Anglo American plc (LON:AAL) has announced the value of rough diamond sales (Global Sightholder Sales and Auctions) for De Beers’ second sales cycle of 2024, amounting to $430 million.

| Cycle 2 2024(1) (provisional) | Cycle 1 2024(2) (actual) | Cycle 2 2023 (actual) | |

| Sales value(3) | $430m | $374m | $497m |

(1) Cycle 2 2024 provisional sales value represents sales as at 12 March 2024.

(2) Cycle 1 2024 actual sales value represents sales between the dates of 21 December and 30 January.

(3) Sales values are quoted on a consolidated accounting basis. Auction sales included in a given cycle are the sum of all sales between the end of the preceding cycle and the end of the noted cycle.

The provisional rough diamond sales figure quoted for Cycle 2 represents the expected sales value for the period and remains subject to adjustment based on final completed sales.

Al Cook, CEO of De Beers, said: “I’m pleased to see a further increase in demand for De Beers rough diamonds during the second sales cycle of 2024. However, ongoing economic uncertainty in the US has led to retailers restocking conservatively after the 2023 holiday season. Consumer demand for diamond jewellery is growing in India but remains sluggish in China. Overall, we expect that the ongoing recovery in rough diamond demand will be gradual as we move through the year.”

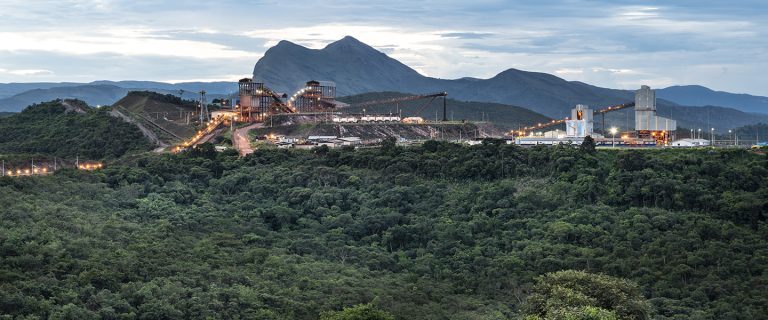

Anglo American is a leading global mining company and our products are the essential ingredients in almost every aspect of modern life. Our portfolio of world-class competitive operations, with a broad range of future development options, provides many of the future-enabling metals and minerals for a cleaner, greener, more sustainable world and that meet the fast growing every day demands of billions of consumers. With our people at the heart of our business, we use innovative practices and the latest technologies to discover new resources and to mine, process, move and market our products to our customers – safely and sustainably.

As a responsible producer of copper, nickel, platinum group metals, diamonds (through De Beers), and premium quality iron ore and steelmaking coal – with crop nutrients in development – we are committed to being carbon neutral across our operations by 2040.