Accrol Group Holdings plc (LON: ACRL), the UK’s leading independent tissue converter, announced today its audited Final Results for the year ended 30th April 2019.

Summary of progress

The scale and pace of change implemented in the business in FY19 to effect a successful and rapid turnaround were extraordinary. Accrol is now a simpler, stronger and more operationally efficient business than it has ever been. Monthly profitability has been restored, despite input cost headwinds of £10.8m, the Group is cash generative and net debt is reducing. With a highly experienced senior leadership team in place and the Group’s primary market growing rapidly, the re-engineered business is ready to capitalise on this opportunity.

The financial results in FY19 were as expected and, despite strengthening foreign exchange headwinds, the Group remains on track to meet market expectations in the year ending 30 April 2020.

Key financials:

| FY19 | FY18 | |

| Underlying results | ||

| Core revenue | £116.7m | £115.3m |

| Adjusted gross profit1 | £21.7m | £24.5m |

| Adjusted gross margin | 18.2% | 17.5% |

| Adjusted EBITDA2 | Profit £1.0m | Loss £5.8m |

| Adjusted loss per share basic and diluted | 1.4p | 7.4p |

| Reported results | ||

| Revenue | £119.1m | £139.7m |

| Gross profit | £17.6m | £24.5m |

| Gross margin | 14.7% | 17.5% |

| Loss before tax | £14.0m | £24.1m |

| Net debt | £27.1m | £33.8m |

| Loss per share basic and diluted | 6.2p | 18.7p |

(1) Adjusted gross profit excludes turnaround and operational costs reported in cost of sales;

(2) Adjusted EBITDA is defined as profit before finance costs, tax, depreciation, amortisation, turnaround and operational costs and share based payments, is a non-GAAP metric used by management and is not an IFRS disclosure.

Analysis of core revenue:

Core revenue comprises retail sales of Toilet Tissue, Kitchen Towel and Facial Tissue. It excludes the Away From Home (“AFH”) business, exited in June 2018.

| FY19 | FY18 | Change | |

| Core revenue | £116.7m | £115.3m | £1.4m |

Current trading and outlook:

· Accrol is now profitable, cash generative and fit for purpose

· Total exceptional costs in FY20, including costs associated with FCA investigation, are expected to reduce to c.£1.0m (FY19: £7.9m), c.£0.5m of which will relate to final turnaround activities.

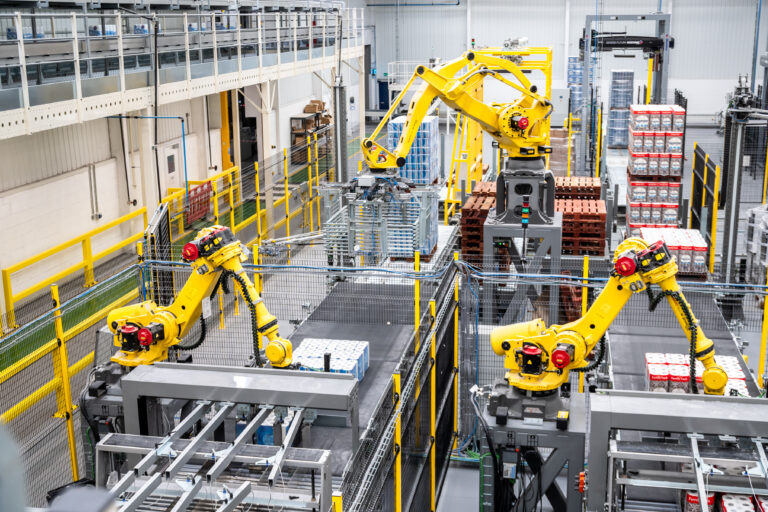

· The Board has approved in principle the investment in further machine capacity and the Group will continue to optimise production through automation

· Net debt is expected to continue to improve as the business grows

· Brand-killer: Accrol perfectly positioned to capitalise on the accelerating consumer shift from expensive established brands to best value tissue products

· The Board continues to explore opportunities to grow the business and de-risk its exposure to FX and tissue price volatility

· Despite strengthening FX headwinds, the Group remains on track to meet market expectations in FY20

Dan Wright, Executive Chairman of Accrol Group Holdings, said:

“The new Board and management team of Accrol delivered a complex and comprehensive turnaround plan in FY19, simplifying and strengthening the business to improve efficiency and optimise operational performance. Following the conclusion of this restructuring, I am pleased to say that I believe the business is more operationally efficient and fit for purpose than it has ever been.

“By the end of the year, we achieved our stated objective to return the Group to monthly profitability and I am pleased to report that the reengineered business is showing resilience in the face of strengthening FX headwinds. The Group is beginning to secure enhanced credit terms from its key suppliers and capitalising on this initiative is a core element of our continued working capital management and improving debt profile.

“The Group has delivered improving levels of monthly profitability since the year end. As such, we are on track to meet market expectations in FY20 and the Board is confident that the Group will exit FY20 at an accelerating monthly run rate.”

Gareth Jenkins, Chief Executive Officer of Accrol, added:

“The heavy lifting of the turnaround is now behind us and the ongoing challenge of maintaining consistent delivery of low cost, quality product to our customers remains. We are now able to instil continuous improvement disciplines into an operation that is fit for purpose.

“As the new financial year progresses, we will continue to be innovative in our approach to winning new business and take steps to bring our low cost, high service brand-killer approach to different products and markets.

“We keep a watchful eye on the strength of the pound and will take the steps necessary to mitigate the risks of continued currency weakness, but that should not distract us from profitably meeting our customers’ needs. The business has now been reset. There is a huge opportunity for the Group in the rapidly growing personal hygiene value market and, whilst there is more to do, the Board has real confidence that the foundations have been laid for a successful future.”