Aferian plc (LON:AFRN), the B2B video streaming solutions company, has announced a trading update for the six months ended 31 May 2023. Trading for the period was in line with the trading and outlook communicated on the 31 May 2023.

Revenue performance

The Group has continued to make encouraging progress in improving the quality of earnings and enhancing revenue visibility. Aferian expects to report an improved exit run rate Annual Recurring Revenue (“ARR”) of c.$19.0m (31 May 2022: $15.8m), representing 20% growth on the prior year, or 21% on a constant currency basis. Higher margin software and services revenue for the period is expected to be c.$13.7m (H1 2022: $12.0m), an increase of 14% versus the prior year, or 16% on a constant currency basis. Device revenues in the first half are expected to be c.$9.4m, representing a decrease of 71% year-on-year.

Consequently, Group revenue for the period is expected to be c.$23.1m (H1 2022: $44.5m).

Cost reduction actions

As previously communicated, management actions taken in February and June 2023 have reduced the Group’s annualised cost base, including capital expenditure, by c.$5m and a further c.$3m respectively. This has saved a total of $3.4m operating costs and $1.5m capital expenditure in the current financial year.

Balance sheet

Following proactive investment made in inventory within the Amino business to de-risk supply chain delays, the Group’s inventory balance at 31 May 2023 was $8.6m (31 May 2022: $4.0m). Net debt at 31 May 2023 was $13.0m (31 May 2022: $7.8m net cash). Net debt is expected to reduce over the remainder of the current financial year as inventory levels reduce. The Group remains in compliance with its loan facilities covenants.

Outlook

For the full year ended 30 November 2023, 90% of management’s forecast Group revenues are contracted. The remaining 10% is covered by a well-developed sales pipeline. Combined with the cost reduction actions taken above, this provides the Board with confidence in the expected outturn for the full year in which the Group is expected to generate a positive material EBITDA.

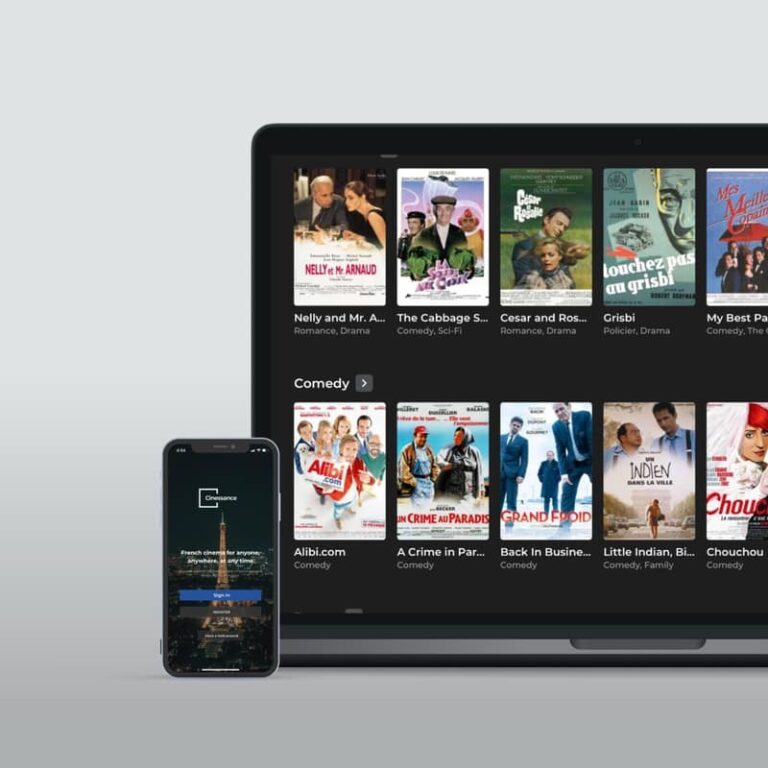

The Group’s strategy continues to be growing software and services revenue in the fast-growing video streaming market through the 24i division’s streaming video platforms. Demand here remains strong and the 24i management team are focused on accelerating profitability in the second half of the financial year and beyond.

The Amino division, which connects Pay TV to streaming services, will now focus on higher quality, higher margin streaming devices which can also be bundled with its SaaS device management platform. This SaaS device management platform is also integrated with 3rd party devices and sold on a standalone basis. With encouraging initial traction, the Group will also look to continue to grow its digital signage business.

At the Group level, the Board anticipates full year software and services revenue growth of c.10% to 15% in this financial year. As we move in to FY2024, the 24i business and management team will focus primarily on the plan to deliver enhanced profitability and cash generation.

Devices revenue in H2 2023 is expected to be higher than H1 2023 and this recovery is expected to continue in FY 2024 as inventory levels continue to normalise within the supply chain.

Update on interim results announcement date

Aferian expects to report its interim results for the six months ended 31 May 2023 in August 2023.