predict the timing exactly when those launches are so I think I’m comfortable saying we see the background level of demand we’ve grown to in this year continuing in bioplastics and then further growth will come in due course, when some of those launches take place.

Q5: How is the other side of the business doing? How is the RF Technologies division?

A5: They had revenues in the first half of £500,000, and that’s an increase of 25% compared to the same period last year. We’re pleased that that growth is coming from both existing; spares, service support of our existing large customer set, and some of that growth is coming in novel market sectors which we’re starting to broaden the business to.

This business has traditionally served the fibre optic market, and it still does, but we’re working on other application areas. Your listeners/viewers will probably have seen that on 22nd June, we announced a significant contract with revenue to the value of £450,000 for the supply of our kit into a market for global scientific glass products. So, that’s a really new exciting space for us and we see the potential of further sales to this area in due course.

We’ve highlighted in the announcement that the revenue associated with that contract will either fall in ’23 or ’24 as we’ve got into the design phase and understood the availability of components etc. We believe it’s now more likely that the revenue from that item will be recognised in ’24.

Importantly, it indicates the growth of the pipeline that the business is getting, and we’ve got a number of other contracts under discussion for the back half of this year and into ’24 that will help build the revenue pipeline for the division.

Q6: Just looking at the future, and turning back to the trading statement, what’s your view on the outlook for the rest of the year and into 2024 for Biome Technologies?

A6: Well, we’re really pleased at the moment that both divisions are performing well. The bioplastics business is substantially ahead of last year, and despite that challenge of being able to recognise revenue in RF, the division is continuing to grow its business and confident to winning further business of a similar nature.

So, we still remain a bit cautious, the world economy is still a precarious place I would say, that macro environment is quite difficult so our expectations at this point we’ve decided to really keep the same for the rest of the year, and in line with forecasts out there in the market.

Q7: Just looking at current news, everybody has seen the fires in Europe, how do you think bio-based plastics have a role in abating climate change?

A7: I think often the focus for climate change is on energy, be it electric cars or heat pumps for homes, but 10-14% of the oil and gas that we dig up goes into the making of products, and a lot of that goes into plastic products. In the end, a lot of that carbon from that oil and gas for making plastics ends up in the atmosphere in the form of CO2, whereas bioplastics are made from plants which have captured the CO2 in their manufacture.

So, there is a significant place for lower carbon bioplastics to help that climate change abatement over time, as we really get to focus on not just energy but the embodied carbon in products. In the end, we have to keep the oil and gas in the ground if we’re going to stop putting it in to the atmosphere and so, I see bio-based plastics at the leading age of that change of our products to more climate-friendly items.