MARKET TRENDS AND FUTURE DEVELOPMENTS

Aircraft leasing is a growth industry which, historically, has taken an increasing share of ownership of the commercial passenger aircraft fleet. Avation plc (LON:AVAP) expects that the percentage of leased aircraft in the global fleet will remain high in future due to the flexibility that the leasing model provides for airlines and also due to the ability of leasing companies to access financial capital.

The market for air travel has continued to perform strongly with IATA reporting record passenger volumes in their latest air passenger market analysis report. Industry RPKs grew 8.0% in the year to July 2024 led by international travel with 10.1% growth followed by domestic travel with 4.8% growth. Growth in passenger volumes was recorded in all regions in the year to July 2024.

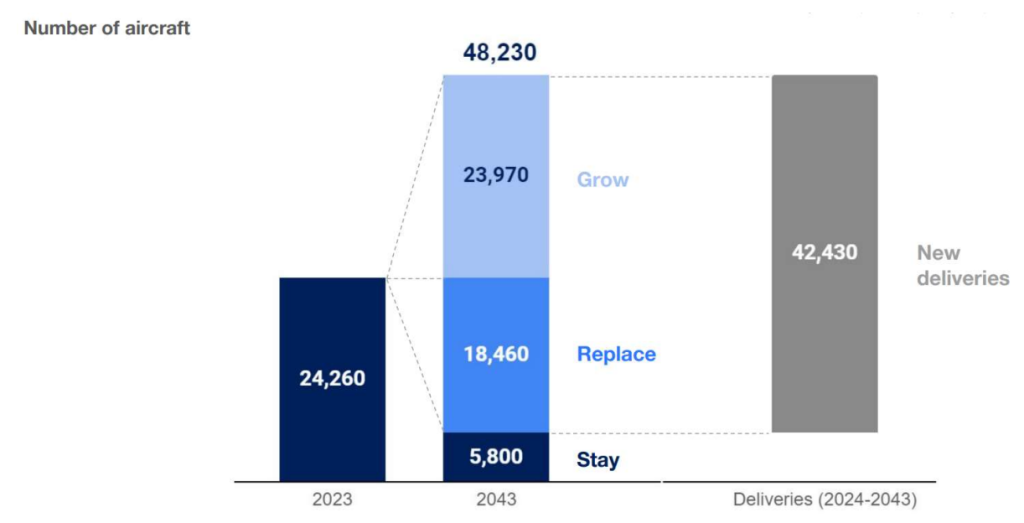

The aircraft leasing industry benefits from good long-term fundamentals including growth in global demand for air travel, capital constraints amongst airlines and normal cycles of aircraft replacement. Airbus estimates that the global commercial aircraft fleet will double from around 24,000 aircraft to around 48,000 aircraft between 2024 and 2043.

Passenger traffic is expected to increase at a compounded annual growth rate of 3.6% between 2027 and 2043 which implies a doubling of demand over the next 20 years. Airbus forecasts that 42,430 aircraft (replacement and growth) will be required over the next 20 years, of which 46% are expected to be in Asia-Pacific, 19% in Europe, 17% in North America, and of the total, 79% are expected to be single aisle.

Around 30% of the current global commercial aircraft fleet are new generation more fuel-efficient types such as the Airbus A220 and A320/A321 neo types. Over the next 20-year period 95% of the global fleet to expected to transition to new generation aircraft types.

Avation plc expects that this trend will support the company’s future strategy of gradually trading out of older aircraft types and focussing on aircraft types such as the Airbus NEO and A220 series in addition to ATR 72 aircraft with new generation PW127-XT engines.