Accrol Group Holdings plc (LON:ACRL) has released H1 results, which are 7% below last year’s level at the adjusted EBITDA level at £5.0m despite significant supply chain disruption and cost escalation. We made our earnings adjustments in the trading update last week but reduce our net debt forecasts by 13% to £23.9m reflecting lower capital expenditure investment. We believe more can be done to reduce this through working capital efficiencies, but we have left our assumptions on this unchanged for now.

- H1 results: Revenue growth of 18.3% YOY reflected the successful scaling and integration of LTC and John Dale, while gross margins also improved YOY despite raw material cost increases. Adjusted EBITDA at £5.0m was just 6.7% below last year despite the impact of supply chain issues. Adjusted PBT was £0.7m vs. £2.6m last year primarily due to a £1.5m YOY increase in depreciation and a £0.3m increase in net finance costs.

- Margin management: A clear plan has been put in place to offset c£45-50m of input cost pressures. Clearly the main variable we are dealing with on this is timing. The cost headwinds will continue to come through as pulp and paper prices continue to climb driven by energy costs, while global shipping issues will take at least 12 months to resolve. That said, c£45m of annualised priced have already been largely agreed. In addition, management are working on £3-5m of annualised efficiencies to further offset the effect of escalating costs.

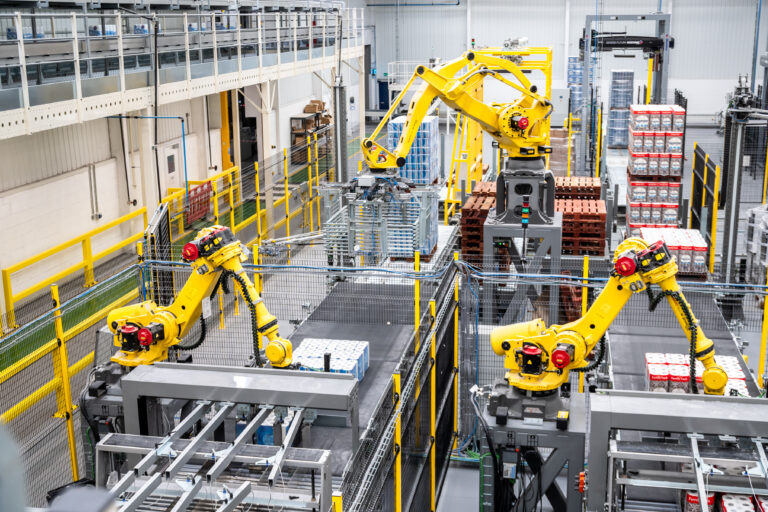

- Outlook: Volumes are said to be returning to normal with private label now back in growth progressing month on month. Operational improvements on track with the final automation of the Leyland site to complete by the end of March 2022, which, alongside the final machine installation, will complete the major investment into Accrol Group’s Tissue business.

- Forecasts: We maintain our earnings forecasts following the trading update last week. However, we have adjusted our net debt forecasts down in 2022E to reflect lower levels of capital expenditure (down from £8m to £5m). We would anticipate management seeking to find further working capital efficiencies at this juncture too but have not revised our forecasts at this stage. Our assumptions for FY23 and FY24 remain unchanged but fall on the back, in absolute terms, of the FY22 position.

- Valuation: The impact of the recent sharp input cost inflation on near term profitability is undoubtedly disappointing, with the Group unable to enact mitigating price rises in the near term. Despite this, we believe Accrol Groupholds a strategically important position in the industry, and in its current form can generate c.£250m in revenue and >£30m EBITDA over the medium term.