Anglo American plc (LON:AAL) has announced that it has entered into a definitive agreement to sell its nickel business to MMG Singapore Resources Pte. Ltd, a wholly owned subsidiary of MMG Limited for a cash consideration of up to $500 million. The nickel business comprises two ferronickel operations in Brazil – Barro Alto and Codemin – and two high quality greenfield growth projects – Jacaré and Morro Sem Boné.

The agreed cash consideration of up to $500 million comprises an upfront cash consideration of $350 million at completion; the potential for up to $100 million in a price-linked earnout(1); and contingent cash consideration(2) of $50 million linked to the Final Investment Decision (FID) for the development projects.

Duncan Wanblad, Chief Executive of Anglo American, said: “The sale of our nickel business after a highly competitive process marks a further important milestone towards simplifying our portfolio to create a more highly valued copper, premium iron ore, and crop nutrients business. Today’s agreement, together with those signed in November 2024 to sell our steelmaking coal business, is expected to generate a total of up to $5.3 billion of gross cash proceeds, reflecting the high quality of our steelmaking coal and nickel businesses. MMG is well-respected as a safe and responsible operator and we believe our agreement represents a strong outcome not only for our shareholders, but also for our employees and Brazilian stakeholders. We will work together to ensure a successful transition.

“Anglo American’s portfolio focus, exceptional asset quality and growth options offer a differentiated investment proposition for investors. We are unlocking the inherent value of all of Anglo American as we create a much simpler, more resilient and agile business that will enable full value transparency in the market.”

Cao Liang, Chief Executive of MMG, said: “We are excited by our acquisition of Anglo American’s nickel business which provides important diversification for our business and strengthens our presence in Latin America. This is a strong business with a talented team, growth potential and demonstrated excellence in sustainability performance and we look forward to continuing this positive legacy. MMG and Anglo American have a long track record of close collaboration and shared values demonstrated through our commitment to ICMM principles. We look forward to working together towards completion.”

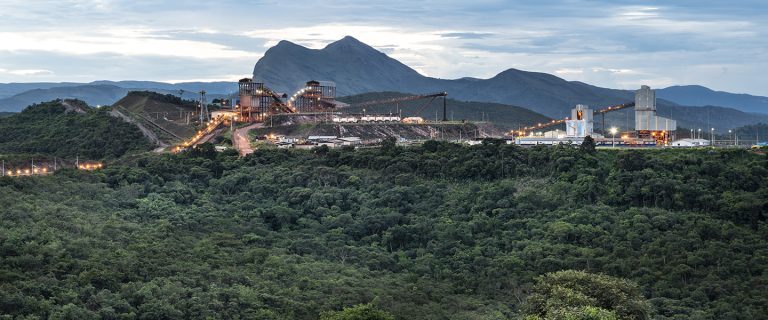

Anglo American’s nickel business is well positioned to serve both the stainless steel and battery value chains. The business comprises the operating assets of Barro Alto mine, Niquelândia mine and the Barro Alto and Codemin ferronickel processing plants which together produced 39,400 tonnes of nickel in 2024; and two high quality greenfield growth development projects: Jacaré with c.300Mt of mineral resources, and Morro Sem Boné (MSB) with a total potential mineralisation of 65Mt. Barro Alto is the only nickel mine in the world certified by the Initiative for Responsible Mining Assurance, having achieved the IRMA 75 level of assurance in 2024.

The Transaction is subject to a number of conditions, including customary competition and regulatory clearances. The upfront cash consideration is subject to normal completion adjustments and completion is expected by Q3 2025.

Footnotes:

(1) The price-linked earnout comprises uncapped semi-annual payments (calculated on a quarterly basis) of up to $100 million in aggregate, applicable for four years starting from the first day of the quarter following the transaction completion date. The payment will be calculated as 50% of incremental revenue post tax from nickel sales above an agreed realised nickel price. The precise trigger price above which payments are made is a realised price of $7.1/lb contained nickel, which includes typical discounts received for ferronickel product.

(2) The contingent cash consideration linked to the development of greenfield projects comprises a $40 million payment payable upon FID of Jacaré and US$10 million payment payable upon FID of MSB.