Biome Technologies plc (LON:BIOM) Chief Executive Officer Paul Mines caught up with DirectorsTalk to discuss highlights from the results, drivers for growth, future growth in the Bioplastics division, changing the way they operate in North America and when investors will know whether this work has been a success.

Q1: Last week, you announced a pre-close trading update giving unaudited results for the financial year ended 31st December 2022. Can you give us a bit more background on these results?

A1: Group revenues for the year ended in line the market expectations at £6.2 million, we were quite pleased, these were 10% ahead of the previous year which was at £5.7 million. So, 10% growth, not as much as we would have liked but in line with the expectations that we had given the market.

We expect that, subject to audit, we’ll generate a loss for the year ended 2022 that’s in line with current market expectations and pleasingly, the cash position was slightly ahead of expectations at year end, at £0.8million.

Q2: What was it that drove the 10% growth in revenues for the group?

A2: As a quick reminder we’ve got the two divisions within Biome, one of which is the Bioplastics division which manufactures and sells bio-based and biodegradable plastics, and then we have the equipment making division called Stanelco RF Technologies that makes our fibreoptic cables and heating for the general industrial space using radiofrequency technology. So, there’s two very different divisions.

The revenues from Bioplastics were just behind those of 2021 which was caused by a slight reduction in demand from one of our large customers and delays to some launches with some of the new customers we’re working with.

Fortunately, RF continued its post pandemic recovery as the capex gates were opened again by a number of our customers and it delivered a flurry of orders to our new customers through the year, helping the group to grow.

Q3: I know you have great hopes for future growth for the Bioplastics division, what are you doing to drive that?

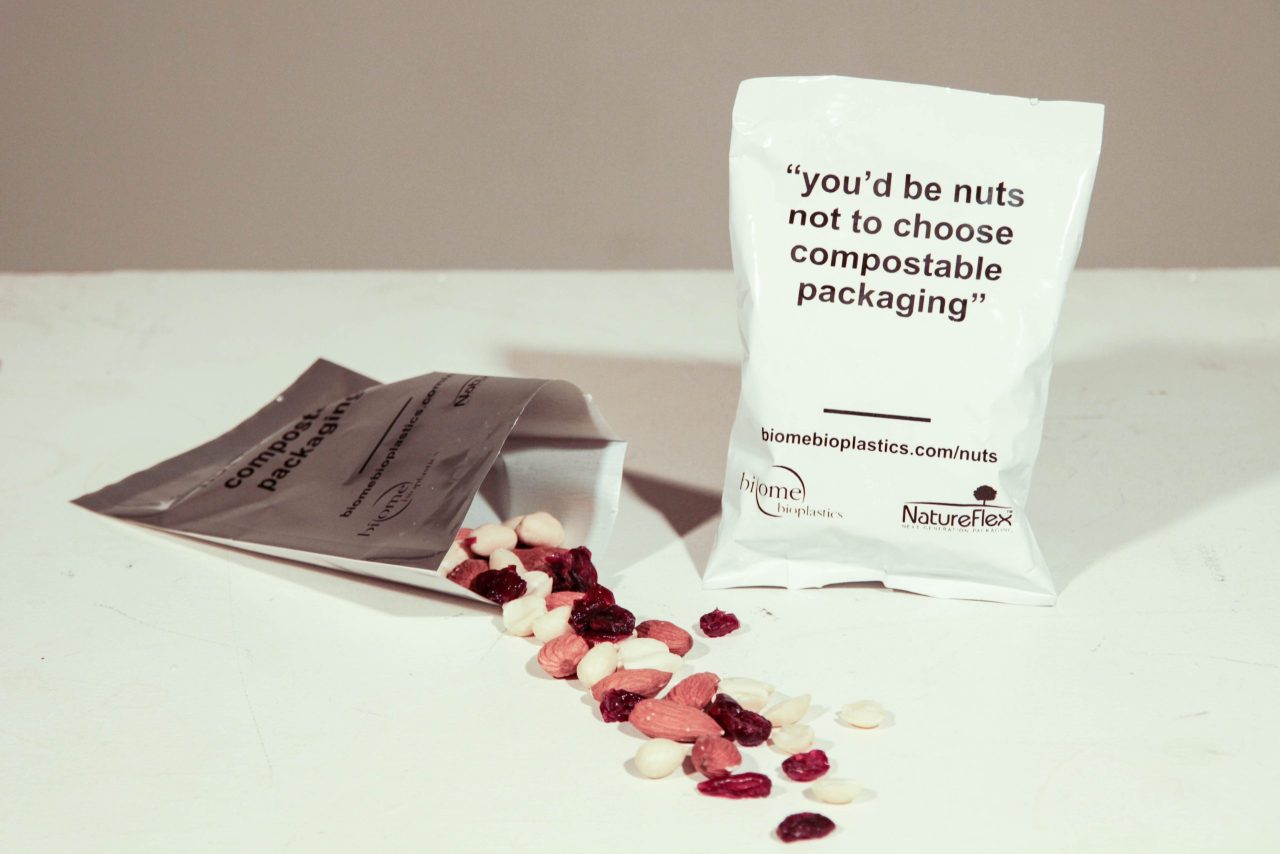

A3: I guess there are three or four things I’d mention, one of which is the market itself for an alternative to fossil-based plastics is growing so there’s a growing and vital market for both bio-based and compostable materials that we have a good understanding on and got a good selection of materials.

Number two is that we have a great product set that comes now out of 13/14 years of research, we’ve got a good team doing that development, based at Southampton with some offshoots in Nottingham, so we continue to create great product with differentiation from some of our competitors in the market.

Perhaps, most importantly, we work closely with our customers, brands and convertors, to understand their needs and support their journey as they transition from fossil-based across to bioplastics. It’s a transition that they can do with their own equipment but needs some learning and adaption of processing as they go.

So, I think that a growing market, a great product set and working closely with our customers is really important and why we expect to grow going forward.

Q4: You have recently announced changing the way you operate in North America, what have you done in North America, and why?

A4: Our current revenues for Bioplastics over 75% of them come from America so it’s already a very important market for us. One of our senior team members has recently, in December in fact, relocated to Canada, that’s Alexandra Busnel, she is now picking up the responsibility for really spearheading our growth in the region. Whilst we’ve had technical support permanently on the ground for some time, this is the first commercial businessperson we’ve had in the US and I think it reflects both our growth and our need to be close to the customers, as I mentioned before, as they grow.

Alongside Alexandra going to Canada, we’ve also established business entities in thew USA and Canada and we’ve opened a further stock point in the region in Canada. We’ve also upgraded our own local systems so that we can take orders and provide a really rapid logistics turnaround in that region rather than having to come back via the UK.

So, it’s a great opportunity set there in the US and we’re just adapting our business model slightly so we’re more present in the country. I think this action really reinforces our commitment to the market and to raise our customer service even further, something that really differentiates us from others.

Q5: It all sounds really exciting, when will investors know whether this work has been a success?

A5: It is exciting, if you look at the Allenby forecast in the market, that’s Biome Technologies’ broker, you can see that there’s clear expectations for growth in our Bioplastics division in 2023. We do report quarterly to the market so investors should see that action through into delivery, and in the subsequent quarters as we go forward, in our revenue numbers.

Q6: Turning back to your trading statement, you said that you’re being cautious in expectations for the RF division, particularly in the current economic environment. The team is working hard to convert its prospect pipeline into firm orders and the Bioplastics division has started 2023 really in an encouraging manner.

A6: Yes, that’s, I guess, unpacking that statement in our trading statement. The RF business really does rely on chunky large capex orders from its customer base and we’ve got a good pipeline. I think we just need to be cognisant in this time that with the world still in turmoil, getting some of those orders over the line from prospect to order with capex being looked at by firms globally, it might take a little bit more time than we expect.

So, as we entered this year, we decided just to be a bit more cautious on the rate that those large orders might land but we’ll obviously update the market as those prospects turn into firm orders.

Bioplastics has had a really encouraging start to the year with good order flow. It’s early days, we’re one month in, we have seen the major uplifts that we got at the back end of last year carry through into Q1 of 2023 and some of our other customers look a little bit firmer than they did last year. So, as I said an encouraging start for the Bioplastics business.

We will provide a further update with our audited results which are out later in April so I hope that gives investors some view of where we are.