Anglo American plc (LON:AAL) has announced its production report for the second quarter ended 30 June 2023.

Duncan Wanblad, Chief Executive of Anglo American, said: “Production increased by 11%(1) compared to the second quarter in 2022, reflecting the ramp-up of our new Quellaveco copper mine in Peru, which has now reached commercial production levels. We also delivered a strong performance at our Minas-Rio iron ore operation in Brazil, as well as higher production from our open cut operations in Steelmaking Coal in Australia. These were offset by temporary lower production from De Beers’ Venetia mine, as it transitions from open pit to underground, and expected lower PGMs production, as well as the impact of lower copper throughput and grades in Chile.

“Our focus remains resolutely on safely achieving our full year production guidance through the seasonally stronger second half of the year. The recent changes to our executive leadership team, coupled with re-organising how we manage our production businesses and the functional expertise that supports them, better positions us to drive safe and consistent operational performance and strategic delivery over the longer term.”

Q2 2023 highlights

• De Beers and the Government of Botswana reached an agreement in principle(2) on a new 10-year sales agreement for Debswana’s rough diamond production (through to 2033) and a 25-year extension of the Debswana mining licences (through to 2054).

• Copper production increased by 56%, reflecting the ramp-up to commercial production levels at our new Quellaveco mine in Peru, while production from our operations in Chile decreased by 2%.

• Steelmaking coal production increased by 28%, reflecting higher production at the open cut operations, which were impacted by unseasonal wet weather in Q2 2022.

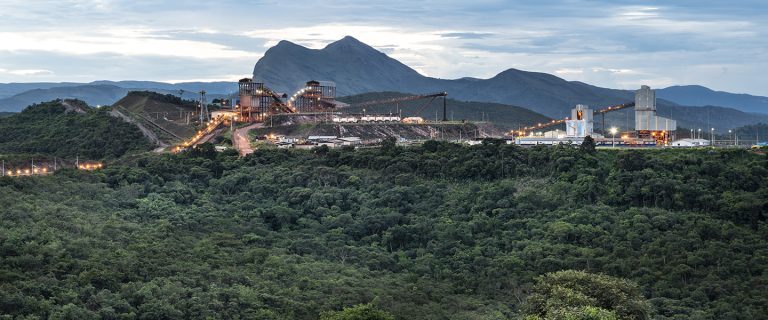

• Iron ore production increased by 9%, principally driven by a strong operational performance at Minas-Rio where production increased by 29%.

• Nickel production decreased by 4%, reflecting the impact of lower grades.

• Rough diamond production decreased by 5%, as a strong operational performance was offset by expected lower production from Venetia, as it transitions to underground operations.

• Production from our Platinum Group Metals (PGMs) operations decreased by 9%, mainly driven by short-term operational challenges and 2022 planned infrastructure closures at Amandelbult, as well as the planned ramp-down of Kroondal.

| Production | Q2 2023 | Q2 2022 | % vs. Q2 2022 | H1 2023 | H1 2022 | % vs. H1 2022 |

| Copper (kt)(3) | 209 | 134 | 56% | 387 | 273 | 42% |

| Nickel (kt)(4) | 9.9 | 10.3 | (4)% | 19.6 | 19.6 | 0% |

| Platinum group metals (koz)(5) | 943 | 1,032 | (9)% | 1,844 | 1,988 | (7)% |

| Diamonds (Mct)(6) | 7.6 | 7.9 | (5)% | 16.5 | 16.9 | (2)% |

| Iron ore (Mt)(7) | 15.6 | 14.4 | 9% | 30.7 | 27.5 | 12% |

| Steelmaking coal (Mt) | 3.4 | 2.6 | 28% | 6.9 | 4.8 | 42% |

| Manganese ore (kt) | 970 | 980 | (1)% | 1,811 | 1,783 | 2% |

(1) Total production across Anglo American’s products is calculated on a copper equivalent basis, including the equity share of De Beers’ production and using long-term consensus parameters.

(2) The final agreement will constitute a related party transaction under the UK Listing Rules, and therefore will be subject to approval by Anglo American’s shareholders in due course.

(3) Contained metal basis. Reflects copper production from the Copper operations in Chile and Peru only (excludes copper production from the Platinum Group Metals business).

(4) Reflects nickel production from the Nickel operations in Brazil only (excludes 6.1 kt of Q2 2023 nickel production from the Platinum Group Metals business).

(5) Produced ounces of metal in concentrate. 5E+Au (platinum, palladium, rhodium, ruthenium and iridium plus gold). Reflects own mined production and purchase of concentrate.

(6) De Beers Group production is on a 100% basis, except for the Gahcho Kué joint operation which is on an attributable 51% basis.

(7) Wet basis.

Production and unit cost guidance summary

| 2023 production guidance | 2023 unit cost guidance(1) | ||

| Copper(2) | 840-930 kt | c.166 c/lb | |

| (previously c.156 c/lb) | |||

| Nickel(3) | 38-40 kt | c.560 c/lb | |

| (previously c.515 c/lb) | |||

| Platinum Group Metals(4) | 3.6-4.0 Moz | c.$1,000/oz | |

| (previously c.$1,025/oz) | |||

| Diamonds(5) | 30-33 Mct | c.$75/ct | |

| (previously c.$80/ct) | |||

| Iron Ore(6) | 57-61 Mt | c.$39/t | |

| Steelmaking Coal(7) | 16-19 Mt | c.$105/t | |

(1) Unit costs exclude royalties and depreciation and include direct support costs only. FX rates used for H2 2023 costs: ~18 ZAR:USD, ~1.5 AUD:USD, ~4.8 BRL:USD, ~800 CLP:USD, ~3.7 PEN:USD (previously ~17 ZAR:USD, ~5.3 BRL:USD, ~900 CLP:USD, ~3.8 PEN:USD, no change to AUD:USD).

(2) Copper business only. On a contained-metal basis. Total copper production is the sum of Chile and Peru: Chile: 530-580 kt and Peru: 310-350 kt. Production in Chile is subject to water availability. Unit cost total is a weighted average based on the mid-point of production guidance. Chile: c.205 c/lb (previously c.190 c/lb) and Peru: c.100 c/lb.

(3) Nickel operations in Brazil only. The Group also produces approximately 20 kt of nickel on an annual basis as a co-product from the PGM operations.

(4) 5E + gold produced metal in concentrate ounces. Includes own mined production (~65%) and purchased concentrate volumes (~35%). The split of metals differs for own mined and purchased concentrate, refer to FY2022 results presentation slide 42 for indicative split of own mined volumes. 2023 metal in concentrate production is expected to be 1.6-1.8 Moz of platinum, 1.2-1.3 Moz of palladium and 0.8-0.9 Moz of other PGMs and gold. 5E + gold refined production is expected to be 3.6-4.0 Moz, subject to the impact of Eskom load-curtailment. Unit cost is per own mined 5E + gold PGMs metal in concentrate ounce.

(5) Production on a 100% basis, except for the Gahcho Kué joint operation, which is on an attributable 51% basis. Production is subject to trading conditions. Venetia continues to transition to underground operations – with first production in 2023. Unit cost is based on De Beers’ share of production.

(6) Wet basis. Total iron ore is the sum of operations at Kumba in South Africa and Minas-Rio in Brazil. Kumba: 35-37 Mt and Minas-Rio: 22-24 Mt. Kumba production is subject to the third-party rail and port performance. Unit cost total is a weighted average based on the mid-point of production guidance. Kumba: c.$43/t (previously c.$44/t) and Minas-Rio: c.$33/t (previously c.$32/t).

(7) Production excludes thermal coal by-product. FOB unit cost comprises managed operations and excludes royalties and study costs.

Realised prices

| H1 2023 | H1 2022 | H1 2023 vs.H1 2022 | |

| Copper (USc/lb)(1) | 393 | 401 | (2) % |

| Copper Chile (USc/lb)(2) | 393 | 401 | (2) % |

| Copper Peru (USc/lb) | 394 | n/a | n/a |

| Nickel (US$/lb) | 9.04 | 11.59 | (22) % |

| Platinum Group Metals | |||

| Platinum (US$/oz)(3) | 1,008 | 964 | 5 % |

| Palladium (US$/oz)(3) | 1,532 | 2,147 | (29) % |

| Rhodium (US$/oz)(3) | 9,034 | 17,131 | (47) % |

| Basket price (US$/PGM oz)(4) | 1,885 | 2,671 | (29) % |

| De Beers | |||

| Consolidated average realised price ($/ct)(5) | 163 | 213 | (23) % |

| Average price index(6) | 137 | 140 | (2) % |

| Iron Ore – FOB prices(7) | 105 | 135 | (22) % |

| Kumba Export (US$/wmt)(8) | 106 | 135 | (21) % |

| Minas-Rio (US$/wmt)(9) | 104 | 134 | (22) % |

| Steelmaking Coal – HCC (US$/t)(10) | 280 | 407 | (31) % |

| Steelmaking Coal – PCI (US$/t)(10) | 236 | 322 | (27) % |

(1) Average realised total copper price is a weighted average of the Copper Chile and Copper Peru realised prices.

(2) Realised price for Copper Chile excludes third-party sales volumes.

(3) Realised price excludes trading.

(4) Price for a basket of goods per PGM oz. The dollar basket price is the net sales revenue from all metals sold (PGMs, base metals and other metals) excluding trading, per PGM 5E + gold ounces sold (own mined and purchased concentrate) excluding trading.

(5) Consolidated average realised price based on 100% selling value post-aggregation.

(6) Average of the De Beers price index for the Sights within the six-month period. The De Beers price index is relative to 100 as at December 2006.

(7) Average realised total iron ore price is a weighted average of the Kumba and Minas-Rio realised prices.

(8) Average realised export basket price (FOB Saldanha) (wet basis as product is shipped with ~1.6% moisture). The realised prices differ to Kumba’s stand-alone results due to sales to other Group companies. Average realised export basket price (FOB Saldanha) on a dry basis is $108/t (H1 2022: $137/t), higher than the dry 62% Fe benchmark price of $104/t (FOB South Africa, adjusted for freight).

(9) Average realised export basket price (FOB Açu) (wet basis as product is shipped with ~9% moisture).

(10) Weighted average coal sales price achieved at managed operations. Australian thermal coal by-product in H1 2023, a 40% decrease to $169/t (H1 2022: $280/t).

Copper

| Copper(1) (tonnes) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Copper | 209,100 | 133,900 | 56 % | 178,100 | 17 % | 387,200 | 273,400 | 42 % |

| Copper Chile | 130,800 | 133,900 | (2) % | 118,600 | 10 % | 249,400 | 273,400 | (9) % |

| Copper Peru | 78,300 | n/a | n/a | 59,500 | 32 % | 137,800 | n/a | n/a |

(1) Copper production shown on a contained metal basis. Reflects copper production from the Copper operations in Chile and Peru only (excludes copper production from the Platinum Group Metals business).

Copper production increased by 56% to 209,100 tonnes, due to the ramp-up of production from our new Quellaveco mine in Peru, while Chile’s production decreased by 2%.

Chile – Copper production decreased by 2% to 130,800 tonnes, driven by lower throughput at Collahuasi and lower grades at Los Bronces, partially offset by planned higher grade at El Soldado.

Production from Los Bronces decreased by 7% to 59,800 tonnes, primarily due to lower grades (0.51% vs. 0.57%), partially offset by plant improvement initiatives which increased throughput, despite higher ore hardness, and resulted in higher copper recovery (83% vs 82%). The unfavourable ore characteristics, including lower grade and higher ore hardness, of the current mining area will continue to impact operations until the next phase of the mine is accessed.

At Collahuasi, attributable production decreased by 8% to 57,300 tonnes, reflecting lower throughput due to maintenance as well as lower copper recovery.

Production from El Soldado increased by 83% to 13,700 tonnes, driven by planned higher grades (0.94% vs 0.50%), reflecting production from a new phase of the mine.

Chile´s central zone continues to face severe drought conditions. Management initiatives to improve water efficiency and secure alternative sources of water will continue in order to mitigate the impact on production. From 2025, more than 45% of Los Bronces’ needs will be met through a desalinated water supply.

Los Bronces’ sales of copper concentrate in the quarter were not significantly affected by the fire at the third-party Ventanas port at the end of 2022. Alternative export routes were successfully secured, with the impact expected to be recovered by the end of the year, subject to alternative port availability.

The H1 2023 average realised price of 393 c/lb includes 134,500 tonnes of copper provisionally priced on 30 June at an average of 377 c/lb.

Peru – Quellaveco produced 78,300 tonnes, reflecting the progressive ramp-up in production volumes, with the plant achieving throughput beyond nameplate capacity several times during the quarter, reaching commercial production levels in June, while the tailings dam growth phase is progressing according to plan.

Following first production from the molybdenum plant in April 2023, the ramp-up is near completion.

The H1 2023 average realised price of 394 c/lb includes 91,700 tonnes of copper provisionally priced on 30 June at an average of 377 c/lb.

2023 Guidance

Production guidance for 2023 is unchanged at 840,000-930,000 tonnes (Chile 530,000-580,000 tonnes; Peru 310,000-350,000 tonnes). Production in Chile is subject to water availability.

Unit cost guidance for 2023 is revised to c.166 c/lb(1) (previously c.156 c/lb) (Chile c.205 c/lb(1) (previously c.190 c/lb), reflecting the stronger Chilean peso; Peru c.100 c/lb(1)).

(1) FX assumption of ~800 CLP:USD and ~3.7 PEN:USD (previously ~900 CLP:USD and ~3.8 PEN:USD).

| Copper(1) (tonnes) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Total copper production | 209,100 | 178,100 | 244,300 | 146,800 | 133,900 | 56 % | 17 % | 387,200 | 273,400 | 42 % |

| Total copper sales volumes | 203,100 | 185,900 | 242,700 | 132,900 | 132,800 | 53 % | 9 % | 389,000 | 264,900 | 47 % |

| Copper Chile | ||||||||||

| Los Bronces mine(2) | ||||||||||

| Ore mined | 13,729,100 | 12,126,800 | 13,133,900 | 11,389,900 | 13,256,600 | 4 % | 13 % | 25,855,900 | 22,232,700 | 16 % |

| Ore processed – Sulphide | 12,462,800 | 10,042,400 | 12,959,300 | 9,848,900 | 11,992,800 | 4 % | 24 % | 22,505,200 | 23,135,400 | (3) % |

| Ore grade processed -Sulphide (% TCu)(3) | 0.51 | 0.52 | 0.69 | 0.58 | 0.57 | (10) % | (2) % | 0.52 | 0.59 | (13) % |

| Production – Copper in concentrate | 52,800 | 44,000 | 74,100 | 46,400 | 55,700 | (5) % | 20 % | 96,800 | 111,000 | (13) % |

| Production – Copper cathode | 7,000 | 8,700 | 10,200 | 10,500 | 8,600 | (19) % | (20) % | 15,700 | 18,700 | (16) % |

| Total production | 59,800 | 52,700 | 84,300 | 56,900 | 64,300 | (7) % | 13 % | 112,500 | 129,700 | (13) % |

| Collahuasi 100% basis(Anglo American share 44%) | ||||||||||

| Ore mined | 15,232,600 | 13,503,400 | 17,975,000 | 20,217,100 | 22,025,700 | (31) % | 13 % | 28,736,000 | 44,030,500 | (35) % |

| Ore processed – Sulphide | 13,814,300 | 14,092,200 | 14,797,300 | 14,339,600 | 14,337,800 | (4) % | (2) % | 27,906,500 | 28,179,500 | (1) % |

| Ore grade processed -Sulphide (% TCu)(3) | 1.09 | 1.05 | 1.08 | 1.08 | 1.10 | (1) % | 4 % | 1.07 | 1.14 | (6) % |

| Production – Copper in concentrate | 130,200 | 129,800 | 142,900 | 137,400 | 141,000 | (8) % | 0 % | 260,000 | 290,400 | (10) % |

| Anglo American’s 44% share of copper production for Collahuasi | 57,300 | 57,100 | 62,900 | 60,400 | 62,100 | (8) % | 0 % | 114,400 | 127,800 | (10) % |

| El Soldado mine(2) | ||||||||||

| Ore mined | 2,930,200 | 1,903,000 | 3,277,100 | 1,942,400 | 948,700 | 209 % | 54 % | 4,833,200 | 1,559,800 | 210 % |

| Ore processed – Sulphide | 1,781,400 | 1,465,000 | 1,898,200 | 1,926,500 | 1,914,100 | (7) % | 22 % | 3,246,400 | 3,723,800 | (13) % |

| Ore grade processed -Sulphide (% TCu)(3) | 0.94 | 0.72 | 0.95 | 0.59 | 0.50 | 87 % | 31 % | 0.84 | 0.54 | 57 % |

| Production – Copper in concentrate | 13,700 | 8,800 | 15,100 | 9,200 | 7,500 | 83 % | 56 % | 22,500 | 15,900 | 42 % |

| Chagres smelter(2) | ||||||||||

| Ore smelted(4) | 32,400 | 33,800 | 23,400 | 25,700 | 20,600 | 57 % | (4) % | 66,200 | 51,500 | 29 % |

| Production | 27,100 | 27,900 | 22,500 | 25,000 | 24,900 | 9 % | (3) % | 55,000 | 50,000 | 10 % |

| Total copper production(5) | 130,800 | 118,600 | 162,300 | 126,500 | 133,900 | (2) % | 10 % | 249,400 | 273,400 | (9) % |

| Total payable copper production | 125,500 | 114,100 | 156,000 | 121,600 | 128,500 | (2) % | 10 % | 239,600 | 262,600 | (9) % |

| Total copper sales volumes | 120,700 | 116,900 | 170,500 | 127,600 | 132,800 | (9) % | 3 % | 237,600 | 264,900 | (10) % |

| Total payable sales volumes | 117,100 | 112,300 | 164,000 | 122,200 | 127,500 | (8) % | 4 % | 229,400 | 254,400 | (10) % |

| Third-party sales(6) | 91,400 | 86,400 | 79,500 | 126,600 | 150,900 | (39) % | 6 % | 177,800 | 216,200 | (18) % |

| Copper Peru | ||||||||||

| Quellaveco mine(7) | ||||||||||

| Ore mined | 11,600,200 | 7,177,900 | 11,063,300 | 8,487,000 | 4,645,400 | 150 % | 62 % | 18,778,100 | 7,880,700 | 138 % |

| Ore processed – Sulphide | 9,660,800 | 7,042,200 | 8,851,800 | 2,867,600 | – | n/a | 37 % | 16,703,000 | n/a | n/a |

| Ore grade processed -Sulphide (% TCu)(3) | 0.96 | 1.04 | 1.17 | 0.96 | – | n/a | (8) % | 0.99 | n/a | n/a |

| Total copper production | 78,300 | 59,500 | 82,000 | 20,300 | – | n/a | 32 % | 137,800 | n/a | n/a |

| Total payable copper production | 75,700 | 57,500 | 79,300 | 19,600 | – | n/a | 32 % | 133,200 | n/a | n/a |

| Total copper sales volumes | 82,400 | 69,000 | 72,200 | 5,300 | – | n/a | 19 % | 151,400 | n/a | n/a |

| Total payable sales volumes | 79,500 | 66,700 | 69,700 | 5,100 | – | n/a | 19 % | 146,200 | n/a | n/a |

(1) Excludes copper production from the Platinum Group Metals business.

(2) Anglo American ownership interest of Los Bronces, El Soldado and the Chagres smelter is 50.1%. Production is stated at 100% as Anglo American consolidates these operations.

(3) TCu = total copper.

(4) Copper contained basis. Includes third-party concentrate.

(5) Total copper production includes Anglo American’s 44% interest in Collahuasi.

(6) Relates to sales of copper not produced by Anglo American operations.

(7) Anglo American ownership interest of Quellaveco is 60%. Production is stated at 100% as Anglo American consolidates this operation.

Nickel

| Nickel (tonnes) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Nickel | 9,900 | 10,300 | (4) % | 9,700 | 2 % | 19,600 | 19,600 | 0 % |

Nickel production decreased by 4% to 9,900 tonnes, reflecting the impact of lower grades, despite operational improvements at Codemin.

2023 Guidance

Production guidance for 2023 is unchanged at 38,000-40,000 tonnes.

Unit cost guidance for 2023 is revised to c.560 c/lb(1) (previously c.515 c/lb), reflecting the stronger Brazilian real and impact of higher costs of production due to lower grade ore.

| Nickel (tonnes) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Barro Alto | ||||||||||

| Ore mined | 1,283,400 | 534,800 | 973,700 | 1,349,100 | 758,300 | 69 % | 140 % | 1,818,200 | 1,102,000 | 65 % |

| Ore processed | 650,700 | 631,900 | 570,600 | 589,000 | 618,100 | 5 % | 3 % | 1,282,600 | 1,262,000 | 2 % |

| Ore grade processed – %Ni | 1.46 | 1.36 | 1.51 | 1.52 | 1.52 | (4) % | 7 % | 1.42 | 1.47 | (3) % |

| Production | 8,000 | 7,800 | 8,000 | 8,200 | 8,600 | (7) % | 3 % | 15,800 | 16,500 | (4) % |

| Codemin | ||||||||||

| Ore mined | – | 27,800 | 800 | – | – | n/a | n/a | 27,800 | – | n/a |

| Ore processed | 146,900 | 146,900 | 148,500 | 133,500 | 134,000 | 10 % | 0 % | 293,800 | 249,100 | 18 % |

| Ore grade processed – %Ni | 1.42 | 1.34 | 1.48 | 1.46 | 1.42 | 0 % | 6 % | 1.38 | 1.41 | (2) % |

| Production | 1,900 | 1,900 | 2,200 | 1,800 | 1,700 | 12 % | 0 % | 3,800 | 3,100 | 23 % |

| Total nickel production(2) | 9,900 | 9,700 | 10,200 | 10,000 | 10,300 | (4) % | 2 % | 19,600 | 19,600 | 0 % |

| Sales volumes | 10,600 | 8,500 | 11,800 | 10,400 | 7,800 | 36 % | 25 % | 19,100 | 16,800 | 14 % |

(1) FX assumption of ~4.8 BRL:USD (previously ~5.3 BRL:USD).

(2) Excludes nickel production from the Platinum Group Metals business.

Platinum Group Metals (PGMs)

| PGMs (000 oz)(1) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Metal in concentrate production | 943 | 1,032 | (9) % | 901 | 5 % | 1,844 | 1,988 | (7) % |

| Own mined(2) | 613 | 686 | (11) % | 586 | 5 % | 1,199 | 1,309 | (8) % |

| Purchase of concentrate (POC)(3) | 330 | 345 | (4) % | 315 | 5 % | 646 | 678 | (5) % |

| Refined production(4) | 1,074 | 1,241 | (13) % | 626 | 72 % | 1,700 | 1,959 | (13) % |

(1) Ounces refer to troy ounces. PGMs consists of 5E+Au (platinum, palladium, rhodium, ruthenium and iridium plus gold).

(2) Includes managed operations and 50% of joint operation production.

(3) Includes the other 50% of joint operation production, as well as the purchase of concentrate from third parties.

(4) Refined production excludes toll refined material.

Metal in concentrate production

Own mined production decreased by 11% to 612,700 ounces, due to lower production from Amandelbult and Mogalakwena.

Production at Amandelbult decreased by 19% to 147,900 ounces, primarily driven by short-term operational challenges as well as planned infrastructure closures at the end of 2022. Mogalakwena production decreased by 7% to 242,400 ounces and Unki production decreased by 11% to 59,000 ounces, due to mining through planned lower grade areas. Eskom load-curtailment deferred production by ~22,000 ounces, primarily at Amandelbult and Mogalakwena. Joint operations decreased by 14% to 86,000 ounces, mainly due to the planned ramp-down at Kroondal.

Purchase of concentrate was 4% lower at 330,400 ounces, due to lower volumes from the Kroondal joint operation.

Refined production

Refined production decreased by 13% to 1,073,800 ounces, primarily due to planned asset integrity work at the processing operations, lower metal in concentrate volumes and the impact of Eskom load-curtailment on the smelters of ~17,000 ounces for the period.

Sales

Sales volumes decreased by 8% in line with lower refined production.

The H1 2023 average realised basket price was $1,885/PGM ounce, reflecting lower market prices compared to H1 2022.

2023 Guidance

Production guidance (metal in concentrate) for 2023 is unchanged at 3.6-4.0 million ounces(1). Refined production guidance for 2023 is 3.6-4.0 million ounces, subject to the impact of Eskom load-curtailment.

Unit cost guidance for 2023 is revised to c.$1,000/PGM ounce(2) (previously c.$1,025/PGM ounce), reflecting the weaker South African rand.

(1) Metal in concentrate production is expected to be 1.6-1.8 million ounces of platinum, 1.2-1.3 million ounces of palladium and 0.8-0.9 million ounces of other PGMs and gold; with own mined output accounting for ~65%.

(2) FX assumption of ~18 ZAR:USD (previously ~17 ZAR:USD).

| Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 | |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| M&C PGMs production (000 oz)(1) | 943.1 | 901.2 | 990.4 | 1,046.1 | 1,031.5 | (9) % | 5 % | 1,844.3 | 1,987.5 | (7) % |

| Own mined | 612.7 | 586.0 | 656.6 | 683.2 | 686.3 | (11) % | 5 % | 1,198.7 | 1,309.4 | (8) % |

| Mogalakwena | 242.4 | 219.0 | 256.7 | 259.3 | 261.4 | (7) % | 11 % | 461.4 | 510.2 | (10) % |

| Amandelbult | 147.9 | 151.5 | 176.6 | 192.6 | 183.4 | (19) % | (2) % | 299.4 | 343.3 | (13) % |

| Unki | 59.0 | 62.5 | 52.6 | 59.9 | 66.3 | (11) % | (6) % | 121.5 | 119.6 | 2 % |

| Mototolo | 77.4 | 68.7 | 71.7 | 75.4 | 75.6 | 2 % | 13 % | 146.1 | 142.8 | 2 % |

| Joint operations(2) | 86.0 | 84.3 | 99.0 | 96.0 | 99.6 | (14) % | 2 % | 170.3 | 193.5 | (12) % |

| Purchase of concentrate | 330.4 | 315.2 | 333.8 | 362.9 | 345.2 | (4) % | 5 % | 645.6 | 678.1 | (5) % |

| Joint operations(2) | 86.0 | 84.3 | 99.0 | 96.0 | 99.6 | (14) % | 2 % | 170.3 | 193.5 | (12) % |

| Third parties | 244.4 | 230.9 | 234.8 | 266.9 | 245.6 | 0 % | 6 % | 475.3 | 484.6 | (2) % |

| Refined PGMs production (000 oz)(1)(3) | 1,073.8 | 626.0 | 877.2 | 994.8 | 1,240.6 | (13) % | 72 % | 1,699.8 | 1,959.1 | (13) % |

| By metal: | ||||||||||

| Platinum | 489.4 | 266.0 | 391.2 | 457.2 | 600.4 | (18) % | 84 % | 755.4 | 934.5 | (19) % |

| Palladium | 352.6 | 230.5 | 278.5 | 317.1 | 374.8 | (6) % | 53 % | 583.1 | 602.9 | (3) % |

| Rhodium | 68.4 | 38.8 | 51.7 | 64.8 | 86.4 | (21) % | 76 % | 107.2 | 132.7 | (19) % |

| Other PGMs and gold | 163.4 | 90.7 | 155.8 | 155.7 | 179.0 | (9) % | 80 % | 254.1 | 289.0 | (12) % |

| Nickel (tonnes) | 6,100 | 3,300 | 4,800 | 5,700 | 6,200 | (2) % | 85 % | 9,400 | 10,800 | (13) % |

| Tolled material (000 oz)(4) | 139.6 | 146.1 | 173.1 | 151.3 | 143.4 | (3) % | (4) % | 285.7 | 298.2 | (4) % |

| PGMs sales from production (000 oz)(1)(5) | 1,108.7 | 698.6 | 883.4 | 933.5 | 1,206.2 | (8) % | 59 % | 1,807.3 | 2,044.4 | (12) % |

| Third-party PGMs sales (000 oz)(1)(6) | 1,153.0 | 912.2 | 789.6 | 403.4 | 256.0 | 350 % | 26 % | 2,065.2 | 656.9 | 214 % |

| 4E head grade (g/t milled)(7) | 3.15 | 3.11 | 3.19 | 3.33 | 3.33 | (5) % | 1 % | 3.11 | 3.29 | (5) % |

(1) M&C refers to metal in concentrate. Ounces refer to troy ounces. PGMs consists of 5E+Au (platinum, palladium, rhodium, ruthenium and iridium plus gold).

(2) The joint operations are Modikwa and Kroondal. Platinum owns 50% of these operations, which is presented under ‘Own mined’ production, and purchases the remaining 50% of production, which is presented under ‘Purchase of concentrate’.

(3) Refined production excludes toll material.

(4) Tolled volume measured as the combined content of: platinum, palladium, rhodium and gold, reflecting the tolling agreements in place.

(5) PGMs sales volumes from production are generally ~65% own mined and ~35% purchases of concentrate though this may vary from quarter to quarter.

(6) Relates to sales of metal not produced by Anglo American operations, and includes metal lending and borrowing activity.

(7) 4E: the grade measured as the combined content of: platinum, palladium, rhodium and gold, excludes tolled material. Minor metals are excluded due to variability.

De Beers

| De Beers(1) (000 carats) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Botswana | 5,829 | 5,521 | 6 % | 6,899 | (16) % | 12,728 | 11,705 | 9 % |

| Namibia | 612 | 565 | 8 % | 619 | (1) % | 1,231 | 1,016 | 21 % |

| South Africa | 466 | 1,220 | (62) % | 739 | (37) % | 1,205 | 2,916 | (59) % |

| Canada | 683 | 643 | 6 % | 673 | 1 % | 1,356 | 1,247 | 9 % |

| Total carats recovered | 7,590 | 7,949 | (5) % | 8,930 | (15) % | 16,520 | 16,884 | (2) % |

Rough diamond production decreased by 5% to 7.6 million carats, due to the planned reduction in South Africa while the Venetia open pit transitions to underground operations, which offset strong performance driven by the planned treatment of higher grade ore at the remaining assets.

In Botswana, production increased by 6% to 5.8 million carats, driven by the planned treatment of higher grade ore at Orapa. This was partly offset by lower throughput at Jwaneng due to planned maintenance.

Namibia production increased by 8% to 0.6 million carats, primarily driven by the ongoing ramp-up and expansion of the mining area at the land operations.

South Africa production decreased by 62% to 0.5 million carats, due to the planned end of Venetia’s open pit operations in December 2022. Venetia continues to process lower grade surface stockpiles, which will result in temporary lower production levels as it transitions to underground operations.

Production in Canada increased by 6% to 0.7 million carats, driven by the treatment of higher grade ore despite planned plant maintenance.

Demand for rough diamonds was impacted by the ongoing macro-economic headwinds, with high levels of polished diamond inventory in the midstream. Rough diamond sales totalled 7.6 million carats (6.4 million carats on a consolidated basis)(2) from two Sights, compared with 9.4 million carats (8.3 million carats on a consolidated basis)(2) from three Sights in Q2 2022, and 9.7 million carats (8.9 million carats on a consolidated basis)(2) from three Sights in Q1 2023.

The H1 2023 consolidated average realised price decreased by 23% to $163/ct (H1 2022: $213/ct), primarily due to selling a larger proportion of lower value rough diamonds, as Sightholders took a more cautious approach to planning their 2023 allocation schedule due to the uncertain macro-economic outlook. The average rough price index decreased by 2%, reflecting the overall softening in consumer demand for diamond jewellery and a build-up of inventory in the midstream.

2023 Guidance

Production guidance(1) for 2023 is unchanged at 30-33 million carats (100% basis), subject to trading conditions.

Unit cost guidance for 2023 is revised to c.$75/carat(3) (previously c.$80/carat), reflecting the weaker South African rand.

(1) De Beers Group production is on a 100% basis, except for the Gahcho Kué joint operation which is on an attributable 51% basis.

(2) Consolidated sales volumes exclude De Beers Group’s JV partners’ 50% proportionate share of sales to entities outside De Beers Group from the Diamond Trading Company Botswana and the Namibia Diamond Trading Company, which are included in total sales volume (100% basis).

(3) FX assumption of ~18 ZAR:USD (previously ~17 ZAR:USD).

| De Beers(1) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Carats recovered (000 carats) | ||||||||||

| 100% basis (unless stated) | ||||||||||

| Jwaneng | 2,955 | 3,782 | 3,126 | 3,567 | 3,120 | (5) % | (22) % | 6,737 | 6,752 | 0 % |

| Orapa(2) | 2,874 | 3,117 | 2,664 | 3,080 | 2,401 | 20 % | (8) % | 5,991 | 4,953 | 21 % |

| Total Botswana | 5,829 | 6,899 | 5,790 | 6,647 | 5,521 | 6 % | (16) % | 12,728 | 11,705 | 9 % |

| Debmarine Namibia | 503 | 498 | 439 | 423 | 488 | 3 % | 1 % | 1,001 | 863 | 16 % |

| Namdeb (land operations) | 109 | 121 | 151 | 108 | 77 | 42 % | (10) % | 230 | 153 | 50 % |

| Total Namibia | 612 | 619 | 590 | 531 | 565 | 8 % | (1) % | 1,231 | 1,016 | 21 % |

| Venetia | 466 | 739 | 948 | 1,651 | 1,220 | (62) % | (37) % | 1,205 | 2,916 | (59) % |

| Total South Africa | 466 | 739 | 948 | 1,651 | 1,220 | (62) % | (37) % | 1,205 | 2,916 | (59) % |

| Gahcho Kué (51% basis) | 683 | 673 | 827 | 741 | 643 | 6 % | 1 % | 1,356 | 1,247 | 9 % |

| Total Canada | 683 | 673 | 827 | 741 | 643 | 6 % | 1 % | 1,356 | 1,247 | 9 % |

| Total carats recovered | 7,590 | 8,930 | 8,155 | 9,570 | 7,949 | (5) % | (15) % | 16,520 | 16,884 | (2) % |

| Sales volumes | ||||||||||

| Total sales volume (100%) (Mct)(3) | 7.6 | 9.7 | 7.3 | 9.1 | 9.4 | (19) % | (22) % | 17.3 | 17.3 | 0 % |

| Consolidated sales volume (Mct)(3) | 6.4 | 8.9 | 6.6 | 8.5 | 8.3 | (23) % | (28) % | 15.3 | 15.3 | 0 % |

| Number of Sights (sales cycles) | 2 | 3 | 2 | 3 | 3 | 5 | 5 |

(1) De Beers Group production is on a 100% basis, except for the Gahcho Kué joint operation which is on an attributable 51% basis.

(2) Orapa constitutes the Orapa Regime which includes Orapa, Letlhakane and Damtshaa.

(3) Consolidated sales volumes exclude De Beers Group’s JV partners’ 50% proportionate share of sales to entities outside De Beers Group from the Diamond Trading Company Botswana and the Namibia Diamond Trading Company, which are included in total sales volume (100% basis).

Iron Ore

| Iron Ore (000 t) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Iron Ore | 15,647 | 14,374 | 9 % | 15,076 | 4 % | 30,723 | 27,539 | 12 % |

| Kumba(1) | 9,320 | 9,469 | (2) % | 9,425 | (1) % | 18,745 | 17,761 | 6 % |

| Minas-Rio(2) | 6,327 | 4,905 | 29 % | 5,651 | 12 % | 11,978 | 9,778 | 22 % |

(1) Volumes are reported as wet metric tonnes. Product is shipped with ~1.6% moisture.

(2) Volumes are reported as wet metric tonnes. Product is shipped with ~9% moisture.

Iron ore production increased by 9% to 15.6 million tonnes, reflecting a 29% increase at Minas-Rio and a 2% decrease at Kumba.

Kumba – Total production decreased to 9.3 million tonnes, primarily driven by a 9% decrease in Sishen’s production to 6.4 million tonnes due to high levels of finished stock at the mine as a result of rail constraints. This was partially offset by a 22% increase at Kolomela to 2.9 million tonnes, owing to operational challenges in the comparative period in 2022.

Total sales decreased by 8% to 9.5 million tonnes(1) due to low levels of finished stock at the port given ongoing weak logistics performance from Transnet, the third-party rail and port operator. As a result, total finished stock increased to 7.9 million tonnes(1), with the majority of this located at the mines.

Kumba’s iron (Fe) content averaged 63.3% (H1 2022: 64.0%), while the average lump:fines ratio was 67:33 (H1 2022: 66:34).

The H1 2023 average realised price of $106/tonne(1) (FOB South Africa, wet basis) was 4% higher than the 62% Fe benchmark price of $102/tonne (FOB South Africa, adjusted for freight and moisture), as the lump and Fe content quality premiums that the Kumba products attract more than offset the impact of provisionally priced sales volumes.

Minas-Rio – Production increased by 29% to 6.3 million tonnes, driven by strong mining and plant performance and timing of maintenance. This has resulted in a number of performance records being achieved this quarter, reflecting the operational improvement.

The H1 2023 average realised price of $104/tonne (FOB Brazil, wet basis) was higher than the Metal Bulletin 65(2) price of $101/tonne (FOB Brazil, adjusted for freight and moisture), which takes into account the premium for our high quality product, including higher (~67%) Fe content, which more than offset the impact of provisionally priced sales volumes.

2023 Guidance

Production guidance for 2023 is unchanged at 57-61 million tonnes (Kumba 35-37 million tonnes; Minas-Rio 22-24 million tonnes). Kumba is subject to third-party rail and port performance.

Unit cost guidance for 2023 is c.$39/tonne(3), revising Kumba to c.$43/tonne(3) (previously c.$44/tonne) reflecting the weaker South African rand and Minas-Rio to c.$33/tonne(3) (previously c.$32/tonne) reflecting the stronger Brazilian real.

(1) Sales volumes, stock and realised price are reported on a wet basis and differ to Kumba’s stand-alone results due to sales to other Group companies.

(2) Fastmarkets has ceased publication of the Metal Bulletin 66 index, therefore the benchmark price has been switched to Metal Bulletin 65.

(3) FX assumption of ~18 ZAR:USD for Kumba and ~4.8 BRL:USD for Minas-Rio (previously ~17 ZAR:USD and ~5.3 BRL:USD).

| Iron Ore (000 t) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Iron Ore production(1) | 15,647 | 15,076 | 15,682 | 16,060 | 14,374 | 9 % | 4 % | 30,723 | 27,539 | 12 % |

| Iron Ore sales(1) | 15,781 | 14,546 | 13,887 | 15,799 | 14,471 | 9 % | 8 % | 30,327 | 28,300 | 7 % |

| Kumba production | 9,320 | 9,425 | 9,961 | 9,977 | 9,469 | (2) % | (1) % | 18,745 | 17,761 | 6 % |

| Lump | 6,086 | 6,146 | 6,523 | 6,530 | 6,230 | (2) % | (1) % | 12,232 | 11,618 | 5 % |

| Fines | 3,234 | 3,279 | 3,438 | 3,447 | 3,239 | 0 % | (1) % | 6,513 | 6,143 | 6 % |

| Kumba production by mine | ||||||||||

| Sishen | 6,442 | 6,341 | 7,010 | 7,085 | 7,106 | (9) % | 2 % | 12,783 | 12,922 | (1) % |

| Kolomela | 2,878 | 3,084 | 2,951 | 2,892 | 2,363 | 22 % | (7) % | 5,962 | 4,839 | 23 % |

| Kumba sales volumes(2) | ||||||||||

| Export iron ore(2) | 9,456 | 9,499 | 7,054 | 9,982 | 10,303 | (8) % | 0 % | 18,955 | 19,635 | (3) % |

| Minas-Rio production | ||||||||||

| Pellet feed | 6,327 | 5,651 | 5,721 | 6,083 | 4,905 | 29 % | 12 % | 11,978 | 9,778 | 22 % |

| Minas-Rio sales volumes | ||||||||||

| Export – pellet feed | 6,325 | 5,047 | 6,833 | 5,817 | 4,168 | 52 % | 25 % | 11,372 | 8,665 | 31 % |

(1) Total iron ore is the sum of Kumba and Minas-Rio and reported in wet metric tonnes. Kumba product is shipped with ~1.6% moisture and Minas-Rio product is shipped with ~9% moisture.

(2) Sales volumes differ to Kumba’s standalone results due to sales to other Group companies.

Steelmaking Coal

| Steelmaking Coal(1) (000 t) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Steelmaking Coal | 3,356 | 2,621 | 28 % | 3,533 | (5) % | 6,889 | 4,847 | 42 % |

(1) Anglo American’s attributable share of production. Includes production relating to processing of third-party product.

Steelmaking coal production increased by 28% to 3.4 million tonnes, as the open cut operations (Capcoal and Dawson) were impacted by unseasonal wet weather in 2022.

Grosvenor undertook a longwall move in Q2 2023 and has now commenced the new longwall panel, with full ramp-up expected towards the end of July. This was offset by higher production from Moranbah, which had a longwall move in Q2 2022.

The ratio of hard coking coal production to PCI/semi-soft coking coal was 70:30, lower than Q2 2022 (81:19), reflecting increased production from the open cut operations that produce higher volumes of PCI/semi-soft coal.

Average realised prices differ from the average market prices due to differences in material grade and timing of shipments. The H1 2023 average realised price for hard coking coal was $280/tonne, compared to the benchmark price of $294/tonne. The price realisation increased to 95% (H1 2022: 87%), driven by larger volumes of premium hard coking coal being produced from the underground longwall operations and the impact of sales timing.

2023 Guidance

Production guidance for 2023 is unchanged at 16-19 million tonnes.

Unit cost guidance for 2023 is unchanged at c.$105/tonne(1).

(1) FX assumption of ~1.5 AUD:USD.

| Coal, by product (000 t)(1) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Production volumes | ||||||||||

| Steelmaking Coal(2)(3) | 3,356 | 3,533 | 4,650 | 5,510 | 2,621 | 28 % | (5) % | 6,889 | 4,847 | 42 % |

| Hard coking coal(2) | 2,358 | 2,842 | 3,647 | 4,562 | 2,126 | 11 % | (17) % | 5,200 | 3,879 | 34 % |

| PCI / SSCC | 998 | 691 | 1,003 | 948 | 495 | 102 % | 44 % | 1,689 | 968 | 74 % |

| Export thermal coal | 481 | 284 | 428 | 424 | 366 | 31 % | 69 % | 765 | 793 | (4) % |

| Sales volumes | ||||||||||

| Steelmaking Coal(2)(3) | 3,585 | 3,334 | 4,233 | 5,245 | 2,776 | 29 % | 8 % | 6,919 | 5,206 | 33 % |

| Hard coking coal(2) | 2,681 | 2,699 | 3,114 | 4,289 | 2,097 | 28 % | (1) % | 5,380 | 3,909 | 38 % |

| PCI / SSCC | 904 | 635 | 1,119 | 956 | 679 | 33 % | 42 % | 1,539 | 1,297 | 19 % |

| Export thermal coal | 390 | 402 | 473 | 480 | 390 | 0 % | (3) % | 792 | 728 | 9 % |

| (1) Anglo American’s attributable share of production.(2) Includes production relating to processing of third-party product.(3) Steelmaking coal volumes exclude thermal coal by-product. | ||||||||||

| Steelmaking coal, by operation (000 t)(1) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Steelmaking Coal(2)(3) | 3,356 | 3,533 | 4,650 | 5,510 | 2,621 | 28 % | (5) % | 6,889 | 4,847 | 42 % |

| Moranbah(2) | 948 | 576 | 1,490 | 1,523 | 210 | 351 % | 65 % | 1,524 | 383 | 298 % |

| Grosvenor | 240 | 976 | 777 | 1,277 | 856 | (72) % | (75) % | 1,216 | 981 | 24 % |

| Aquila (incl. Capcoal)(2) | 874 | 745 | 1,023 | 1,150 | 527 | 66 % | 17 % | 1,619 | 1,274 | 27 % |

| Dawson | 576 | 520 | 584 | 741 | 318 | 81 % | 11 % | 1,096 | 762 | 44 % |

| Jellinbah | 718 | 716 | 776 | 819 | 710 | 1 % | 0 % | 1,434 | 1,447 | (1) % |

| (1) Anglo American’s attributable share of production.(2) Includes production relating to processing of third-party product.(3) Steelmaking coal volumes exclude thermal coal by-product. | ||||||||||

Manganese

| Manganese (000 t) | Q2 | Q2 | Q2 2023 vs. Q2 2022 | Q1 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2022 | 2023 | 2023 | 2022 | ||||

| Manganese ore(1) | 970 | 980 | (1) % | 841 | 15 % | 1,811 | 1,783 | 2 % |

(1) Anglo American’s attributable share of production. Saleable production.

Manganese ore production was relatively stable at 969,800 tonnes.

| Manganese (tonnes) | Q2 | Q1 | Q4 | Q3 | Q2 | Q2 2023 vs. Q2 2022 | Q2 2023 vs. Q1 2023 | H1 | H1 | H1 2023 vs. H1 2022 |

| 2023 | 2023 | 2022 | 2022 | 2022 | 2023 | 2022 | ||||

| Samancor production | ||||||||||

| Manganese ore(1) | 969,800 | 840,900 | 984,300 | 973,300 | 979,600 | (1) % | 15 % | 1,810,700 | 1,783,100 | 2 % |

| Samancor sales volumes | ||||||||||

| Manganese ore | 937,900 | 823,600 | 954,700 | 834,400 | 960,200 | (2) % | 14 % | 1,761,500 | 1,807,100 | (3) % |

(1) Anglo American’s attributable share of production. Saleable production.

Exploration and evaluation

Exploration and evaluation expenditure was largely unchanged at $90 million (Q2 2022: $87 million). Exploration expenditure decreased by 17% to $35 million, mostly driven by lower iron ore activity. Evaluation expenditure increased by 22% to $55 million, driven by higher spend in PGMs and diamonds.

Corporate and other activities

Charges recognised within EBITDA for the first six months of 2023 – at De Beers, an inventory adjustment, is currently estimated to be $0.1 billion and at PGMs, a stock count adjustment and a net realisable value inventory write-down, is currently estimated to be $0.2 billion.

The underlying effective tax rate for the first half of 2023 is estimated to be between 36-38%, primarily due to the mix of earnings in the countries where we operate.

At the end of the first half of 2023, working capital cash outflows of between $0.6-0.8 billion are estimated, resulting in net debt between $8.7-9.0 billion.

The above figures are subject to the external auditors concluding their review procedures of these results. The Group’s results announcement is scheduled for 27 July.

ESG summary factsheets on a range of topics are now available on our website. For more information on Anglo American’s announcements since our previous production report, please find links to our Press Releases below.

• 3 July 2023 | De Beers and Botswana agree in principle on sales agreement and mining licences

• 21 June 2023 | Anglo American rough diamond sales value for De Beers’ fifth sales cycle of 2023

• 15 June 2023 | Anglo American and Jiangxi Copper collaborate on responsible copper

• 31 May 2023 | Anglo American re-organises senior management team to lead next phase of value delivery

• 17 May 2023 | Anglo American rough diamond sales value for De Beers’ fourth sales cycle of 2023

• 26 April 2023 | AGM 2023 – Address to Shareholders

Notes

• This Production Report for the second quarter ended 30 June 2023 is unaudited.

• Production figures are sometimes more precise than the rounded numbers shown in this Production Report.

• Copper equivalent production shows changes in underlying production volume. It is calculated by expressing each product’s volume as revenue, subsequently converting the revenue into copper equivalent units by dividing by the copper price (per tonne). Long-term forecast prices are used, in order that period-on-period comparisons exclude any impact for movements in price.

• Please refer to page 16 for information on forward-looking statements.

In this document, references to “Anglo American”, the “Anglo American Group”, the “Group”, “we”, “us”, and “our” are to refer to either Anglo American plc and its subsidiaries and/or those who work for them generally, or where it is not necessary to refer to a particular entity, entities or persons. The use of those generic terms herein is for convenience only, and is in no way indicative of how the Anglo American Group or any entity within it is structured, managed or controlled. Anglo American subsidiaries, and their management, are responsible for their own day-to-day operations, including but not limited to securing and maintaining all relevant licences and permits, operational adaptation and implementation of Group policies, management, training and any applicable local grievance mechanisms. Anglo American produces Group-wide policies and procedures to ensure best uniform practices and standardisation across the Anglo American Group but is not responsible for the day to day implementation of such policies. Such policies and procedures constitute prescribed minimum standards only. Group operating subsidiaries are responsible for adapting those policies and procedures to reflect local conditions where appropriate, and for implementation, oversight and monitoring within their specific businesses.