Anglo American plc (LON:AAL) held its Annual General Meeting for shareholders in London today. The following remarks were made by the Chairman and the Chief Executive.

Stuart Chambers, Chairman of Anglo American plc, made the following remarks:

Good afternoon ladies and gentlemen and welcome to Anglo American’s 2019 Annual General Meeting. Notice of the meeting was sent to shareholders on 18 March 2019, and a quorum is present. I therefore declare this meeting duly constituted. Have I your permission to take the Notice of Meeting as read and formally propose the resolutions set out in the Notice? Thank you

Before I introduce the rest of the Board, I would like to thank Sir Philip Hampton, who retired at the end of 2018, and Jack Thompson, who will retire at the conclusion of this meeting, for their commitment and contribution to the Board during their tenure.

With the exception of Jack Thompson, the rest of the Board are all present today. Starting on my left is Mphu Ramatlapeng and Jim Rutherford, two of our non-executive directors, then Ian Ashby, the new chair of the sustainability committee, following Jack Thompson’s retirement. Next to Ian is Stephen Pearce, our finance director and our chief executive, Mark Cutifani. To my immediate right is Richard Price, the Group’s General Counsel and Company Secretary and then Anne Stevens, now the chair of the remuneration committee following Sir Philip Hampton’s retirement. Next to Anne is Byron Grote, senior independent director and chair of the Audit Committee, then Tony O’Neill our technical director and Nolitha Fakude, a non-executive director.

Finally, I am pleased to introduce Marcelo Bastos, a new member of the Board who joined us on 1 April. Marcelo is Brazilian and brings to Anglo American more than 30 years of operational and project experience in the mining industry across numerous commodities and geographies, particularly throughout South America.

Ensuring we have the right mix of skills and experience at Board level that reflects the breadth of our business is critical to effective governance. To that end, our Board appointments are sequenced to reflect the areas of expertise that we feel we need most pressingly.

Given that South America currently represents roughly one third of our business, and that is before the addition of our major new copper project at Quellaveco in Peru, the Nomination Committee’s first priority was to identify someone of Marcelo’s calibre and expertise, particularly following the retirement of Jack Thompson, who had a significant technical mining background. I am delighted that Marcelo has agreed to join us.

We will continue to ensure the appropriate mix of skills and experience is central to our planning for future Board appointments and, for example, our plan remains that our next non-executive director appointment will reinforce the Board’s experience in relation to South Africa.

You can find the biographies on each director in our Notice of AGM and I trust that you agree with me in noting the high calibre and diverse nature of our Board members. Later, I will be asking you to vote on the election of Marcelo for the first time and the normal annual re-election of myself and all other directors.

Now, before I ask Mark Cutifani, our chief executive, to give you an overview of recent performance and an update on what you can expect in the next year or two, allow me to share

some of my perspectives on your company, Anglo American.

Firstly, this is a company that is radically different in shape, quality and performance compared to just five or six years ago – and that is testament to Mark, the management team and all our people around the world. Our Total Shareholder Return last year of 18% far exceeded that of the FTSE100 Index (-8.7%) and the FTSE350 Mining Index (-4.1%).

However, beyond the direct financial outcomes, this is a company that thinks deeply about its role in society and also directs its energy towards doing the right thing.

I want to talk to you about our Purpose, about doing the right thing and about sustainability; and I will start with Purpose. Last year the management team consulted widely amongst our 90,000 employees and with the Board to distil our Purpose as a business. Our Purpose is simple and inspiring to our employees – we are committing ourselves to think very differently about the future of mining: to reduce our environmental footprint and to bring lasting and positive benefit to all those who interact with our business – from those who live closest to our mines to the consumers of everyday products at the other end of the value chain. It is that clarity of Purpose – “to re-imagine mining to improve people’s lives” – supported by our Values, that informs our strategy and guides our decision-making.

As a global miner, we operate all over the world and ultimately our products form an essential part of the daily lives of billions of people. That same society’s demands and expectations are growing – and rightly so – whether in terms of product provenance, ethical supply chains or community wellbeing, as examples. Likewise, we have extensive responsibilities to ensure we conduct our operations safely, cleanly and efficiently, with due regard for all our stakeholders.

Amongst these responsibilities is our response to climate change. We continue to appreciate the dialogue with representatives of Climate Action 100+, some of whom are here today. We are pleased to tell you that, since our AGM last year, we have done what we said we would do.

We have completed the Quantitative Scenario Analysis as well as the Review of Industry Association Memberships. You can find both of these reports on our website. These are the final steps for our business to be fully aligned with TCFD (Taskforce on Climate-related Financial Disclosures) requirements.

Sustainability is a much-used term and is often limited to environmental or social considerations. Your Board and management team are deliberate in ensuring that we consider business sustainability in all its dimensions and in an integrated fashion. To my mind, a sustainable business is one that acts with purpose, is competitive, resilient and agile, and that thrives irrespective of economic cycles or evolving societal trends. A truly sustainable business is one that is valued by all its stakeholders for the contribution it makes.

Let me describe a few of those dimensions:

Firstly, we must keep our people safe. Always number one on the Board’s agenda, we are very disappointed that the business saw five fatal incidents at the managed operations last year. While we see continued improvements with injury rates (and our lowest ever such rate in 2018), our Elimination of Fatalities Taskforce has urgent work to do to bring to an end this unacceptable loss of human life. We have a long way to go and I’m sorry to report that we have lost two employees this year in workplace incidents. You may also have seen the widespread news reporting of one of our Singapore-based employees who so tragically lost her life – as well as her two young children – in the horrors of the recent attacks in Sri Lanka. Our thoughts are with all those whose lives have been changed through such tragedies.

Secondly, FutureSmart Mining™ – how our technology and digital programmes are aimed squarely at transforming many of the physical activities of mining and processing ore. The expected benefits include step-change improvements in safety, in our energy and water consumption and our wider environmental footprint; significant cost and productivity benefits; and potentially unlocking access to hitherto uneconomic orebodies.

These technologies are also the enabling force behind the environmental commitments we have made in our Sustainable Mining Plan. This ambitious plan, aligned with the UN’s Sustainable Development Goals, sets out a series of stretching goals across three primary sustainability pillars: to create a healthy environment; sustain thriving communities; and proactively shape policy and ethical standards to drive greater trust and transparency.

Lastly on dimensions is our stewardship of mineral resources. Let us remember that we do not own the metals and minerals in the ground. We are custodians and have a duty to our host countries and communities to invest, develop and extract them at the appropriate time and to do so safely, responsibly and in a spirit of partnership. It is incumbent on us to allocate capital and sustain investment to ensure the economic lives of those resources are optimised. We must strike the right balance over the short, medium and long term to secure value for all our stakeholders.

A sustainable business is borne of all these considerations and many more. And our licence to operate is derived from the trust that we build by operating our business in a sustainable manner.

So, in summary, it begins with our Purpose and we are judged by how closely we align our behaviours to that Purpose: “to re-imagine mining to improve people’s lives”. Let me assure you that that is how we consider what we do as a business and how we go about it. Your Board’s commitment is to live up to that Purpose, to generate value in all its forms to all our different stakeholders and to create an ever more valuable and sustainable company for you, our shareholders.

Let me now invite Mark Cutifani to provide an overview of the Group’s strong performance during 2018.

Mark Cutifani, Chief Executive of Anglo American plc, made the following remarks:

Thank you, Stuart. Good afternoon everyone. It’s good to take you, our shareholders and owners of Anglo American, through the highlights of another very successful year.

In 2018, we continued to deliver on all fronts. We did what we said we were going to do. This is a strong set of results. But more importantly, these results show what we can do and provide a foundation for us to continue to improve our business for the long term.

The numbers speak for themselves:

· Volumes were up by 6% – with a significant contribution from our Copper business;

· Underlying EBITDA was up by 4% to $9.2 billion – from our cost and productivity work and stronger prices, and that’s despite having Minas-Rio suspended for nine months of the year;

· Our mining EBITDA margin is now at 42%, up there with the best in the industry;

· And all of this translates into a free cash flow of $3.2 billion, a healthy ROCE of 19% and earnings per share of $2.55.

Importantly, we are also delivering healthy cash returns to you, our shareholders. Our dividend policy to pay out 40% of underlying earnings translates into an even $1.00 per share dividend for the year, and you will be receiving your final portion of that – which is 51 US cents per share – on Friday, subject to your approval today.

Since early 2017, we have returned $2.6 billion in dividends to shareholders, while also paying down more than $10 billion of net debt to put us in the resilient position we are in today.

Now, let me start with the operations and our most important and immediate challenge – safety. The safety of our people is always front of mind for all of us as leaders of Anglo American. The fact that we continue to experience serious safety incidents, in which five of our people died in 2018, is tragic beyond words. Most regrettably, we have also reported two fatalities this year.

We are determined to get to zero. In industry, broad-based safety improvement is generally regarded as a journey – but for us today, given the progress we’ve now made – eliminating workplace deaths is not a journey. It needs to happen now. That is why, in 2018, we launched a taskforce to eliminate fatal incidents from the company as a significant push to get us across that next hurdle – to eliminate all fatalities from the workplace.

And we are starting to see the positive results of this work. We’ve made significant and urgent operational interventions to manage activities to end fatal incidents across all operations. While it is important to acknowledge our progress in more than halving workplace injuries over the last few years – the job isn’t done until its done. We know we can operate safely and without fatalities – now we need to prove we can do it – every day.

On health, we continue to lead mining and broader businesses around the globe on the treatment of HIV/AIDS and TB-management programmes. We are also using ground-breaking technology to monitor, in real time, health hazards and risks to employees and host communities. Again, the initial roll-out is giving very encouraging results across our sub-Saharan African operations.

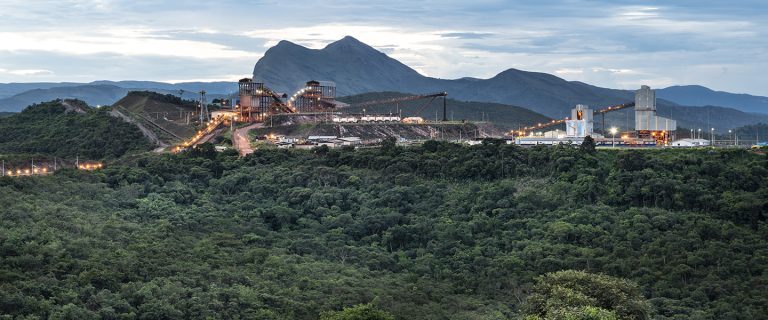

On the environmental front, our most significant incident was at Minas-Rio, where there were two pipeline leaks in March 2018. Working closely with the local authorities and the communities, we were able to quickly react to the two incidents and complete the clean-up on schedule. There were no injuries or lasting damage to the environment. It is also very clear our community and other stakeholders have recognised us for the approach we took, and the pipeline came back on stream in December. The corresponding ramp to full production is ahead of schedule and we expect our installation licence for the next phase of our tailings dam to be converted to an operation licence by the end of the year.

On the topic of tailings dams, two incidents at another company’s facilities in Brazil have reminded us all what can happen when things go wrong in the most catastrophic way. Let me assure you that we manage our tailings dams to the very highest standards, using the latest technologies, and exceeding established regulatory standards, with multiple levels of internal and external controls. Regardless, we will carefully examine and learn from the Brumadinho disaster in January and adjust our approach as appropriate. We will also be publishing detailed information on each of our tailings facilities in the next month or so to increase transparency as a first step to the industry restoring trust with all stakeholders.

Now, back to our business performance. Whichever way you look at Anglo American, this is a fundamentally different business. Since 2012, we have halved the number of assets, significantly upgrading the performance of each remaining asset, which has reinforced the sheer quality of the portfolio and our Operating Model impact. We are now delivering 30% more product from each retained asset, translating into 10% more physical product in aggregate across the portfolio at a 26% lower unit cost (in nominal terms), driving a doubling of productivity per employee.

It’s quite a contrast from where we were. We now have a leading competitive position, where we are at the front of the pack on operational leverage. As I mentioned, we have driven our mining margin up from 30% in 2012 to 42% today, and that’s with a lower price basket. This is because our overall position on the margin curve (effectively a cost curve adjusted for product quality) has improved from the 49th percentile to the 37th percentile – again, with the best in the industry, overtaking many of our peers. As we look forward, we have also been careful to nurture our undeveloped resources and to build a longer term resource inventory through targeted investment in greenfield exploration. As a result, we have a range of highly attractive, low cost, high return growth options within our business – so unlike a number of our peers, we don’t need to go out and buy growth.

Since I stood here a year ago, your Board has approved the development of the Quellaveco project in Peru. This is a rare opportunity to add a further world-class copper operation, one of the most attractive metals of the future. We expect Quellaveco to generate strong cash flows, a real post-tax IRR exceeding 15%, ROCE above 20%, with a four-year payback and an EBITDA margin of more than 50% owing to its highly competitive first-quartile cash position. And two other things … We see significant potential beyond its current 30-year Reserve Life, while we have substantially de-risked the project through our financing and equity partnership with Mitsubishi.

Most importantly, Quellaveco is on track. The river diversion agreed as part of our extensive community dialogue table commitments and the water catchment dam are both complete. And we continue to make good progress on the concrete and earthworks for the plant. We are certainly not complacent, but we are on track. We have the right team in place to deliver the project on time and on budget.

Beyond Peru, our growth opportunities span our copper interests in Chile, metallurgical coal in Australia and diamonds in Botswana, Namibia and South Africa, to name a few examples. The investments we make to sustain our existing assets, to expand them, to extend their lives and to develop new mines, amount to multi-billion investments over many years and symbolise the commitment that Anglo American makes to those countries. For example, in South Africa alone, over the next five years, we are committed to investing more than $5 billion in our businesses – a major commitment to the country where Anglo American first laid down its roots more than a century ago. We remain the most significant mining investor in South Africa, and by a considerable margin. As we continue to deliver industry-leading margins and returns in the country, we will continue to work with the government and our other key stakeholders to further improve our businesses. In 2018 alone, our total tax and economic contribution to South Africa amounted to $8.5 billion or more than 120 billion Rand.

On the subject of South Africa, I would like to take a moment to acknowledge a very special leader who will be retiring at the end of June after 18 years with us. Norman Mbazima has made an exceptional contribution, delivered with tireless energy, most recently as Deputy Chairman of Anglo American South Africa. Norman has played a number of critical leadership roles, as CEO of Kumba Iron Ore and our South African coal business, and as joint acting CEO of our PGMs business, always bringing a unique perspective to our management team. While Norman will be retiring from his executive responsibilities, I am delighted that he has taken up the role of non-executive chairman of Anglo American Platinum, our world-class PGMs business. Norman, we wish you and Lilly all the very best.

Turning back to all that we have achieved, you may be tempted to ask whether there is more we can do to enhance value for you, having already transformed the performance of the business. The answer is yes, much more. At the heart of our performance – or the chassis, perhaps – is our unique operating model. The Operating Model achieves two things: first – by planning the work to the right level of detail, we improve safety and the predictability of performance. And second – materially improved and sustainable performance. Through a virtuous cycle of creating stable performance that can then be pushed to higher levels, we are creating a culture of continuous improvement through the organisation. Every individual in Anglo American is responsible for driving a spirit of restless innovation and constant improvement.

In building that culture, every conversation drives us towards going beyond the industry’s current best-in-class performance for key pieces of equipment and processes ‒ what you might call “P100” ‒ to what we call “P101” – beyond benchmark. At our Metallurgical Coal operations in Australia, for example, we have doubled the output of one of our longwall operations from 100,000 tonnes per week to 200,000 tonnes ‒ thereby becoming the new benchmark of best performance in Australia. The objective now is to lead the industry by achieving 250,000 tonnes per week – through detailed planning, precise execution of our plans and a constant focus on making sure everything is done safely and within our operating specifications. For us, being best is no accident.

Then come the real step-change opportunities to change the way we mine. This is our FutureSmart Mining™ programme – where we take our innovation culture towards new technologies that will change the face of how mining is done today, and into the future. We are connecting technology and digitalisation to our Sustainable Mining Plan, to create a more sustainable business in every sense. Many of the technologies we are developing and now implementing at scale in our operations serve to significantly reduce our energy and water usage per tonne of metal or mineral. Alongside the obvious benefits of a smaller environmental footprint, the cost and throughput improvements have the potential to change the future of mining. In our world, sustainable mining is just good business.

Our Sustainable Mining Plan is setting the tone throughout our business and covers three principal areas of sustainability, aligned to the UN’s Sustainable Development Goals: first, to be a trusted corporate leader; second, to develop thriving communities; and third, to promote a healthy environment. We are working to be the mining company that communities and governments choose to develop their precious natural resources. That is the essential building block of a long term sustainable business.

You may ask, what are the outcomes of our highly competitive position, our clear asset-driven strategy and our step-changes in performance and sustainability? Simply put – inherent growth and higher margins, all within a disciplined capital allocation framework. As I said, we have moved the business from a 30% mining margin in 2012 to 42% by the end of 2018 – driven by the upgraded portfolio, technical changes and our operating model.

We are now pushing for P101 levels of performance. Through our FutureSmart Mining™ approach and being disciplined about investing in high quality growth, we can step up even further: to between 45% to 50% margins, and with a further 20% increase in volumes.

What’s more, when you overlay our portfolio with the major global demand trends of the next generation and more, our asset quality plays well to those themes. Through diamonds, copper, the platinum group metals and the high-quality end of the bulk products, we are well positioned to supply a fast-growing consumer world, a greener world and an inter-connected electrified world.

So why hold your shares in Anglo American and perhaps buy a few more? We believe it is a simple investment proposition: high quality assets, to which we apply our leading and innovative capabilities, to drive sustainable and competitive returns. This is a fundamentally different business and, let me assure you all, as shareholders, we are pursuing a very material further increase in the value of your company.

Following a number of questions from shareholders and their proxies, Stuart Chambers closed the meeting, by adding:

I am pleased to say that we have received strong support for all 20 resolutions based on the shares already voted that represent approximately 75% of the share capital.

I would point out that although it looks like the appointment of Marcelo Bastos will be approved by a significant majority, the proportion voting in favour is lower than for other directors. As I mentioned earlier in the meeting, in light of Jack Thompson’s retirement and the important contribution that South America makes to our business, as well as the development of Quellaveco, I firmly believe that in Mr Bastos we have brought on to the Board an individual of the highest calibre who brings additional technical expertise relating to many aspects of mining operations and projects, particularly across South America.

As I said at the start of today’s meeting, this Board – and any board – should make sure it has the right mix of skills and experience that reflect the breadth of the business it governs. We take that responsibility seriously and follow a rigorous process in identifying both the skills we need at particular times and the highest calibre candidates. Unfortunately, the voting, while sufficient for strong approval, indicates that there is not universal support for our approach. We of course respect shareholders’ opinions and will continue to engage and advocate for what we believe is the right approach.

Ladies and gentlemen, that concludes the business of this meeting. Thank you all for your attendance today and I now declare the meeting closed.