Accrol Group Holdings plc (LON:ACRL) is the topic of conversation when Zeus Capital’s Head of Research Mike Allen caught up with DirectorsTalk for an exclusive interview.

Q1: It sounds like the acquisition of John Dale Limited was a good move from the Accrol Group. What did you take from the update?

A1: We think it’s a positive move, I think this acquisition executes on its stated strategic goal to expand its presence in the household and personal hygiene market. This deal also takes the company into the high growth wet wipes segments of the market as well for the first time and we think that’s a complimentary product range, it’s a natural extension of its product range. I think the consideration, which is £3.9 million and funded from existing cash resources shows very good value as well.

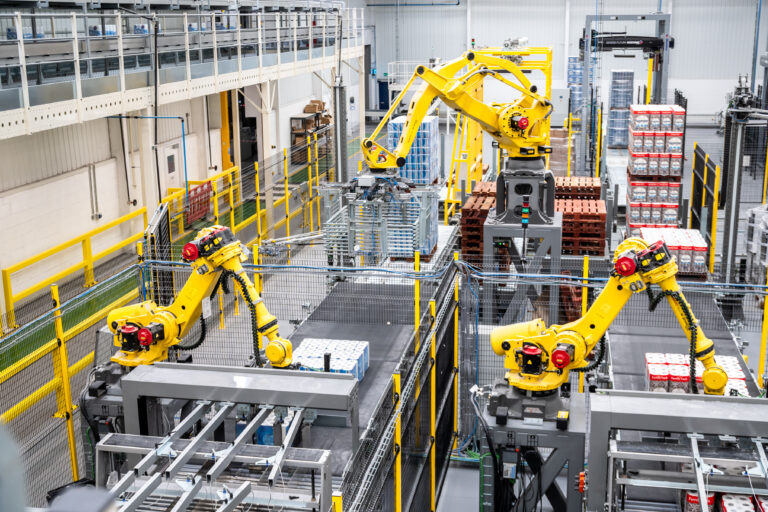

The acquisition includes a 47,000 square foot production facility and the business generated revenues of about £6 million and 0.6 of EBITDA so that’s a multiple of about 6.5 EBITDA, which provides them obviously with a big production facility but also into a new growth market.

Q2: Have you had to make any changes to your forecast on the back of this?

A2: Obviously, we’re very close to the company year-end at the moment so all we’ve done is put in the consideration, we’ve accounted for that, but we haven’t made any earnings adjustments on the back of it.

I’d like to think longer term, this acquisition will realise some good operational synergies, both on the revenue side and on the cost side but we’ll review that post year-end.

Q3: So, what your thoughts on Accrol Group in terms of evaluation?

A3: I think, from a valuation perspective at the moment, we’re still pretty confident the company can emerge as a £35/40 million EBITDA business and that would imply above average growth as it diversifies into other categories, obviously with this acquisition and the acquisition of the tissue company as well.

At the moment the shares are trading on a PE of about 13 times to April 2022, falling to 11.8 times in 2023. If you look at it on an EV/EBITDA basis, just accounting for the bank debt on the net debt, EV/EBITDA is under eight times in 2022, which we think is very good value for a business that is very well managed and obviously looking to expand further from a growth and M&A perspective.

So, we think the valuation is cheap at the moment given the expertise of the management team and the growth opportunities ahead.