Accrol Group Holdings plc (LON:ACRL), the UK’s leading independent tissue converter, has announced its audited Final Results for the year ended 30 April 2021, which show a transformed business, delivering further strong improvement in margins and a return to dividend payments.

Despite the challenges of the pandemic, the Group was able to deliver on its strategic objectives. The business was successfully scaled, through the acquisition of Leicester Tissue Company (“LTC”) and diversified via the John Dale (“JD”) wet wipes acquisition.

The team’s continued focus on operational efficiency delivered an overall improvement in reported gross margin of 580ppt to 27.7% and a tripling of initial expectations on LTC synergies. Adjusted EBITDA rose by 47% in the year to £15.6m.

Despite the volatility created in the tissue market by the pandemic limiting the Group’s revenue growth to 1.4% in the Period, Accrol outperformed its peers and increased its market share to 15.9% from 13.1% in FY21. Over the last 2 years the like for like sales (excluding Away from Home) have grown by 16% from £117.6m to £136.6m and market share growth for the Group has risen from 12% to 15.9%.

With the business in excellent operational shape, scalable foundations for growth in place, and a strong market position, the Group is very well placed to benefit from the anticipated recovery in tissue volumes, as the effects of the pandemic unwind.

Key financials

| FY21 | FY20 | Change | FY19 | FY18 | |

| Revenue | £136.6m | £134.8m | 1.4% | £119.1m | £139.7m |

| Gross margin | 27.7% | 21.9% | 26.5% | 14.7% | 17.5% |

| Adjusted EBITDA1 | £15.6m | £10.6m | 47.0% | £1.0m | (£5.8m) |

| Adjusted profit/(loss) before tax2 | £9.1m | £4.7m | 93.3% | (£2.8m) | (£9.1m) |

| Loss before tax | (£2.6m) | (£1.9m) | (35.7%) | (£14.0m) | (£24.1m) |

| Adjusted diluted earnings/(loss) per share | 2.7p | 1.7p | 58.8% | (1.4p) | (7.4p) |

| Diluted earnings/(loss) per share | (1.1p) | (0.8p) | (37.5%) | (6.2p) | (18.7p) |

| Adjusted net debt3 | £14.6m | £17.9m | (18.1%) | £27.1m | £33.8m |

| 1 | Adjusted EBITDA is defined as profit before finance costs, tax, depreciation, amortisation, separately disclosed items and share based payments |

| 2 | Adjusted profit before tax is defined as loss before tax, amortisation, separately disclosed items and share based payments |

| 3 | Adjusted net debt excludes operating type leases recognised on balance sheet in accordance with IFRS 16 |

Financial highlights

| ● | Revenue of £136.6m reflecting third consecutive year of growth (FY20: £134.8m) |

| ● | Gross profits up 28% to £37.9m (FY20: £29.5m) |

| ● | Gross margin improved for the third consecutive year to 27.7%, up 5.8% (FY20: 21.9%) |

| ● | Adjusted EBITDA of £15.6m, an increase of 47% (FY20: £10.6m) |

| ● | Adjusted EBITDA margin improved by 3.5% to 11.4% |

| ● | Adjusted PBT almost doubled at £9.1m (FY20: £4.7m) – the third consecutive year of improvement |

| ● | Adjusted net debt reduced to £14.6m (FY20: £17.9m) – the third consecutive year of adjusted net debt reduction, despite the £3.4m cash acquisition of JD |

| ● | Adjusted net debt now equal to c.0.9x Adjusted EBITDA (FY20: 1.7x) |

| ● | Dividend payments restored with a proposed final dividend of 0.5p (FY20: nil), demonstrating the Board’s confidence in the future prospects of the business |

Operational highlights

| ● | Increasingly strong market position – market share up 2.8% to 15.9% |

| ● | Headcount reduced further and output per head increased for the third consecutive year |

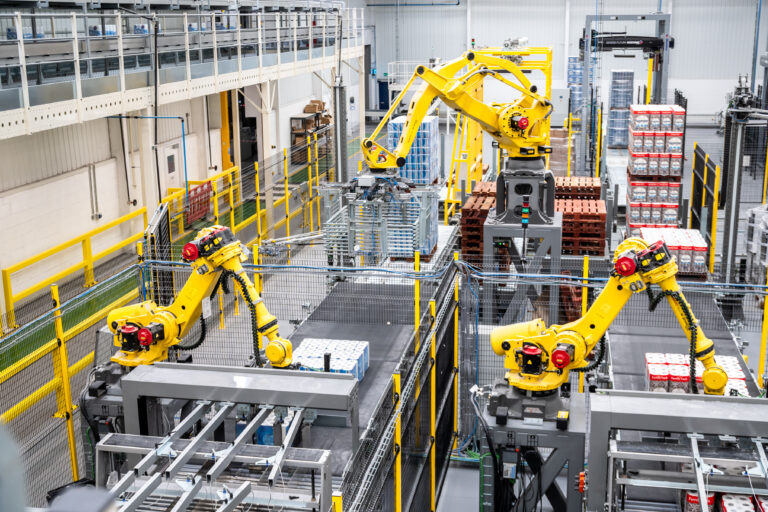

| ● | Blackburn and LTC sites fully automated with no operational impact |

| ● | New fully integrated IT system installed throughout the business without interruption |

| ● | 11% reduction in CO2 emissions per tonne of production (FY20: 25% reduction) with almost all energy requirements now sourced from renewables |

Acquisitions

| ● | LTC acquired with cash raised via a placing and open offer, bringing scale to the tissue operations – now fully integrated delivering an estimated £3m of annualised synergies compared to the £1m anticipated at the time of the acquisition |

| ● | JD acquired with existing cash resources, bringing a new product range, including fully flushable wet wipes, and the footprint and assets to build a business of scale |

Current trading in FY22 and outlook

| ● | Strong progress being made on the recovery of higher input costs, driven by rising global pulp prices, through prompt pricing actions post-year end |

| ● | Tissue market showing strong but steady signs of recovery as panic buying unwinds, with increased sales month on month and improvement in year on year sales |

| ● | Automation of tissue business to complete in FY22 with the installation of a new machine at Leyland, providing three fully invested, state-of-the-art operations in geographically pertinent locations |

| ● | Tissue operation capacity rising to £210m in revenue terms, following final element of automation at Leyland |

| ● | Investment in wet wipes planned for FY22 with material growth expected from FY23 |

| ● | Longer term growth supported by major discounters’ acceleration of planned new store openings |

| ● | Significant advancement made on UK paper mill |

| ● | The Group expects to see FY22 exit run rates to be significantly improved with the major discounters expecting uplift in tissue volumes and Accrol’s recently secured additional new business has increased confidence for FY23 revenues and returns |

| ● | Trading in line with forecasts in FY22 to date and the Board remains confident in the long-term prospects for Accrol |

Dan Wright, Executive Chairman of Accrol Group Holdings, said:

“This is the third straight year of strong improvements across many aspects of the business. Gross margins have improved again, and the business is even better placed to take advantage of the planned growth of the discounters. Whilst there may yet be some further short-term fluctuations in demand, as the effects of the pandemic unwind, I am more excited for the future of this business than ever. The growth opportunities for the Group over the next two years remain very strong.”

Gareth Jenkins, Chief Executive Officer of Accrol, added:

“The opportunities for a relentlessly efficient business, which delivers great-value products, are growing, as the world recalibrates in the aftershock of COVID-19 and consumers continue to move away from brands which offer little value.

The discounters are recovering and Accrol is well positioned to take full advantage of this. Given this combination I am confident about the long-term prospects of the Group.”