Aferian plc (LON:AFRN), the B2B video streaming solutions company, has announced today its unaudited results for the six months ended 31 May 2022, which demonstrate a performance in line with the trading update announced on 14 June 2022.

Donald McGarva, Chief Executive Officer of Aferian plc said:

“Eighteen months into the execution of our 2025 strategy, I am pleased to see the steady drumbeat of progress towards our goals showing through in our performance. Our strategy of driving our business towards higher quality, increasingly visible revenue streams is galvanising our team, focusing our efforts and – most importantly – delivering results. We step into the second half of this year with an Annual Recurring Revenue some 14% higher than this time last year. This is an achievement of which all our colleagues should be proud.

“Now, nearly three months into Q3, we continue to have confidence in our second half prospects. We are seeing improved availability of components in the second half, unwinding delays seen in H1. With the acquisition of The Filter now complete we have an even more compelling offering for our customers. The increasing quality of engagement we are able to have with current and prospective customers underpins my view that Aferian is well positioned to not only benefit from global growth in streaming, but also shape the way this dynamic market evolves for years to come.”

Financial Key Figures

| Periods ended 31 May | |||||

| $m unless otherwise stated | H1 2022 | H1 2021 | Change | ||

| Revenue | 44.5 | 45.3 | (2%) | ||

| Exit run rate Annual Recurring Revenue (“ARR”) (1) | 15.8 | 13.8 | 14% | ||

| Statutory operating (loss)/profit | (0.6) | 1.9 | (132%) | ||

| Statutory basic earnings per share (US cents) | (1.76) | 1.16 | – | ||

| Adjusted operating profit (2) | 2.4 | 5.1 | (53%) | ||

| Adjusted basic earnings per share (US cents) (3) | 1.50 | 5.05 | (70%) | ||

| Net cash (4) | 7.8 | 10.1 | (23%) | ||

| Interim dividend per share (GBP pence) | 1.0 | 1.0 | -% | ||

Notes

1. Exit Annual Recurring Revenue (ARR) is annual run-rate recurring revenue as at 31 May 2022.

2. Adjusted operating profit is a non-GAAP measure and excludes amortisation of acquired intangibles, exceptional items, and share-based payment charges.

3. Adjusted basic earnings per share is a non-GAAP measure and excludes amortisation of acquired intangibles, exceptional items, share-based payment charges and non-recurring finance income and expense.

4. Net cash is cash and cash equivalents less loans and bank borrowings.

Financial Highlights

· Further momentum demonstrated in improving the quality and visibility of Group earnings:

o Higher margin software & services revenue of $12.0m, up 21% in H1 2022 compared to H1 2021.

o Recurring revenue of $8.2m, up 49% in H1 2022 compared to H1 2021.

o Exit run rate ARR of $15.8m, up 14% in H1 2022 compared to H1 2021 (constant currency basis: 26%).

· As previously announced in June 2022 device revenues were negatively impacted in H1 by delays in product shipments because of COVID-related supply chain issues, but we are confident that the order book and improved availability of components will drive higher revenues in H2.

· Adjusted operating profit of $2.4m, down 53% in H1 2022 compared to H1 2021 due to delay of device revenues into H2.

· Significant increase in adjusted cashflow from operating activities before tax from $4.0m to $6.7m, an increase of 68%

· A strong balance sheet, providing capacity for organic and M&A-related investments, and a banking facility of up to $100m in place and undrawn.

Strategic & Operational Highlights

· Market dynamics continue to support Aferian’s growth ambitions and strategic positioning.

· Customer offering further enhanced by the acquisition and integration of The Filter:

o Brings new customers, new capabilities for existing customers – and powered the launch of 24iQ: our new personalisation and content recommendations service.

· Continued to innovate in product modularity and capability:

o 24i: Relaunched our streaming platform under the name 24i Mod Studio, alongside launching 24i OTT Studio and 24i Pay TV Studio: two proprietary off-the-shelf solutions containing all the technology capabilities required to launch a streaming service in a matter of weeks for Tier 3 and Tier 4 customers.

o Amino: More than 116 customers have now deployed our SaaS device software management platform, with the number of devices managed growing by 48% year-on-year.

· Supported customers with critical, innovative rollouts and deployments:

o 24i: Supported Waoo in Denmark and Telenor Sweden with their rollouts of advanced new streaming services based on devices using Google’s popular Android TV operating system.

o Amino: PCCW publicly launched its new generation of Now TV streaming services powered by Amino software, facilitating the integration of Netflix and other third-party streaming content alongside its own.

Current Trading and Outlook

Trading since the period-end has reinforced the Board’s full year confidence, as expressed in our 14 June 2022 Trading Update. The Group remains in a strong position both financially and operationally. With a solid H2 order book, availability of components much improved since H1, delayed orders from H1 now shipped and H2 production weighted to Q3 to mitigate any potential, additional supply chain issues, the Board expects to deliver a much improved second half performance. Therefore, subject to continuing availability of components and shipment levels, the Board remains confident in achieving results in line with its expectations for the year ending 30 November 2022

Chief Executive Officer’s review

2025 Strategy: moving with – and shaping – our markets

During the first half of this current financial year, we have made further, meaningful progress towards our goals of delivering improved quality of earnings from our operations and enhanced visibility of the revenues we seek to generate.

Our work is helped by the fact that Aferian continues to operate in the growing video streaming market. This is aligned with our view that consumers expect to be able to watch the video content they love, anywhere, anytime on any device. This market remains a growing, dynamic and exciting space with Aferian well-placed to help Pay TV operators, streaming services and content owners capture value from these behavioural shifts.

As consumer viewing habits change, video streaming consumption is currently growing by c.13% per annum*, which is further evidenced in the UK by recent reports of record usage of the BBC iPlayer streaming service**. At the same time, audiences watch streaming video services across an ever-increasing range of devices, enabled by the ongoing growth in global penetration of high-speed broadband. As this happens, our customers, Pay TV operators and streaming service providers, are continuing to invest in and adapt their offerings to meet consumer demand, refreshing and optimising their services in order to provide the features and functionality that consumers desire. In a market dictated by consumer choice, new video streaming services are also continually launching with a long tail of niche content that enables them to capture additional revenue share.

This is the backdrop against which Aferian operates. More importantly, this is a market Aferian is helping to shape. Our products & services, augmented by the continuing service development and M&A enhancements we have invested in this year, are allowing Pay TV operators, streaming services and content owners to improve and re-align their own offerings and drive value from the innovative new services our technologies make possible.

Continued progress towards delivering improved quality of earnings

Supported by these trends, the Group has continued to make strong progress in the first half of 2022 toward improving the quality and visibility of its earnings. This progress is particularly encouraging, given it has been made against a backdrop of challenging conditions in the global supply chain and currency headwinds caused by the decrease of the value of the Euro against the US Dollar.

Aferian reported an exit run rate ARR of $15.8m for H1 2022 (H1 2021: $13.8m) representing 14% growth or 26% on constant currency basis (using exchange rates as at 31 May 2021). Higher margin software and services revenues were $12.0m in H1 2022 (H1 2021: $9.9m), representing a half-on-half increase of 21%, or 28% on a constant currency basis.

As reported in our 14 June 2022 trading update, device revenues in the first half were $32.5m: a decrease of 8% year-on-year. Our ability to supply streaming devices to customers in the period was impacted by supply chain challenges, including shipping and production delays, caused principally by COVID-19 related manufacturing shutdowns in China. However, to mitigate against further potential delays, second half device production has been weighted into Q3. The Board expects device revenues to be higher in the second half of the year, supported by the order book.

Consequently, Group revenue for the first half stood at $44.5m (H1 2021: $45.3m).

H1 2022 Key Performance Indicators

Our key performance indicators demonstrate continued strategic progress during the first half, reporting growth in software & services revenue (up 21%) and exit ARR (up 14%).

| H1 2022$m | H1 2021$m | |

| Software & services revenues | 12.0 | 9.9 |

| Device revenues | 32.5 | 35.4 |

| Total revenue | 44.5 | 45.3 |

| ARR at 31 May (“Exit ARR”) | 15.8 | 13.8 |

| Adjusted operating cashflow before tax | 6.7 | 4.0 |

| Net customer revenue retention rate on recurring revenue** | 113% | 120% |

*Source: Boston Consulting Group

**Source: https://www.csimagazine.com/csi/BBC-iPlayer-streams-off-to-best-start-to-the-year.php

***on a constant currency basis

M&A

In April 2022, we acquired The Filter, a UK data science specialist business, for an initial consideration of $1.5m and a deferred consideration payable in October 2023 of $0.3m. Additional consideration of $1.8m (capped at $3.2m), is expected to be paid subject to Exit ARR targets being met over a two-year period. Amid intense competition for viewers in the streaming market, our customers are increasingly looking to make use of the data collected by their video streaming applications to help them offer consumers more highly personalised and engaging experiences. The Filter’s advanced machine learning algorithms and managed services can be sold either as an integrated or standalone solution to new or existing customers. This represents an excellent opportunity for us to expand our customer base and is a clear example of how we are actively shaping and driving the growth markets we operate in.

The acquisition of The Filter immediately added high quality customers to the Group including BBC Studios-owned UK TV Play, German streaming service Joyn, and EPIX, a North American Video on Demand service owned by MGM/Amazon. It has also brought an incredibly talented and engaged new team with it. The rapid integration of The Filter’s complementary technologies into 24i has already enabled us to launch a new managed personalisation and recommendations service called 24iQ in May.

Aferian’s M&A strategy continues to include the acquisition of emerging technologies that add value to our customers by solving more of the key challenges they face in meeting consumer needs. In addition, the Group seeks further acquisitions that will enable us to scale up and to expand into new geographies and market verticals.

People and culture

As the majority of our employees return to some degree of normality with the opportunity for office working and face-to-face meetings and events, ongoing COVID-19 restrictions have made it a particularly difficult first half for our team in Hong Kong. Hybrid working, of course, brings its own challenges, but its many benefits are yet to be fully experienced by our Hong Kong colleagues. We pay tribute to them for their resilience and determination in dealing with continuing lockdowns and thank them for their commitment to delivering on the Group’s priorities, despite the significant difficulties affecting their personal and working lives. We also offer our ongoing support and gratitude to our small but valued team of developers based in Ukraine who have largely continued to work uninterrupted under the most extraordinarily difficult circumstances since the start of the war in February.

Operational review

24i

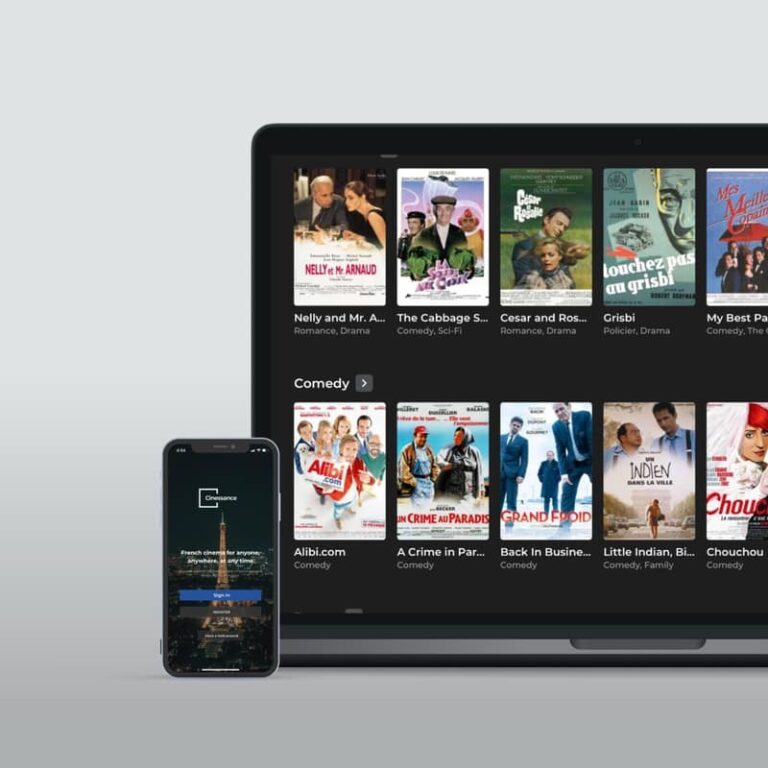

24i offers a robust technology platform that enables both media and entertainment companies and Pay TV operators to stream their TV and video programming to any type of screen and to build audience engagement. 24i has a 13-year market-leading position and works with customers like NPO, Telenor, Pure Flix and Broadway HD.

In the first half, 24i has seen a period of significant investment in the future, with the acquisition of The Filter, the rebranding of its core streaming platform and ongoing product development to drive further growth.

24i continues to focus on building recurring revenues in line the with Group’s overall strategy. At the period end, 24i reported a half-on-half increase of 13% in exit ARR (constant currency: 26%). This growth predominately came from existing customers with a net retention rate (“NRR”) of 117% (H1 2021: 128%) on a constant currency basis.

In December 2021, we relaunched our streaming platform under the new name 24i Mod Studio. The new identity is designed to reflect the modularity and flexibility of the 24i offering.

Alongside the name change, we launched pre-packaged, productised solutions for two of our key target markets – content owners and Pay TV operators. 24i OTT Studio and 24i Pay TV Studio are off-the-shelf solutions containing all the technology that a customer in these markets would need to launch a streaming service in a matter of weeks.

During the period we supported two existing Pay TV customers, Waoo in Denmark and Telenor Sweden, to rollout new consumer services that include attractive third-party streaming services alongside their own Pay TV offering on a single, managed device. This helps the operators to cement their role at the centre of household viewing and is an emerging trend in the Pay TV market.

We also completed a significant project to fully implement geo-redundancy for our customer, Delta, in the Netherlands, enabling them to offer a more robust and resilient service to their growing subscriber base. In addition, our team implemented KPN’s video streaming service in the Netherlands on Amazon Fire TV devices, adding to our previous work to make the KPN service available on Smart TVs from Samsung and LG, as well as those TVs that use the Android TV operating system.

Our teams are now working hard to finalise development of our fully managed and hosted “TV as a Service” offering which is due to launch to the market in September 2022. This cloud-based solution will enable Pay TV operators to go to market more quickly with a fully featured TV offering. 24i has integrated its solutions with market-leading partners into a fully hosted and managed end-to-end solution, enabling operators to enjoy a single point of contact for all elements of their best-of-breed TV streaming infrastructure.

Amino

Amino provides streaming devices powered by its own software that are integrated into a Pay TV operator’s technology ecosystem to enable them to offer the advanced streaming services demanded by today’s consumers. The same devices and software also enable advertisers and businesses to display their content on the growing population of different digital video displays in use in our public spaces. Amino has a 25-year heritage in streaming video with customers like PCCW, Cincinnati Bell, T-Mobile Netherlands and Entel.

During the period Amino revenues fell by 7% to $35.2m, because of production delays caused by COVID-19 related lockdowns in China which impacted the availability of components, device production and the onward supply chain. This resulted in approximately 10% fewer devices being shipped in H1 2022 compared to H1 2021. However, to mitigate any further impact of delays, we have weighted second half production of devices into Q3. Therefore, the Group expects device revenues to be higher in the second half of the year, supported by the order book. Amino continues to maintain its strong margins and cash generation, despite increased costs of raw materials.

The launch of the Now TV video streaming service by our customer PCCW in Hong Kong was an excellent example of how Amino’s software makes it easy for Pay TV operators to add third party streaming offerings, such as Netflix, alongside their own content to remain competitive. Engage, our leading SaaS device software management, customer support and analytics solution, continued to grow strongly. More than 116 customers have now deployed Engage, an increase of 29% from the end of H1 2021. At the same time the number of active devices managed by the solution has grown by 48% year-on-year. This solution remains a significant differentiator for us in a competitive landscape. We also continue to invest in high levels of customer service and our Net Promotor Score averaged 88 during the period (FY 2021: 86).

As a result of R&D investment over the past 12 months, during the Period, we launched our new range of streaming devices, which utilise the Reference Design Kit (RDK) software stack. RDK is one of the fastest-growing Pay TV platforms in the world and is already used in millions of devices globally to power their next-generation of video and broadband services. The rise of RDK gives Pay TV operators a viable alternative to traditional Linux devices or the popular Android TV platform as a route to combining their content with third party streaming services. Shortly after the period end, Amino was accepted as an RDK “Preferred Plus” member, which evidences our commitment to helping to enhance the RDK stack through collaboration and contributions which speed up innovation and customer time to market.

In addition to the Pay TV market, Amino’s streaming devices have long been used by a variety of enterprises to stream video over private networks such as in hospitals and hotels. Our marketing efforts aim to capitalise further on the fast-growing Digital Signage market which is worth an estimated $1.6bn globally according to research conducted by Mordor Intelligence in November 2021.

Environmental, Social and Governance (“ESG”)

Today we have published an update to our ESG report. This can be found on our website at https://aferian.com/esg. Our approach to ESG uses the Japanese concept of Ikigai meaning “a reason for being” and which refers to having a meaningful direction or purpose in life. The ESG report provides an overview of our ongoing progress against our chosen six of the United Nations Sustainable Development Goals as well as the Sustainable Accounting Standards Board’s (“SASB”) Software and IT Services and Hardware sustainability accounting standards.

Board changes

There have been a number of changes to the Board composition since the publication of the Annual Report.

We are delighted to welcome Bruce Powell who joined the Group on 3 August 2022 as a Non-Executive Director and Chair of the Aferian Audit committee. Bruce brings more than 30 years of extensive board-level experience to the Group. He is currently Chairman of packaging companies Threadless Closures Ltd and Crateight Ltd, and of Holyport College. His previous roles include 18 years on the board of Kofax plc and serving as CFO for Imagination Technologies plc.

On 3 August 2022, Steve Oetegenn was appointed as an Executive Director of the Group as President of the Americas. Steve has been supporting the Aferian executive management team in a consultancy capacity since joining the Board as a Non-executive Director in January 2021. He has now taken on a leadership role to support the growth of Aferian in this key region. As a result, Steve has stepped down from his role as Non-Executive Director.

Joachim Bergman stepped down from his role of CEO of 24i in March 2022 and from the Board of Directors in April 2022. Joachim joined Aferian in September 2017 as SVP Cloud Services and we would like to thank him for the successful integration and growth achieved by 24i since its acquisition by Aferian in May 2019. As planned, the leadership of 24i successfully transitioned to Dr Neale Foster who joined 24i as their CEO in March 2022.

Erika Schraner stepped down as a Non-Executive Director and from her role as Chair of the Aferian Audit Committee on 29th July 2022. Since joining the Board in 2019, Erika has made a strong contribution to the Group, and we wish her well in the next phase of her career.

Following these changes, the Board comprises three Non-Executive Directors and three Executive Directors. The Group remains focussed on improving the diversity of its Board and carefully considers a broad range of candidates ahead of any appointment.

Current trading and outlook

Trading since the period-end has reinforced the Board’s full year confidence, as expressed in our 14 June 2022 Trading Update. The Group remains in a strong position both financially and operationally. With a solid H2 order book, availability of components much improved since H1, delayed orders from H1 now shipped and H2 production weighted to Q3 to mitigate any potential, additional supply chain issues, the Board expects to deliver a much improved second half performance. Therefore, subject to continuing availability of components and shipment levels, the Board remains confident in achieving results in line with its expectations for the year ending 30 November 2022.

Donald McGarva

Chief Executive Officer

22 August 2022