Anglo American plc (LON:AAL) has announced its production report for the second quarter ended 30 June 2021.

Q2 highlights

• Completed the demerger of the South Africa thermal coal operations.

• Announced the sale of our 33% interest in the Cerrejón thermal coal mine, subject to regulatory approvals.

• Rough diamond production increased by 134%, reflecting planned higher production in response to the ongoing consumer demand recovery.

• Platinum Group Metals (PGMs) production increased by 59%, with Mogalakwena production increasing by 11%, reflecting the relatively lower impact of Covid-19 lockdowns compared to Q2 2020. Strong refined output reflected stable performance from the ACP Phase A unit.

• Iron ore production increased by 6%, driven primarily by Kumba, reflecting the lower impact of Covid-19 lockdowns compared to Q2 2020.

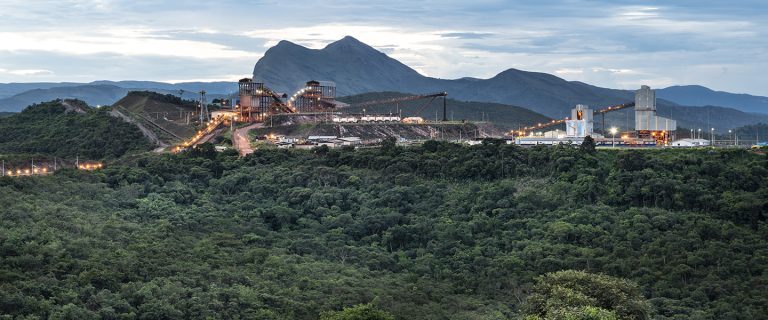

• Copper production increased by 2% due to strong plant performance at Los Bronces.

• At our longwall metallurgical coal operations, mining restarted at Moranbah at the beginning of June and development work at Grosvenor continues to progress, with restart expected towards the end of the year.

| Production | Q2 2021 | Q2 2020 | % vs. Q2 2020 | H1 2021 | H1 2020 | % vs. H1 2020 |

| Diamonds (Mct)(3) | 8.2 | 3.5 | 134% | 15.4 | 11.3 | 37% |

| Copper (kt)(4) | 170 | 167 | 2% | 330 | 314 | 5% |

| Platinum group metals (koz)(5) | 1,058 | 665 | 59% | 2,079 | 1,620 | 28% |

| Iron ore (Mt)(6) | 15.7 | 14.8 | 6% | 31.9 | 30.8 | 3% |

| Metallurgical coal (Mt) | 3.0 | 4.0 | (25)% | 6.2 | 7.8 | (20)% |

| Nickel (kt)(7) | 10.6 | 10.8 | (2)% | 20.7 | 21.7 | (5)% |

| Manganese ore (kt) | 941 | 796 | 18% | 1,845 | 1,639 | 13% |

| Thermal coal (Mt)(8) | 4.3 | 4.4 | (1)% | 9.3 | 10.5 | (12)% |

(1) Production capacity excludes Moranbah and Grosvenor.

(2) Copper equivalent production is normalised to reflect the demerger of the South Africa thermal coal operations and the closure of the manganese alloy operations and excludes the impact of the Grosvenor suspension and announced sale of Cerrejón. Including the impact of Grosvenor and Cerrejón, copper equivalent production increased by 20% compared to Q2 2020.

(3) De Beers Group production is on a 100% basis, except for the Gahcho Kué joint venture which is on an attributable 51% basis.

(4) Contained metal basis. Reflects copper production from the Copper business unit only (excludes copper production from the Platinum Group Metals business unit).

(5) Produced ounces of metal in concentrate. 5E+Au (platinum, palladium, rhodium, ruthenium and iridium plus gold). Reflects own mine production and purchase of concentrate.

(6) Wet basis.

(7) Reflects nickel production from the Nickel business unit only (excludes nickel production from the Platinum Group Metals business unit).

(8) Reflects export primary production, secondary production sold into export markets and production sold domestically at export parity pricing from South Africa until the demerger of the South Africa thermal coal operations effective on 4 June 2021, and attributable export production (33.3%) from Colombia (Cerrejón).

Mark Cutifani, Chief Executive of Anglo American, said: “We have delivered a solid operational performance supported by comprehensive Covid-19 measures to help safeguard the lives and livelihoods of our workforce and host communities. We have generally maintained operating levels at approximately 95%(1) of normal capacity and, as a consequence, production increased by 20%(2) compared to Q2 of last year, with planned higher rough diamond production at De Beers, as well as strong plant performance at our Los Bronces copper operation in Chile and higher throughput at our Mogalakwena platinum group metals mine in South Africa.

“We also successfully completed the demerger of our thermal coal operations in South Africa and announced the sale of our minority interest in Cerrejón in Colombia, marking the last stage of our transition from thermal coal operations, ahead of schedule. Our portfolio and growth investments are increasingly focused on those future-enabling metals and minerals that are critical to decarbonising energy and transport and to meeting consumers’ growing needs, from luxury to everyday.”