Anglo American plc with ticker (LON:AAL) now has a potential upside of 28.9% according to Barclays.

Barclays set a target price of 2,575 GBX for the company, which when compared to the Anglo American plc share price of 1,997 GBX at opening today (29/12/2023) indicates a potential upside of 28.9%. Trading has ranged between 1,630 (52 week low) and 3,699 (52 week high) with an average of 4,273,915 shares exchanging hands daily. The market capitalisation at the time of writing is £26,218,418,849.

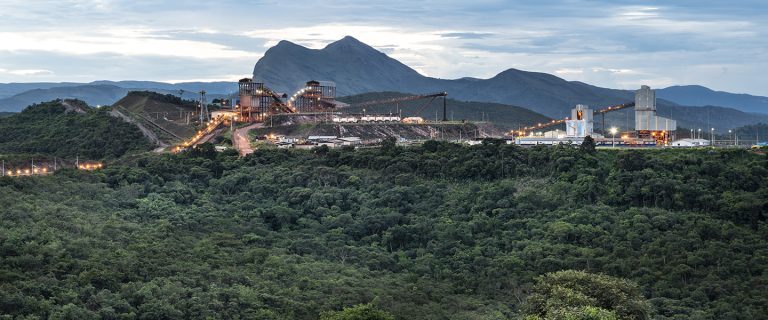

Anglo American PLC is a mining company with a portfolio of mining and processing operations and undeveloped resources. The Company’s segments include De Beers, Copper, Platinum Group Metals, Iron Ore, Steelmaking Coal, Nickel, Manganese and Crop Nutrients. De Beers is engaged in the diamond business, which offers rough and polished diamonds. Its Copper projects include Quellaveco copper, Los Bronces, El Soldado, and Collahuasi. Its Platinum Group Metals owns and operates five mining operations in South Africa’s Bushveld complex, including Mogalakwena, Amandelbult and Mototolo, as well as the Unki mine, in Zimbabwe. Its Iron Ore operations provide customers with iron ore content through assets in Brazil and South Africa. Its Steelmaking Coal business includes five operating mines, along with additional development projects and joint-venture interests. Its Nickel business consists of mine assets in Brazil, with two ferronickel production sites: Barro Alto and Codemin.

Anglo American plc 28.9% potential upside indicated by Barclays

- Written by: Charlotte Edwards

Latest Company News

Anglo American and Teck Resources have received approval from the Government of Canada under the Investment Canada Act for their proposed merger of equals.

Anglo American has confirmed that shareholders voted in favour of the resolutions required to implement its merger of equals with Teck Resources Limited.

Anglo American has reported a strong third quarter for 2025, with solid performances in copper and iron ore driving results. Copper output rose 1% year-on-year to 184,000 tonnes, supported by higher grades at Quellaveco and Los Bronces, while Minas-Rio’s iron ore guidance was raised to 23–25 Mt following a successful pipeline inspection.

Anglo American plc has stated that Teck Resources’ updated operational outlook is consistent with its due diligence, confirming the strategic rationale and expected synergies of their planned merger.

Anglo American and Codelco have signed a definitive agreement to coordinate operations at Los Bronces and Andina in Chile. The joint mine plan is expected to deliver an extra 2.7 million tonnes of copper over 21 years from 2030, lowering costs by around 15% and generating at least $5 billion in pre-tax value, shared equally between the partners.

Anglo American and Teck will combine in a merger of equals to form Anglo Teck, expected to provide more than 70% copper exposure and deliver US$800 million in annual pre tax synergies. A further average underlying EBITDA uplift of US$1.4 billion per year is targeted from 2030 to 2049 via Collahuasi and Quebrada Blanca integration.