Accrol Group Holdings plc (LON:ACRL) Chief Executive Officer Gareth Jenkins caught up with DirectorsTalk for an exclusive interview to discuss the post-close statement, growing market share & volume, further investment, space capacity to grow, the John Dale wet wipe business, and what the future looks like for the group.

Q1: Gareth, final results are scheduled to be released in late September, what pleases you most about the post-close statement?

A1: I think the most exciting bit about it really is that Accrol Group delivered what we said we’re going to do. We upgraded our numbers in late December ’22, and we’re really pleased to report that our revenue is higher than we expected.

Quite simply, we’ve delivered on all the promises that we gave our shareholders at the beginning of the year, despite some really challenging times in the last 12 months.

So, we’re just pleased with delivering on our promises.

Q2: You’ve gained further market share this year, not to 21.5%, and you’ve grown volume by almost 8%, what do you feel that you’re getting right?

A2: Over the last 5 years, we’ve seen our market share grow from probably around 8% to now, as you said, just under 22% this year. Certainly, over the last 12 months we’ve listed to the retailers, we’ve listened to what consumers have been saying and we know we’re now getting the right products in front of the individuals.

For toilet tissue, it’s all around softness and we’re one of the market leaders in the sector there. With kitchen towel, it’s on absorbency, and again we compete head-to-head with the brand leaders on performance.

So, it’s about getting the right product to the right consumer, and clearly, we feel we’re getting that right now.

Q3: You’ve spent, over the last few years, about £20 million on capital investment in the business, what else is needed in the next 3-5 years?

A3: In the core business, very little. There’ll be maintenance capital of around £3 million per year but really quite modest investment for the business going forward.

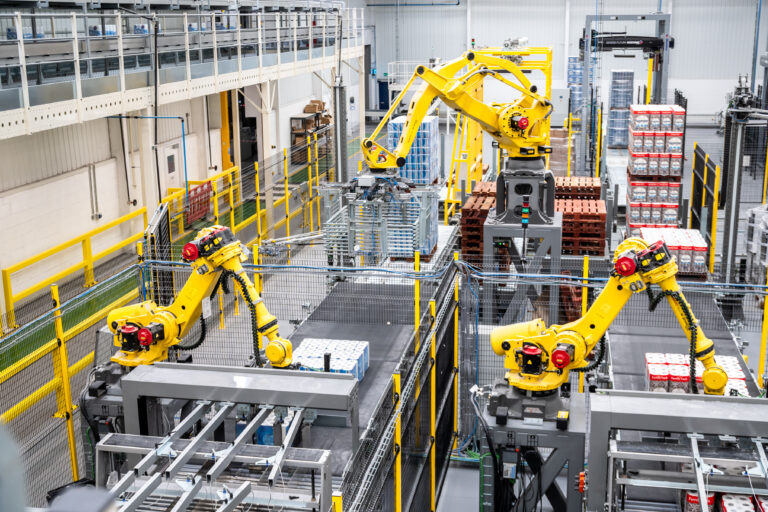

As you’ve said, we’ve spent a great deal of money. We’ve put the business in an incredibly strong position and all our sites are fully automated, all with state of the art machinery.

So, we’re in a really strong position to take advantage of what’s happening in the market.

Q4: How much spare capacity do you have to grow into?

A4: So, the business has about 20-25% spare capacity as we stand today., so more than enough for the next 2-3 years. We’ve worked really hard investing in the right areas to give us that additional headroom and we’re very confident that our growth projections that we’ve got in the marketplace.

We will continue to deliver on those, and we’ve certainly got the machinery and the capacity to do that so we’re in a really good space.

Q5: How excited are you about the wet wipe business, and can you tell us more about that part of the business?

A5: We bought John Dale just under 2 years ago and we bought that business because it was capable of producing biodegradable, water industry approved, flushable wet wipes, turning over in wet wipe volume then of around £2 million. We’ve made some relatively modest investments so far, but we plan to put a further machine into the business.

What I’m really pleased about is the reaction from retailers so we’ve brought to them some new products, all of them are water industry approved, flushable wipes. All of them are plastic-free and we’ve seen a real dramatic increase in revenues in this part of our business, current run rates are over £10 million.

So, we’re really excited about what we can achieve and the capacity, once this new machine comes online, will give us around about £40 million of the revenue. It’s an exciting part of our business, it’s growing very strongly and I’m looking forward to seeing how it progresses over the next couple of years.

Q6: Finally, what does the future look like for Accrol Group?

A6: Good. We’re well positioned going into next year, volumes continue to track where we expect and the business is really well invested.

We’re seeing a real market shift towards private label products as the cost of living crisis impacts individuals, people looking for real value on the shelf for an everyday product like toilet roll or kitchen towel.

We’re really well positioned to take advantage of that so we’re really excited about next year and beyond.